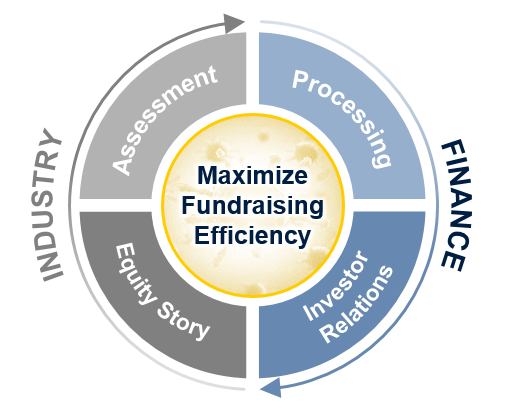

by integrating industry and finance expertise

Strategic Financing Advisory in Life Sciences

Healthcare & Life Sciences is part of FCF’s DNA. We pair unique industry experience with extensive financing track record. FCF has established itself as a leading Healthcare & Life Sciences financing expert in Europe. Together with our very hands-on approach in company advisory and our experienced Healthcare & Life Sciences Advisory Board we find the perfect individual financing solution for your company. At FCF we have helped many Healthcare- and Life Sciences companies to translate their innovative- and unique technologies into successful financing stories.

We have a broad sector focus and aim to represent unique companies with a clear patient benefit in the areas of:- Pharmaceuticals & Biotechnology

- Medical Technology & Medical Devices

- Diagnostics & Healthcare Technology (IT)

We address all aspects of financing, that companies face from the seed- to commercialization stages. We focus on finding the best long-term financing strategy and selecting the best available financing instruments for your individual needs:

- Venture Capital

- Equity-Linked Structures

- Growth / Venture Debt

- Off-Balance Financing

- Licensing

FACTS & FIGURES

European Healthcare & Life Sciences team specialised in pre-IPO financing

WHAT WE DO

At FCF Healthcare & Life Sciences, we develop bespoke financing strategies and support our clients throughout the entire fundraising process and beyond:

Industry Expertise

- Technology Assessment

- Finetuning of Equity Story

- Pre Due-Diligence

- Science-driven Deal Selection

Finance Expertise

- Process Management

- Investor Relations

- Intelligent Market Monitoring

- Efficient Investor Communications

- Technology Assessment

- Finetuning of Equity Story

- Pre Due-Diligence

- Science-driven Deal Selection

- Process Management

- Investor Relations

- Intelligent Market Monitoring

- Efficient Investor Communications

FOCUS AREAS

- Joint Venture with YAFO Capital (Shanghai) Ltd.

- Specialist in fundraising, licensing and M&A transactions in the Asian market

- Access to >500 financial and strategic investors

TEAM

We have built the largest venture stage dedicated team with industry and finance backgrounds in Europe:

Industry Expertise

Finance Expertise

Dr. Alexandra Goll

Advisor – Venture Capital

Dr. Axel Polack

Advisor – Science & Technology

Enno Spillner

Advisor – Capital Markets

Prof. Dr. Horst Domdey

Advisor – Science & Technology

Dr. Joachim M. Greuel

Advisor – Valuations

Arno Fuchs

Chief Executive Officer

Mathias Klozenbücher

Healthcare & Life Sciences Banking – Europe

Johannes Link

Healthcare & Life Sciences Banking – Europe

Zaid Maleh

Healthcare & Life Sciences Banking – Dubai

Sean Jiang, CFA

Healthcare & Life Sciences Banking – China

We have built the largest venture stage dedicated team with industry and finance backgrounds in Europe:

GLOBAL NETWORK

We maintain trusted relationships to leading institutional and strategic Healthcare investors as well as family offices in Europe, USA and Asia. Supported by our US and Asian partners, we can approach the right investors depending on our client’s situation. We can rely on a deep network to Life Sciences specialists (e.g. legal, valuation, licensing and IPO investment banks in the USA and Europe) to execute a seamless 360-degree long-term financing strategy. Our goal is to create value by implementing the best financing options for our clients.

| FCF Partner (New York): |

|---|

|

|

FCF Life Sciences (Munich): |

|---|---|

|

|

BioScience Valuation (Garmisch): |

|---|---|

|

| FCF Partner (New York): |

|---|

|

|

|---|

| FCF Life Sciences (Munich): |

|

|

|---|

| BioScience Valuation (Garmisch): |

|

SELECTED TRANSACTIONS

Limmatech Biologics AG

December 2023

[amount confidential]

In Ovo B.V.

