Die “FCF DeepTech Series” ist eine quartalweise erscheinende Studie, welche die europäischen Venture Capital Finanzierungsaktivitäten in vier DeepTech-Verticals verfolgt. FCF beleuchtet dabei die Venture Financing Trends (u.a. Anzahl der Finanzierungen / Deals, Deal-Volumina, Investoren-Interessen, Subsector-Trends, geographische Schwerpunkte) als auch die IPO sowie M&A / Trade Sale Aktivitäten. Jedes Quartal betrachten wir einen von vier Verticals: CleanTech, Advanced Manufacturing, Industrial Internet of Things (IIoT) sowie Robotics.

FCF CLEANTECH VENTURE CAPITAL REPORT

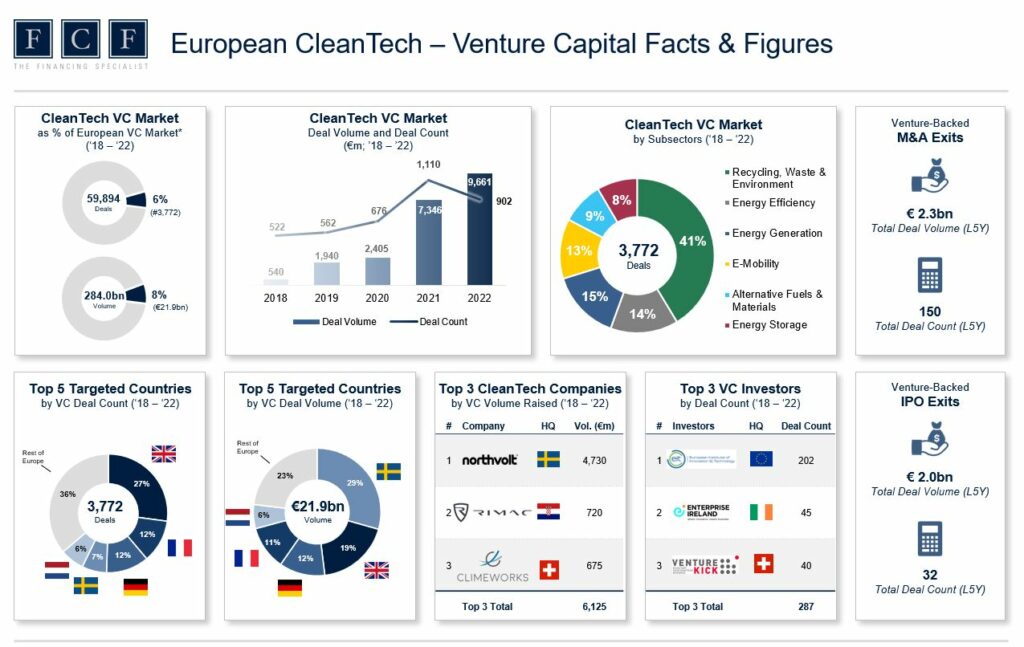

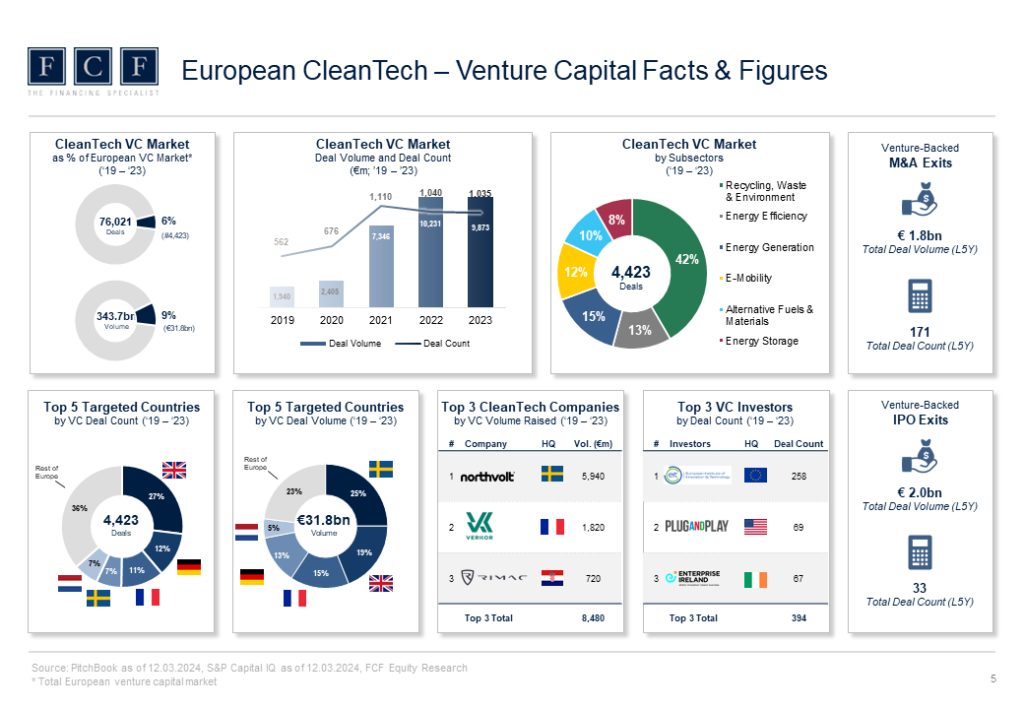

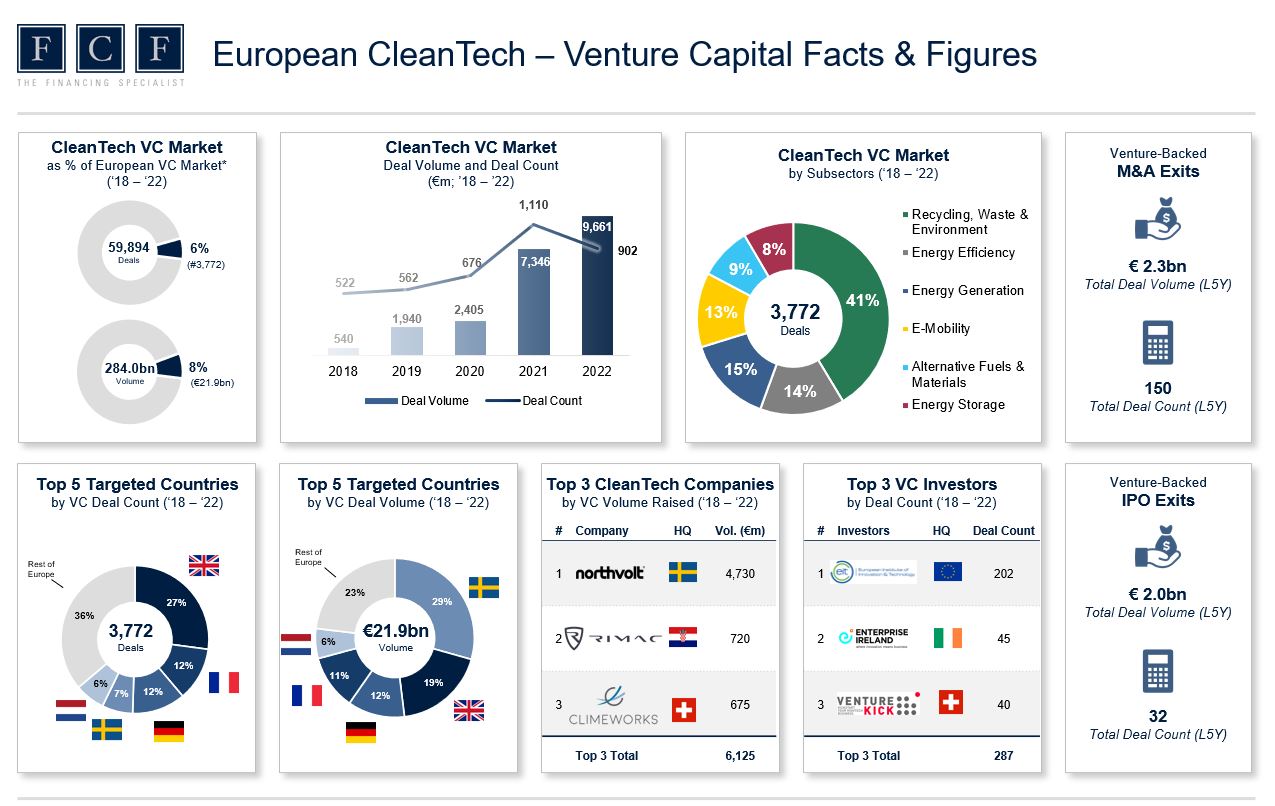

Diese Ausgabe der ‘FCF DeepTech Series’ konzentriert sich auf VC-Finanzierungsentwicklungen innerhalb des europäischen CleanTech-Verticals. Das europäische CleanTech-Vertical wurde in sechs Untersektoren aufgeteilt:

