OUR APPROACH

Our experienced team of industry and finance experts form a unique platform to develop the best financing story together with our clients. We emphasize on a clear and easy to understand presentation of the technology, development plan, competitive positioning, market potential and financial model. With the broadest portfolio of life sciences and capital markets data bases, we also add value with in-depth market intelligence not only to the management, but also to the board and shareholders.

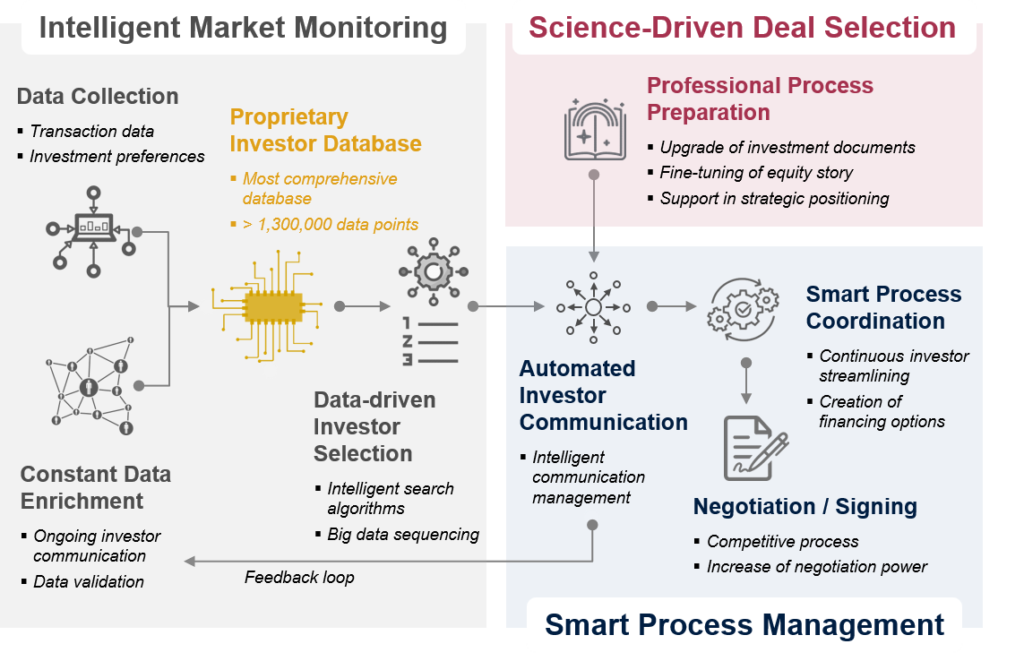

Science-Driven Deal Selection

Professional investment documents are very critical for the first investor approach. Life Sciences companies often fail to transport a clear equity story and outline their key differentiation factors or uniqueness compared to other technologies. In addition, documents often lack important “investor-specific” information and are too science-driven

- FCF supports to strategically position our clients, fine-tune the equity story, upgrade the investment documents and implement key sections to the investment documents

Smart Process Management

The management may lack fundraising experience and capacity for managing a financing process while simultaneously focusing on its business development

- FCF pro-actively manages the financing process with automated investor approaches and follow-ups, streamlining investor communications

- FCF manages the transaction from the first investor approach to closing

- FCF can provide additional capacities to the management and can act as an “external finance department”

Intelligent Market Monitoring

It is key to address the right investors, whose investment preferences match the company’s profile

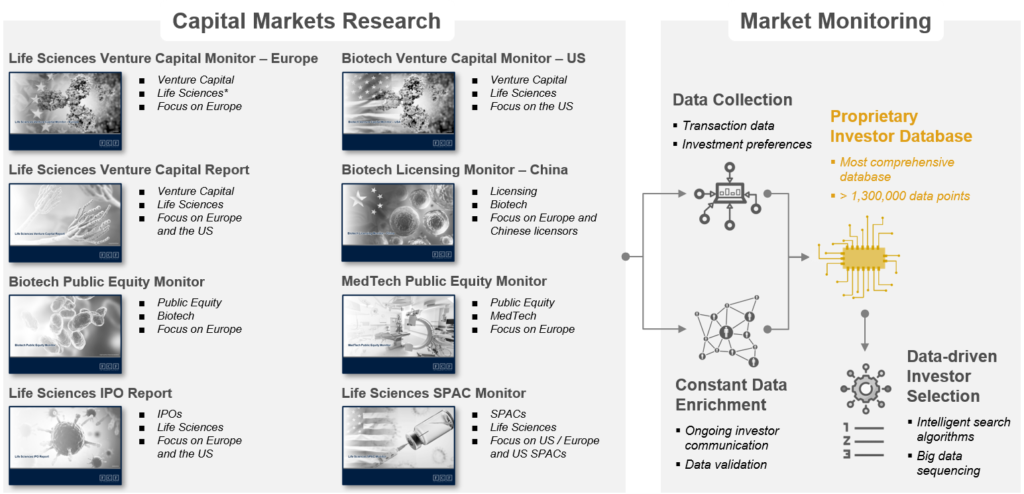

- FCF tracks every transaction in the market, feeding our most comprehensive and intelligent investor and transaction database in Life Sciences

- FCF’s intelligent search algorithms sequences big data sets to match relevant investors

- FCF has established a large network to the relevant investors for each indication, stage, geography and ticket size, increasing interest, response and closing probability

SERVICES

Full Mandate

- Situation: Often virtual companies with scarce resources with the need for external capacities

- Scope: FCF coordinates the whole financing process from preparation to negotiation

- Value Add: FCF acts as an “external finance department”, offering a full service package to outsource the fundraising process

Mandate Lite

- Situation: A company has prepared a sound investment proposal and is interested in outsourcing investor communications

- Scope: FCF coordinates and streamlines the entire investor communications and supports in the closing of the transaction

- Value Add: The company can focus on its daily operations with certainty of professional fundraising support

Call Sheet Optimization

- Situation: A company has started to approach investors

- Scope: FCF matches the company’s call sheet with its proprietary investor data base, identifying and approaching residual investors

- Value Add: Assurance that all relevant investors will be approached