August 2023

€ 40 million

numares AG

February 2022

€ 20 million

Precisis AG

September 2021

€ 20 million

Immunic AG

October 2020

€ 25 million

Limmatech Biologics AG

December 2023

[amount confidential]

UPCOMING EVENT

| ACCESS CHINA Biotech Forum |

Winter Showcase 2022 January 4th to 13th (Online & San Francisco) |

MARKET INTELLIGENCE

We dedicate a fair amount of our resources to market monitoring, in order to derive market intelligence on life sciences companies, investors and capital market trends. We share our findings in various ways:

To hear from us on the latest market updates, please sign-up here:

Venture Capital Sentiment

Based on our market monitoring, we estimate the current monthly venture capital sentiment of the European biotechnology, medical technology and health technology sub-sectors:

December 2023:

Biotechnology

Medical Technology

Health Technology

Biotechnology

Medical Technology

Health Technology

Insights

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

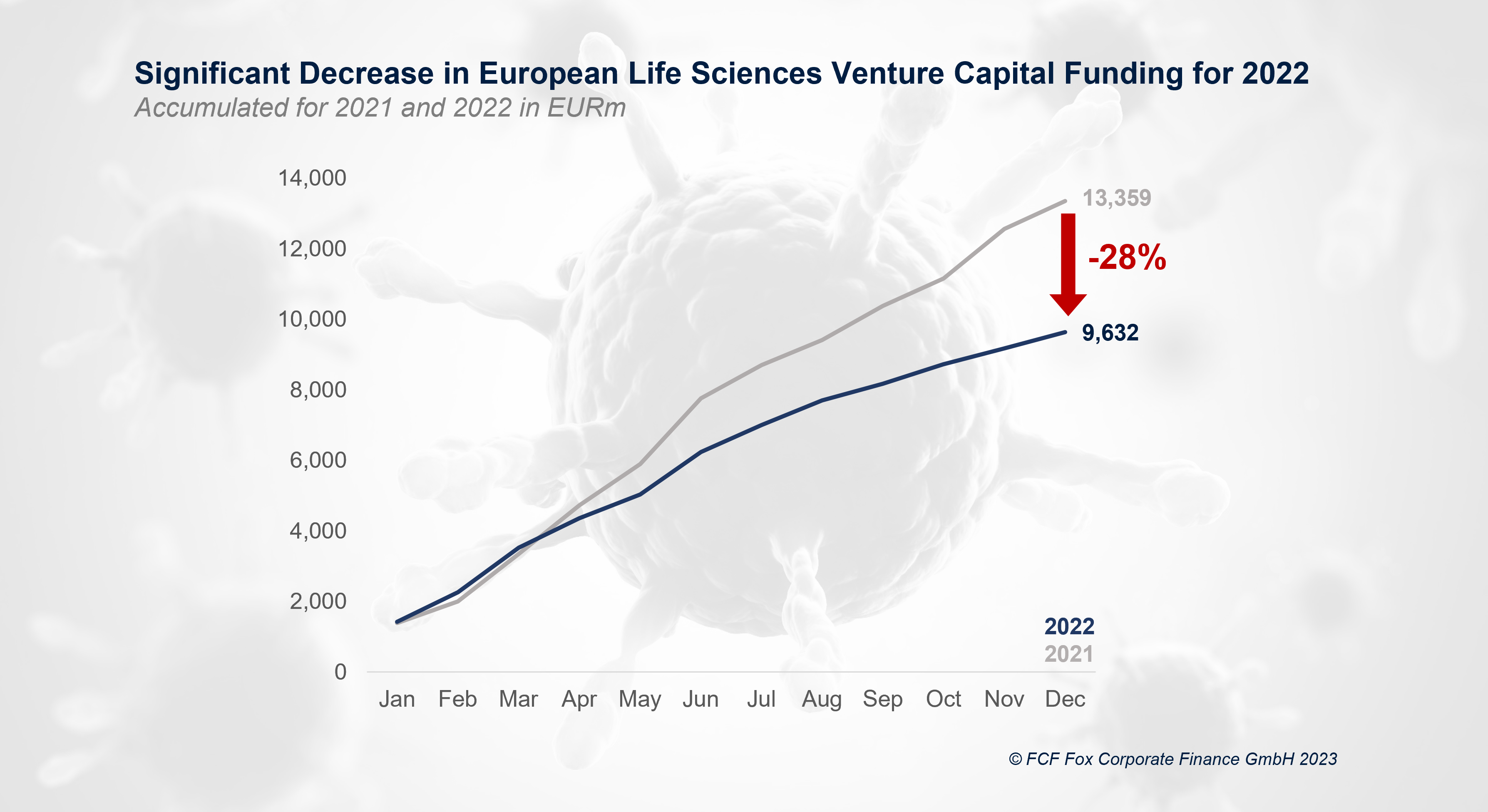

Venture capital funding in 2022 significantly decreased compared to 2021

The ever-increasing venture capital funding for European life sciences companies halted in 2022. With a roughly EUR 9.6bn volume, the overall financing for European life sciences companies in 2022 decreased significantly compared to 2021 (EUR 13.6bn) by 28%. While in the first quarter, funding volumes roughly matched, from April onwards,