- Alternative Kraftstoffe & Materialien

- E-Mobilität

- Energie-Effizienz

- Energieerzeugung

- Energiespeicherung

- Recycling, Abfall & Umwelt

Wichtigste Erkenntnisse:

- Venture Investments in CleanTech Start-ups bleiben stabil auf hohem Niveau: Trotz des schwierigen Umfelds im VC Bereich blieb die Deal-Aktivität im CleanTech Bereich auf dem Niveau des Rekordjahres 2022: 1.035 Transaktionen und €9,9 Mrd. Investments in 2023 vs. 1.040 Transaktionen und €10.2 Mrd. Investments in 2022

- Schweden führt das Ranking nach Deal Volumen an: Mit einem Finanzierungsvolumen von €7,8 Mrd. im Zeitraum 2019-2023 liegt Schweden klar vor dem Vereinigten Königreich (€5,9 Mrd.) und Frankreich (€4,8 Mrd.). Dies liegt allerdings hauptsächlich an den 5 Megadeals von Northvolt (insgesamt €5,8 Mrd.) – ohne Northvolt wäre Schweden mit €1,9 Mrd. auf Platz 4 hinter Deutschland

- Trend zu Mega-Deals sowie Spätphasenfinanzierungen: Mit einem durchschnittlichen Transaktionsvolumen von ca. €9,5 Mio. liegt das Jahr 2023 deutlich über den Werten der Vorjahre (2020: €3,6 Mio.; 2021: €6,6 Mio.). Dies resultiert zum einen aus den abgeschlossenen Mega-Deals (Verkor: €1,5 Mrd.; Northvolt: €1,1 Mrd.; Conigital: €583 Mio.; HUMARA: €281 Mio.; Enpal: €215 Mio.; 1komma5: €215m) sowie zum anderen aus dem Anstieg bei Spätphasenfinanzierungen (37% in 2023 vs. 26% in 2019) – beides Anzeichen für eine höhere Reife von Technologien und Start-Ups in diesem Sektor

- Kaum Aktivität an der Börse in 2023: Auch 2023 war ein schwieriges Jahr für den IPO- und SPAC-Markt im CleanTech Venture Capital Sektor mit lediglich 1 IPO (Osmosun) and 4 SPAC (Zapp Electric Vehicles, Next.e.GO Mobile, EnergyPathways, und H2B2 Electrolysis Technologies)

DEEPTECH RESEARCH SERIE

Die “FCF DeepTech Series” ist eine quartalweise erscheinende Studie, welche die europäischen Venture Capital Finanzierungstrends in vier DeepTech-Verticals verfolgt. Wir beleuchten u.a. Anzahl der Finanzierungen / Deals, Deal-Volumina, Investoren-Interessen, Subsector-Trends, geographische Schwerpunkte, IPO sowie M&A / Trade Sale Aktivitäten. Jedes Quartal betrachten wir einen der vier Verticals: Cleantech, Advanced Manufacturing, Industrial Internet of Things (IIoT) sowie Robotics.

Jeder Report dient Investoren, Corporates und Professionals als schneller Überblick bezüglich der Finanzierungsaktivitäten im jeweiligen Vertical.

Cleantech Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Cleantech-Sektor

Cleantech Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Cleantech-Sektor

Advanced Manufacturing Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Bereich Advanced Manufacturing

Advanced Manufacturing Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Bereich Advanced Manufacturing

Industrial Internet of Things Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im IIoT-Sektor

Industrial Internet of Things Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im IIoT-Sektor

