On a quarterly basis, FCF published its FCF Bank Monitor. The FCF Bank Monitor is a research report, based on publicly available data, on the most active and largest 22 banking institutions addressing the German and Austrian Mittelstand. It supports CFOs and Heads of Treasury in the selection of their long-term banking partners, following the motto “Know-Your-Bank”.

FCF BANK MONITOR

The FCF Bank Monitor includes:

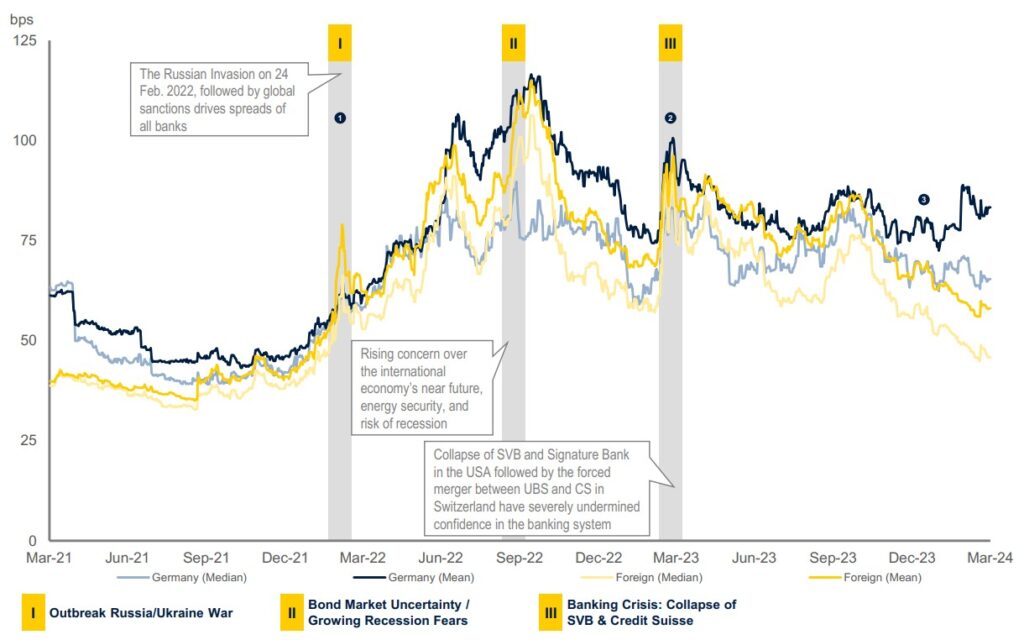

- Credit Default Swaps: Analysis of the 1-, 5- and 10-year Credit Default Swap-Spreads (CDS-Spreads), which serve as a forward-looking risk indicator within the banking sector.

- Rating: Rating information of the big-3 rating agencies.

- Performance: Key fundamental performance indicators for financial institutions.

- Bank Ranking: A ranking based on above criteria provides insight into the health and market perspective of the individual banking institutions, in addition to highlighting the relative performance between the institutions.

- League Table: Most active banks in German and Austrian mid-cap segments by lending volume.

- The trend of declining CDS spreads, which started in 2023, continued in Q1 2024 for both domestic and foreign banks, reflecting the market’s confidence in a “soft landing” of the European economy and declining risk within the banking industry.