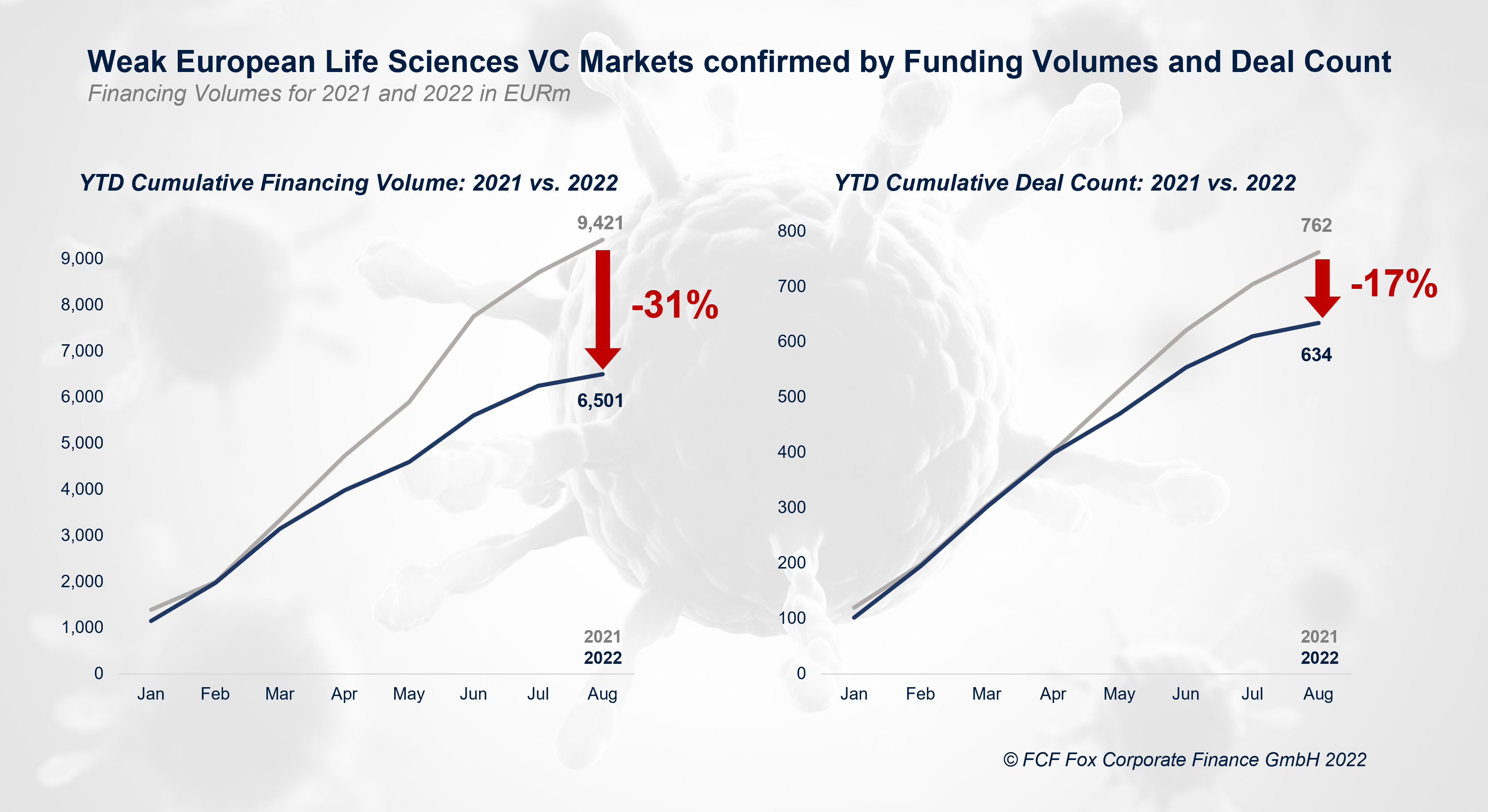

European VC life sciences funding continues to decline

In 2022, the venture capital funding for life sciences in Europe continues to weaken, further widening the gap to 2021 (EUR 9.4bn vs. EUR 6.5bn). The cumulative financing volume in August 2022 falls by more than -31% compared to August 2021. The cumulative number of closed deals in 2022 started

