FCF regularly engages in research on the infrastructure and construction sector based on available data from European infrastructure and construction companies. The findings are regularly published in the

FCF EUROPEAN INFRASTRUCTURE & CONSTRUCTION MARKET STUDY

The FCF European Infrastructure & Construction Market Study includes:

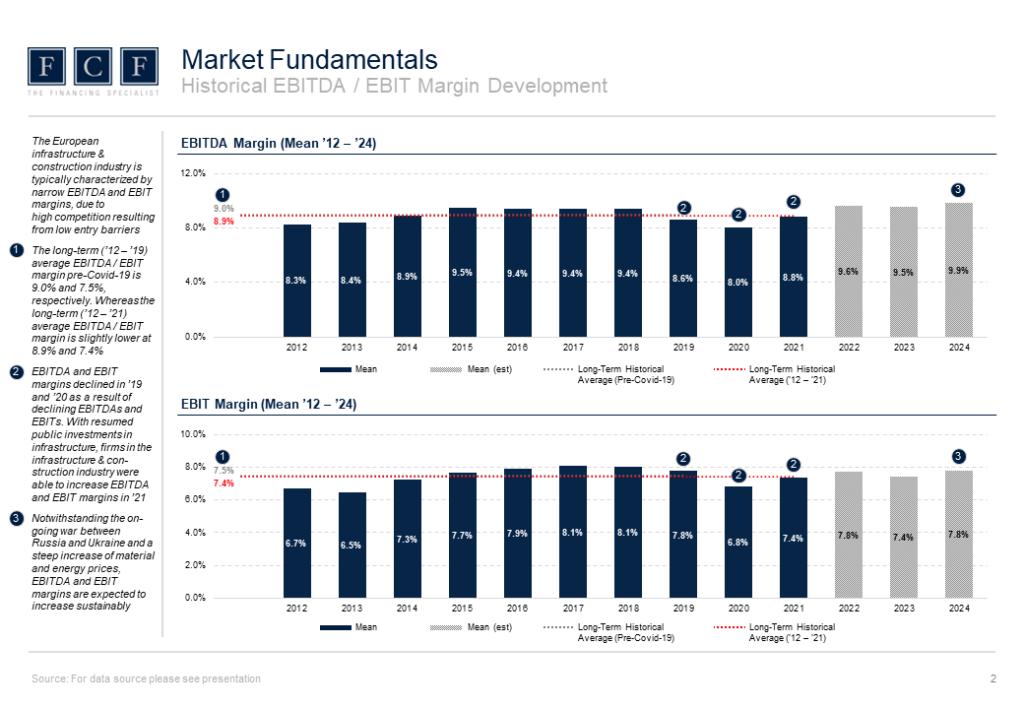

Market Fundamentals: Development of key P&L metrics (revenue, EBITDA, EBIT) and profitability metrics (EBITDA-/ EBIT margin)

Market Valuation: Development of valuation multiples (EV / EBITDA, EV / EBIT)

Credit Statistics: Development of relevant credit metrics (net leverage ratio, equity ratio, EBITDA interest cover ratio and loan-to-value ratios), market rating and implied cost of capital (WACC)

Private Equity and Mergers & Acquisitions: Development of deal volume and deal count

The FCF European Infrastructure & Construction Market Study includes (December 2022):

- Revenue Development ’20-’21: 10.6%

- EBITDA Development ’20-’21: 56.0%

- EBITDA Margin ‘21: 8.8%

- EV / EBITDA-Multiple ‘21: 9.0x

- Net Leverage ’21: 2.9x

- Equity Ratio ’21: 38.8%

- Rating ’21: BX+

- WACC ’21: 6.7%

- Private Equity Deal Count ’21: 77

- M&A Deal Count ’21: 75

- Revenue Development ’20-’20: -8.0%

- EBITDA Development ’20-’20: -25.5%

- EBITDA Margin ’20: 6.6%

- EV / EBITDA-Multiple ’20: 9.5x

- Net Leverage ’20: 4.2x

- Equity Ratio ’20: 36.9%

- Rating ’20: BB+

- WACC ’20: 5.2%

- Private Equity Deal Count ’20: 39

- M&A Deal Count ’20: 29

SMALLCAP / MIDCAP RESEARCH SERIES

The FCF SmallCap / MidCap research reports are periodically updated and cover eight specific sectors as well as certain general capital market developments. Based on the data of publicly listed European corporates, the respective sector and market are individually analyzed. Our systematic analyses include information to, amongst others:

Sector Research

Automotive Supplier Market Study

Research on the automotive supplier sector based on available data from European automotive suppliers.

