The ‘FCF DeepTech Series’ is a quarterly series of reports tracking European venture capital funding trends within four main DeepTech verticals. We highlight deal counts, volumes, investor interests, subsector trends, geographic hotspots, IPO activity as well as M&A / trade sale activity. Each quarter one of the four verticals – CleanTech, Advanced Manufacturing, Industrial Internet of Things (IIoT) and Robotics – is examined individually.

Each report is a quick reference for investors, corporates and professionals for the funding trends within the respective vertical.

FCF CLEANTECH VENTURE CAPITAL REPORT

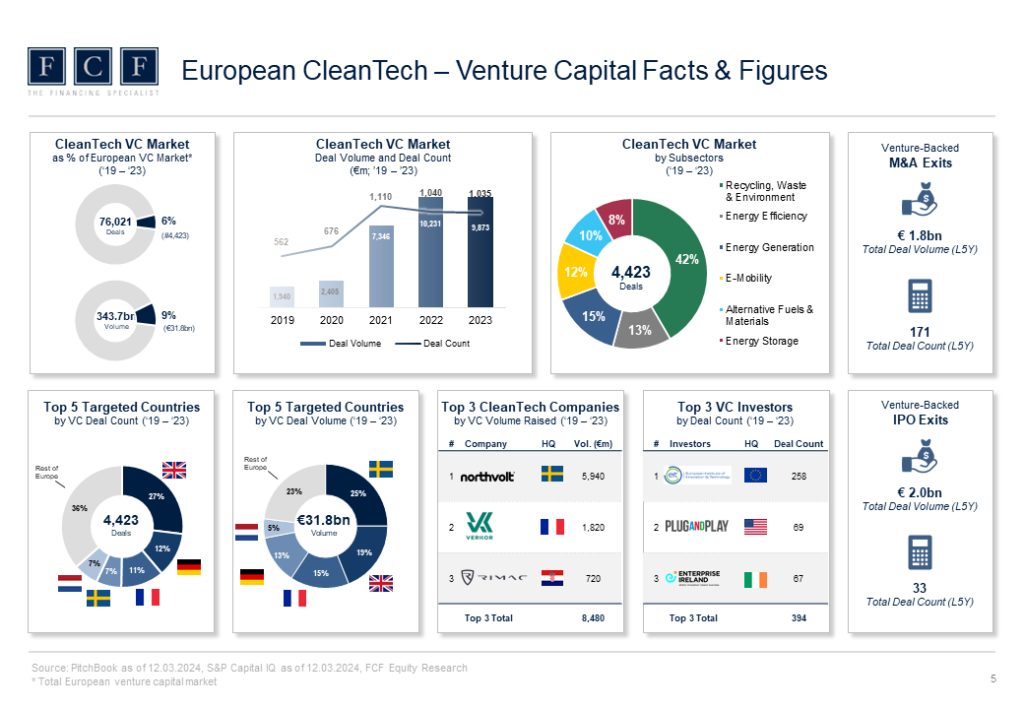

This edition of the inaugural ‘FCF DeepTech Series’ focuses on VC funding developments within the European CleanTech vertical. The European CleanTech vertical has been split into six main subsectors:

- Alternative Fuels & Materials

- E-Mobility

- Energy Efficiency

- Energy Generation

- Energy Storage

- Recycling, Waste & Environment

Key Findings:

- Venture investments in cleantech start-ups remains stable at high levels: Despite the difficult circumstances in the venture capital market, deal activity in the cleantech sector remained stable in 2023 at the level of the record year 2022: 1,035 transaction and €9.9bn investments in 2023 vs. 1,040 transactions and €10,2bn investments in 2022.

- Sweden leads the ranking by deal volume: With a financing volume of €7.8bn in the period 2019-2023, Sweden is clearly ahead of the UK (€5.9bn) and France (€4.8bn). However, this is mainly due to Northvolt’s 5 megadeals (totaling €5.9bn) – without Northvolt, Sweden would be ranked 4th behind Germany with €1.9bn

- Trend towards mega deals and late-stage financings: With an average transaction volume of around €9.5m, 2023 figure is significantly higher than in previous years (2020: €3.6m; 2021: €6.6m). This is partly due to the successfully closed mega deals (Verkor: €1.5bn; Northvolt: €1.1bn; Conigital: €583m; HUMARA: €281m; Enpal: €215m; 1komma5: €215m) and partly due to the increase in late-stage financing (37% in 2023 vs. 26% in 2019) – both signs of greater maturity of technologies and start-ups in this sector

- Almost no activity on the stock market in 2023: 2023 was again a difficult year for the IPO and SPAC market in the CleanTech Venture Capital sector with only 1 IPO (Osmosun) and 4 SPACs (Zapp Electric Vehicles, Next.e.GO Mobile, EnergyPathways, and H2B2 Electrolysis Technologies)

DEEPTECH RESEARCH SERIES

The “FCF DeepTech Series” is a quarterly series of reports tracking European venture capital funding trends within four main DeepTech verticals. We highlight deal counts, volumes, investor interests, subsector trends, geographic hotspots, IPO activity as well as M&A / trade sale activity.

Each quarter one of the four verticals – Cleantech, Advanced Manufacturing, Industrial Internet of Things (IIoT) and Robotics – is examined individually.

Each report is a quick reference for investors, corporates and professionals for the funding trends within the respective vertical.

Cleantech Venture Capital Report

European VC Funding trends, IPO and M&A activity in the CleanTech sector

Cleantech Venture Capital Report

European VC Funding trends, IPO and M&A activity in the CleanTech sector

Advanced Manufacturing Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Advanced Manufacturing sector

Advanced Manufacturing Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Advanced Manufacturing sector

Industrial Internet of Things Venture Capital Report

European VC Funding trends, IPO and M&A activity in the IIoT sector

Industrial Internet of Things Venture Capital Report

European VC Funding trends, IPO and M&A activity in the IIoT sector

Robotics Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Robotics and Drones sector

Robotics Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Robotics and Drones sector

NEWS & PRESS

FCF CleanTech Venture Capital Report – 2024 published

FCF Fox Corporate Finance GmbH is pleased to publish the “CleanTech Venture Capital Report – 2024”. This edition of the “FCF DeepTech Series” focuses on VC funding developments within the European Cleantech vertical. This vertical

FCF Robotics Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “Robotics Venture Capital Report – 2023”. The report is part of the “FCF DeepTech Series”, which is a quarterly series of reports tracking European venture

FCF at the Tech Tour NRW Green 2023 in Dusseldorf on 19 September, 2023

September 19, the Tech Tour Green 2023 Programme will take place in Dusseldorf with an exciting live event. The Tech Tour NRW Green Programme is designed to help start-ups based in North Rhine -Westphalia region developing tech solutions in the broad

FCF Advanced Manufacturing Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “FCF Advanced Manufacturing Venture Capital Report – 2023”. The report is part of the “FCF DeepTech Series“, which is a quarterly series of reports tracking

FCF CleanTech Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “CleanTech Venture Capital Report – 2023”. This edition of the “FCF DeepTech Series” focuses on VC funding developments within the European Cleantech vertical. This vertical