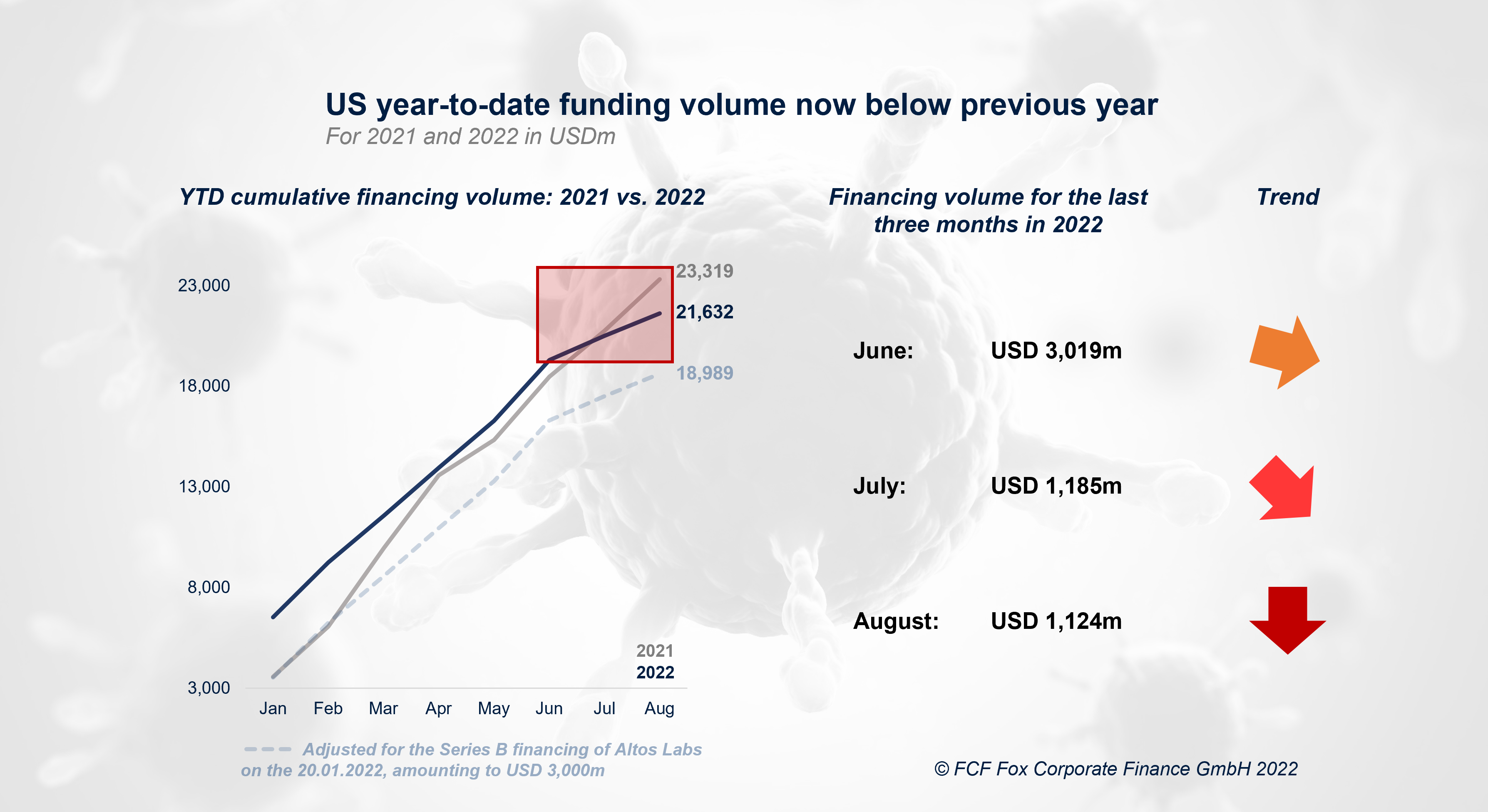

US year-to-date funding volume now below previous year’s level

After an exceptional year 2021 for venture capital funding in the US Biotech-sector, aggregated financing volumes in 2022 are for the first time lower than in 2021. During the last months funding volumes have declined significantly. Especially in June, funding volumes were almost three times as high compared August. Excluding

Capital Markets Research

We constantly engage in capital markets research to identify financing trends early in the Life Sciences sector. Our research focuses on the most relevant equity markets: Venture Capital, Public Equity, Initial Public Offerings (IPO). The findings are currently published in the following publications:

Venture Capital

Licensing

Healthcare & Life Sciences Venture Capital Monitor – Europe

Monthly Venture capital activities in the European Life Sciences sector

Healthcare & Life Sciences Venture Capital Monitor – Europe

Monthly Venture capital activities in the European Life Sciences sector

Healthcare & Life Sciences Venture Capital Monitor – USAMonthly Venture capital activities in the US Life Sciences sector

Healthcare & Life Sciences Venture Capital Monitor – USAMonthly Venture capital activities in the US Life Sciences sector

Life Sciences Venture Capital ReportRecent Venture capital trends in the European Life Sciences sector

Life Sciences Venture Capital ReportRecent Venture capital trends in the European Life Sciences sector

Other Research

Life Sciences IPO ReportRecent IPO trends in the Life Sciences sector

Life Sciences IPO ReportRecent IPO trends in the Life Sciences sector

Biotech Public Equity MonitorRecent valuations of listed European Life Sciences companies

