The ‘FCF DeepTech Series’ is a quarterly series of reports tracking European venture capital funding trends within four main DeepTech verticals. We highlight deal counts, volumes, investor interests, subsector trends, geographic hotspots, IPO activity as well as M&A / trade sale activity. Each quarter one of the four verticals – CleanTech, Advanced Manufacturing, Industrial Internet of Things (IIoT) and Robotics – is examined individually.

Each report is a quick reference for investors, corporates and professionals for the funding trends within the respective vertical.

FCF ADVANCED MANUFACTURING VENTURE CAPITAL REPORT

This edition of the ‘FCF DeepTech Series’ focuses on VC funding developments within the European Advanced Manufacturing vertical.

The European Advanced Manufacturing vertical has been split into four main subsectors:

- Additive Manufacturing

- Robotic Automation

- Sensors and IoT Platforms

- Industrial Process Software

Key Findings:

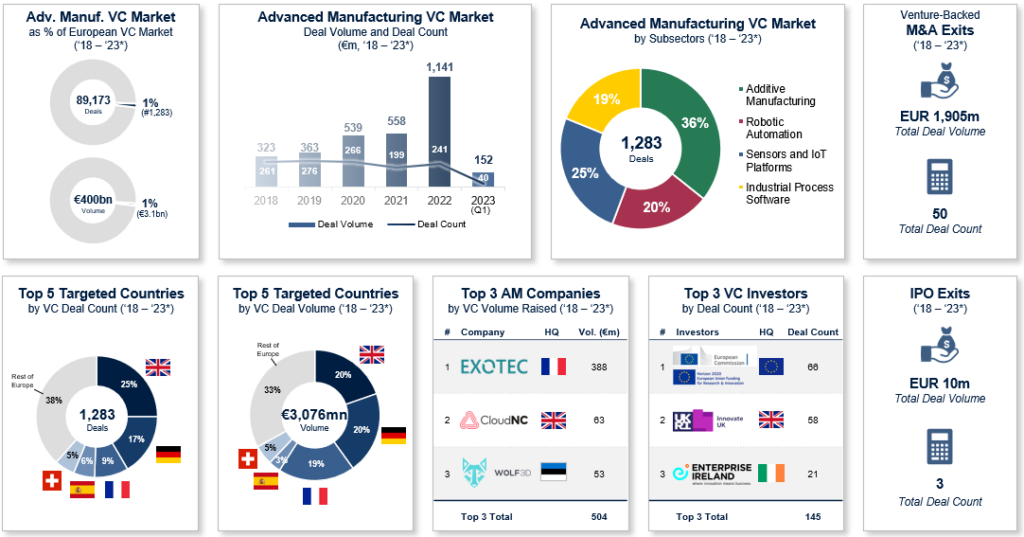

- Sharp decline in venture capital investment in the Advanced Manufacturing sector in Q1 2023: After a strong 2022 (all-time high investment volume at €1.1bn and an average of 60 deals per quarter), Q1 2023 drops significantly. Although the first quarter usually has been the strongest quarter in recent years, Q1 2023 recorded only 40 deals and an investment volume of only €152m. This sharp decline reflects the economic and political uncertainty and the current gloom in the VC environment.

- Germany leads the ranking by deal volume: With a funding volume of €628m (2018 to Q1 2023), Germany is ahead of the UK (€605m) and France (€585m). Due to high a high number of undisclosed deals (only 55% of German deals disclose the financing volume vs. 83% in the UK), the actual volume (and leadership position) is even higher.

- The maturity of the sector and its companies continues to increase: the average size of financing rounds increased from €1.3m in 2019 to €4.7m in 2022. In terms of investor types, accelerators and other early-stage financiers are losing importance while late-stage investors are becoming more relevant. The startups themselves are becoming larger and more mature.

- The exit is dominated by the trade sale way before IPO: The increasing maturity of the start-ups is not reflected in the number of IPOs withonly 3 IPOs in the last 5 years. However, as the business model of many advanced manufacturing startups is usually highly synergistic for classic industrial companies, the trade sale is the more typical exit path (50 trade sale exits between 2018 and 2023 Q1).

DEEPTECH RESEARCH SERIES

The “FCF DeepTech Series” is a quarterly series of reports tracking European venture capital funding trends within four main DeepTech verticals. We highlight deal counts, volumes, investor interests, subsector trends, geographic hotspots, IPO activity as well as M&A / trade sale activity.

Each quarter one of the four verticals – Cleantech, Advanced Manufacturing, Industrial Internet of Things (IIoT) and Robotics – is examined individually.

Each report is a quick reference for investors, corporates and professionals for the funding trends within the respective vertical.

Cleantech Venture Capital Report

European VC Funding trends, IPO and M&A activity in the CleanTech sector

Cleantech Venture Capital Report

European VC Funding trends, IPO and M&A activity in the CleanTech sector

Advanced Manufacturing Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Advanced Manufacturing sector

Advanced Manufacturing Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Advanced Manufacturing sector

Industrial Internet of Things Venture Capital Report

European VC Funding trends, IPO and M&A activity in the IIoT sector

Industrial Internet of Things Venture Capital Report

European VC Funding trends, IPO and M&A activity in the IIoT sector

Robotics Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Robotics and Drones sector

Robotics Venture Capital Report

European VC Funding trends, IPO and M&A activity in the Robotics and Drones sector

NEWS & PRESS

FCF CleanTech Venture Capital Report – 2024 published

FCF Fox Corporate Finance GmbH is pleased to publish the “CleanTech Venture Capital Report – 2024”. This edition of the “FCF DeepTech Series” focuses on VC funding developments within the European Cleantech vertical. This vertical

FCF Robotics Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “Robotics Venture Capital Report – 2023”. The report is part of the “FCF DeepTech Series”, which is a quarterly series of reports tracking European venture

FCF at the Tech Tour NRW Green 2023 in Dusseldorf on 19 September, 2023

September 19, the Tech Tour Green 2023 Programme will take place in Dusseldorf with an exciting live event. The Tech Tour NRW Green Programme is designed to help start-ups based in North Rhine -Westphalia region developing tech solutions in the broad

FCF Advanced Manufacturing Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “FCF Advanced Manufacturing Venture Capital Report – 2023”. The report is part of the “FCF DeepTech Series“, which is a quarterly series of reports tracking

FCF CleanTech Venture Capital Report – 2023 published

FCF Fox Corporate Finance GmbH is pleased to publish the “CleanTech Venture Capital Report – 2023”. This edition of the “FCF DeepTech Series” focuses on VC funding developments within the European Cleantech vertical. This vertical