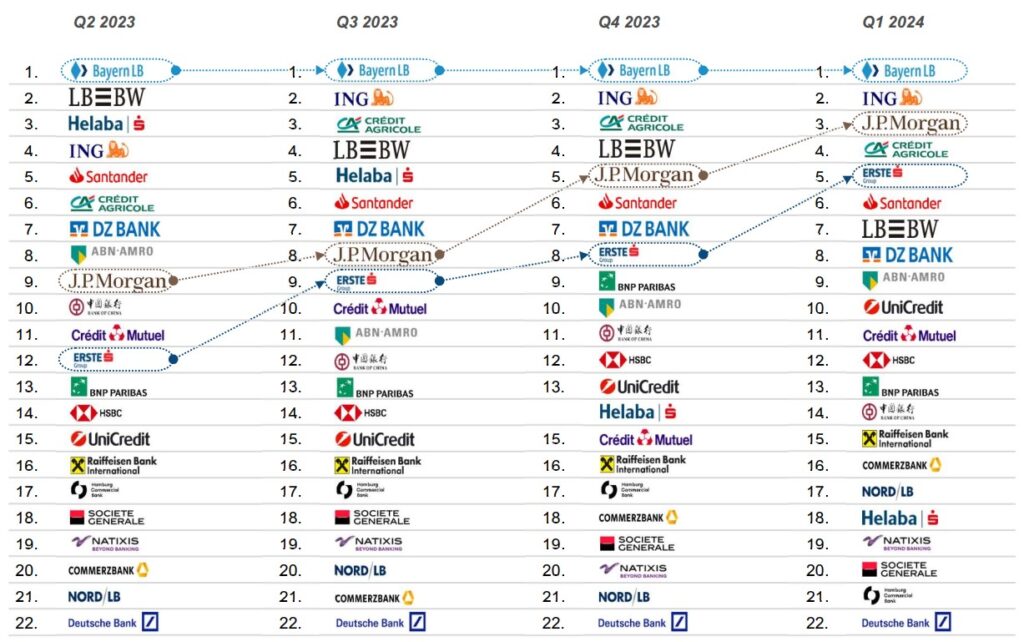

- The Q1 2024 league table is headed, once again, by Bayern LB, followed by ING Bank and J.P. Morgan. Crédit Mutuel and NORD/LB are the biggest winners, gaining four ranks over the last 3 months, however, both remaining in the second half of the league table.

- On average, the mean CDS spreads of German banks are still trading somewhat above those of their foreign peers, driven by a more pessimistic outlook for the German economy.

SMALLCAP / MIDCAP RESEARCH SERIES

The FCF SmallCap / MidCap research reports are periodically updated and cover eight specific sectors as well as certain general capital market developments. Based on the data of publicly listed European corporates, the respective sector and market are individually analyzed. Our systematic analyses include information to, amongst others:

Sector Research

Automotive Supplier Market Study

Research on the automotive supplier sector based on available data from European automotive suppliers.

Automotive Supplier Market Study

Research on the automotive supplier sector based on available data from European automotive suppliers.

European Chemicals Market Study

European Chemicals Market Study

Research on the chemicals sector based on available data from European chemical companies.

Forestry, Paper and Packaging Market Study Research on the forestry, paper and packaging sector based on available data from European forestry, paper and packaging companies.

Forestry, Paper and Packaging Market Study Research on the forestry, paper and packaging sector based on available data from European forestry, paper and packaging companies.

Industrial Machinery Market StudyResearch on the industrial machinery sector based on available data from European industrial machinery companies.

Industrial Machinery Market StudyResearch on the industrial machinery sector based on available data from European industrial machinery companies.

Metals & Materials Market Study

Metals & Materials Market Study

Research on the metals & materials sector based on available data from European metals & materials producers.

Logistics & Transportation Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

Logistics & Transportation Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

European Infrastructure & Construction Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

European Infrastructure & Construction Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

TMT Market StudyResearch on the TMT sector based on available data from European TMT companies.

TMT Market StudyResearch on the TMT sector based on available data from European TMT companies.

European Recycling Services Market Study

European Recycling Services Market Study

Research on the recycling services sector based on available data from European recycling services companies.

Market Research

Bank Monitor

Analysis of the historic and current spreads of credit default swaps for banks most active in the German corporate lending market.

Bank Monitor

Analysis of the historic and current spreads of credit default swaps for banks most active in the German corporate lending market.

IPO Market MonitorProviding relevant valuation metrics (e.g. ratios, multiples), general information and performance data of European IPOs that have been issued within the last six months.

IPO Market MonitorProviding relevant valuation metrics (e.g. ratios, multiples), general information and performance data of European IPOs that have been issued within the last six months.

Valuation MonitorThe FCF Valuation Monitor is a comprehensive quarterly valuation analysis (e.g. ratios and multiples) for the German small / midcap market segment of selected industry sectors.

Valuation MonitorThe FCF Valuation Monitor is a comprehensive quarterly valuation analysis (e.g. ratios and multiples) for the German small / midcap market segment of selected industry sectors.

Interest & Corporate Loan MonitorComprehensive analysis of the interest rate environment and loan market for corporates in Germany.

Interest & Corporate Loan MonitorComprehensive analysis of the interest rate environment and loan market for corporates in Germany.

NEWS & PRESS

FCF Automotive Supplier Market Study – 2024 published

FCF Fox Corporate Finance GmbH is pleased to publish the new “FCF AUTOMOTIVE SUPPLIER MARKET STUDY – 04/2024”. Based on available data from European automotive suppliers, the FCF AUTOMOTIVE SUPPLIER MARKET STUDY is a detailed

FCF Bank Monitor – Q1 2024 published

On a quarterly basis, FCF publishes its FCF Bank Monitor. The FCF Bank-Monitor is a research report, based on publicly available data, on the most active and largest 22 banking institutions addressing the German and

FCF Valuation Monitor – Q1 2024 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q1 2024”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and

FCF Interest & Corporate Loan Monitor Q4/2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the new “FCF Interest & Corporate Loan Monitor Q4/2023”. FCF regularly conducts comprehensive research regarding the German corporate loan and interest market, based on publically available

FCF Bank Monitor – Q4 2023 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q4 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and