Automotive Supplier Market Study

Research on the automotive supplier sector based on available data from European automotive suppliers.

European Chemicals Market Study

European Chemicals Market Study

Research on the chemicals sector based on available data from European chemical companies.

Forestry, Paper and Packaging Market Study Research on the forestry, paper and packaging sector based on available data from European forestry, paper and packaging companies.

Forestry, Paper and Packaging Market Study Research on the forestry, paper and packaging sector based on available data from European forestry, paper and packaging companies.

Industrial Machinery Market StudyResearch on the industrial machinery sector based on available data from European industrial machinery companies.

Industrial Machinery Market StudyResearch on the industrial machinery sector based on available data from European industrial machinery companies.

Metals & Materials Market Study

Metals & Materials Market Study

Research on the metals & materials sector based on available data from European metals & materials producers.

Logistics & Transportation Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

Logistics & Transportation Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

European Infrastructure & Construction Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

European Infrastructure & Construction Market StudyResearch on the logistics and transport sector based on publicly available data from European logistics and transportation providers.

TMT Market StudyResearch on the TMT sector based on available data from European TMT companies.

TMT Market StudyResearch on the TMT sector based on available data from European TMT companies.

European Recycling Services Market Study

European Recycling Services Market Study

Research on the recycling services sector based on available data from European recycling services companies.

Market Research

Bank Monitor

Analysis of the historic and current spreads of credit default swaps for banks most active in the German corporate lending market.

Bank Monitor

Analysis of the historic and current spreads of credit default swaps for banks most active in the German corporate lending market.

IPO Market MonitorProviding relevant valuation metrics (e.g. ratios, multiples), general information and performance data of European IPOs that have been issued within the last six months.

IPO Market MonitorProviding relevant valuation metrics (e.g. ratios, multiples), general information and performance data of European IPOs that have been issued within the last six months.

Valuation MonitorThe FCF Valuation Monitor is a comprehensive quarterly valuation analysis (e.g. ratios and multiples) for the German small / midcap market segment of selected industry sectors.

Valuation MonitorThe FCF Valuation Monitor is a comprehensive quarterly valuation analysis (e.g. ratios and multiples) for the German small / midcap market segment of selected industry sectors.

Credit MonitorComprehensive analysis of the interest rate environment and loan market for corporates in Germany.

Credit MonitorComprehensive analysis of the interest rate environment and loan market for corporates in Germany.

NEWS & PRESS

FCF Automotive Supplier Market Study – 2024 published

FCF Fox Corporate Finance GmbH is pleased to publish the new “FCF AUTOMOTIVE SUPPLIER MARKET STUDY – 04/2024”. Based on available data from European automotive suppliers, the FCF AUTOMOTIVE SUPPLIER MARKET STUDY is a detailed

FCF Bank Monitor – Q1 2024 published

On a quarterly basis, FCF publishes its FCF Bank Monitor. The FCF Bank-Monitor is a research report, based on publicly available data, on the most active and largest 22 banking institutions addressing the German and

FCF Valuation Monitor – Q1 2024 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q1 2024”. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and

FCF Interest & Corporate Loan Monitor Q4/2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the new “FCF Interest & Corporate Loan Monitor Q4/2023”. FCF regularly conducts comprehensive research regarding the German corporate loan and interest market, based on publically available

FCF Bank Monitor – Q4 2023 published

FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Bank Monitor – Q4 2023”. FCF regularly engages in research on the banking sector based on available data from the most active and