Biotech Public Equity MonitorRecent valuations of listed European Life Sciences companies

MedTech & Diagnostics Public Equity MonitorRecent valuations of listed MedTech companies

MedTech & Diagnostics Public Equity MonitorRecent valuations of listed MedTech companies

Life Sciences SPAC MonitorPerformance overview of merged Life Sciences SPACs

Life Sciences SPAC MonitorPerformance overview of merged Life Sciences SPACs

NEWS

FCF Healthcare & Life Sciences Venture Capital Monitor – USA – 02/2024 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Healthcare & Life Sciences Venture Capital Monitor – USA – 02/2024”. The Monitor is a monthly published overview of venture capital trends in

FCF Healthcare & Life Sciences Venture Capital Monitor – USA – 01/2024 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Healthcare & Life Sciences Venture Capital Monitor – USA – 01/2024”. The Monitor is a monthly published overview of venture capital trends in

FCF Healthcare & Life Sciences Venture Capital Monitor – Europe – 01/2024 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Healthcare & Life Sciences Venture Capital Monitor – Europe 01/2024”. The Monitor is a monthly published overview of venture capital trends in the

FCF Biotech Venture Capital Monitor – USA 12/2023 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Biotech Venture Capital Monitor – USA 12/2023”. The Monitor is a monthly published overview of venture capital trends in the US-Biotech sector. As

FCF Healthcare & Life Sciences Venture Capital Monitor – Europe – 12/2023 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Healthcare & Life Sciences Venture Capital Monitor – Europe 12/2023”. The Monitor is a monthly published overview of venture capital trends in the European