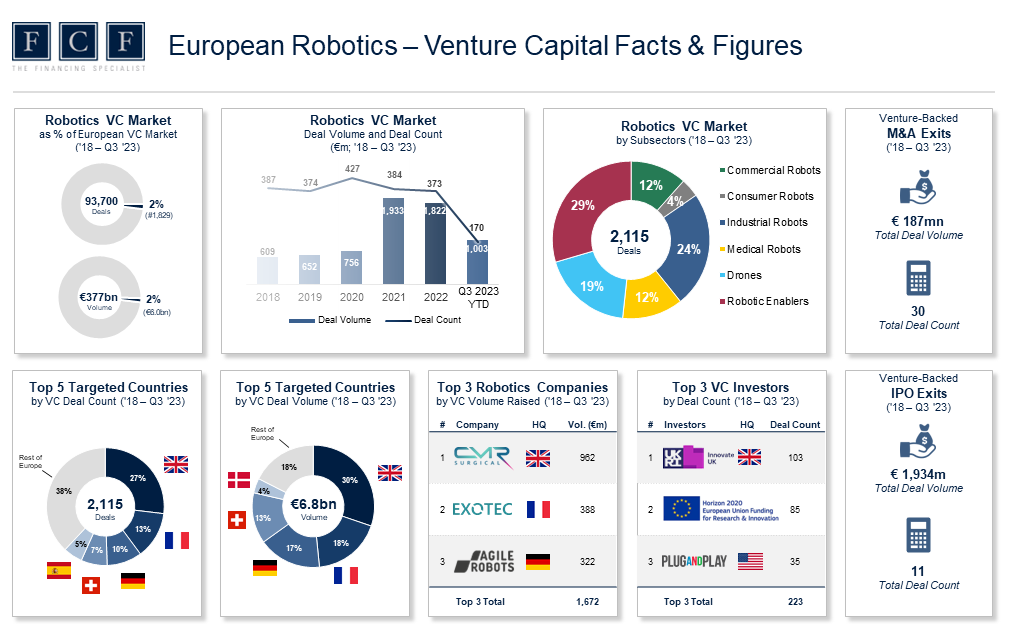

Robotics Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Bereich Robotik und Drohnen

Robotics Venture Capital Report

Europäische VC-Finanzierungstrends, IPO- und M&A-Aktivitäten im Bereich Robotik und Drohnen

NEWS & PRESS

FCF CleanTech Report 2024: Venture Investments in CleanTech Start-ups widersetzen sich dem negativem Trend im allgemeinen VC Markt

PRESSEMITTEILUNG FCF CleanTech Report 2024: Venture Investments in CleanTech Start-ups widersetzen sich dem negativem Trend im allgemeinen VC Markt VC Deal-Aktivität im CleanTech Bereich in Europa in 2023 auf dem Niveau des Rekordjahres 2022 Schweden

FCF CleanTech Venture Capital Report – 2024 veröffentlicht

FCF Fox Corporate Finance GmbH freut sich den neuen „CleanTech Venture Capital Report – 2024” zu veröffentlichen. Diese Ausgabe der ‘FCF DeepTech Series’ konzentriert sich auf VC-Finanzierungsentwicklungen innerhalb des europäischen CleanTech-Verticals. Das europäische CleanTech-Vertical wurde

FCF Fox Corporate Finance GmbH veröffentlicht den Robotics Venture Capital Monitor 2023 – Abwärtstrend folgt dem breiteren VC Markt

PRESSEMITTEILUNG FCF Fox Corporate Finance GmbH veröffentlicht den Robotics Venture Capital Monitor 2023 – Abwärtstrend folgt dem breiteren VC Markt Deutlicher Abwärtstrend im Robotik-Venture-Capital-Sektor Mega-Deals dominieren weiter das Finanzierungsvolumen Skandinavien führend bei IPOs im Robotics-Bereich

FCF Robotics Venture Capital Report – 2023 veröffentlicht

FCF Fox Corporate Finance GmbH freut sich den neuen „Robotics Venture Capital Report – 2023” zu veröffentlichen. Der Report ist Teil der “FCF DeepTech Series“, einer quartalweise erscheinenden Studie, welche die europäischen Venture Capital Finanzierungstrends

FCF bei der Tech Tour NRW Green 2023 in Düsseldorf am 19 September 2023

Am 19. September findet das Tech Tour Green 2023 Programm in Düsseldorf mit einem spannenden Live-Event statt. Das Tech Tour NRW Green Programm wurde entwickelt, um Start-ups mit Sitz in Nordrhein-Westfalen, die Technologielösungen in den