We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here:

Table of Contents

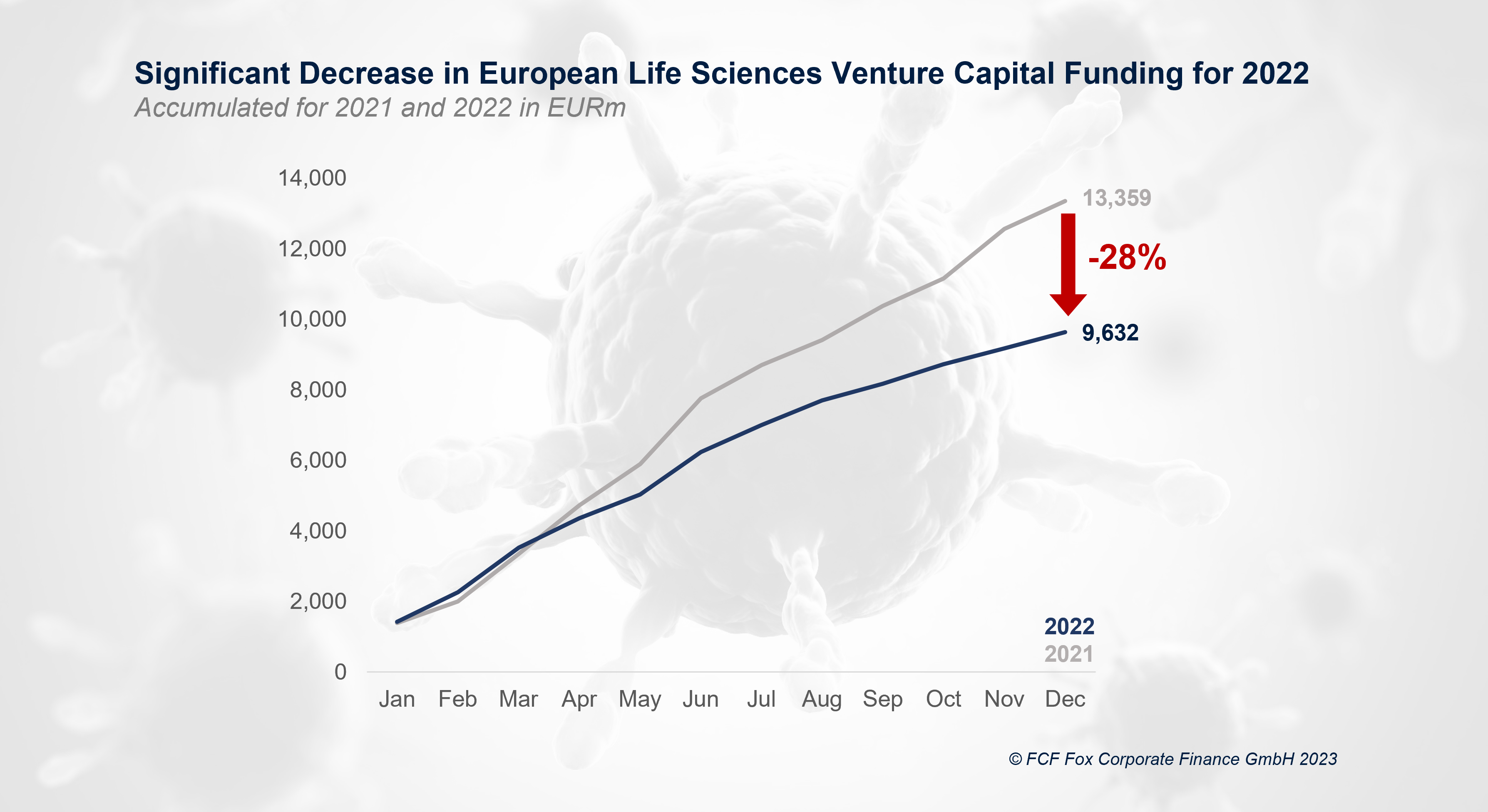

Venture capital funding in 2022 significantly decreased compared to 2021

The ever-increasing venture capital funding for European life sciences companies halted in 2022. With a roughly EUR 9.6bn volume, the overall financing for European life sciences companies in 2022 decreased significantly compared to 2021 (EUR 13.6bn) by 28%. While in the first quarter, funding volumes roughly matched, from April onwards, the funding volumes in 2021 consistently outperformed those of 2022. Based on these observations, we expect more challenging fundraising campaigns for European healthcare companies over the next few months.

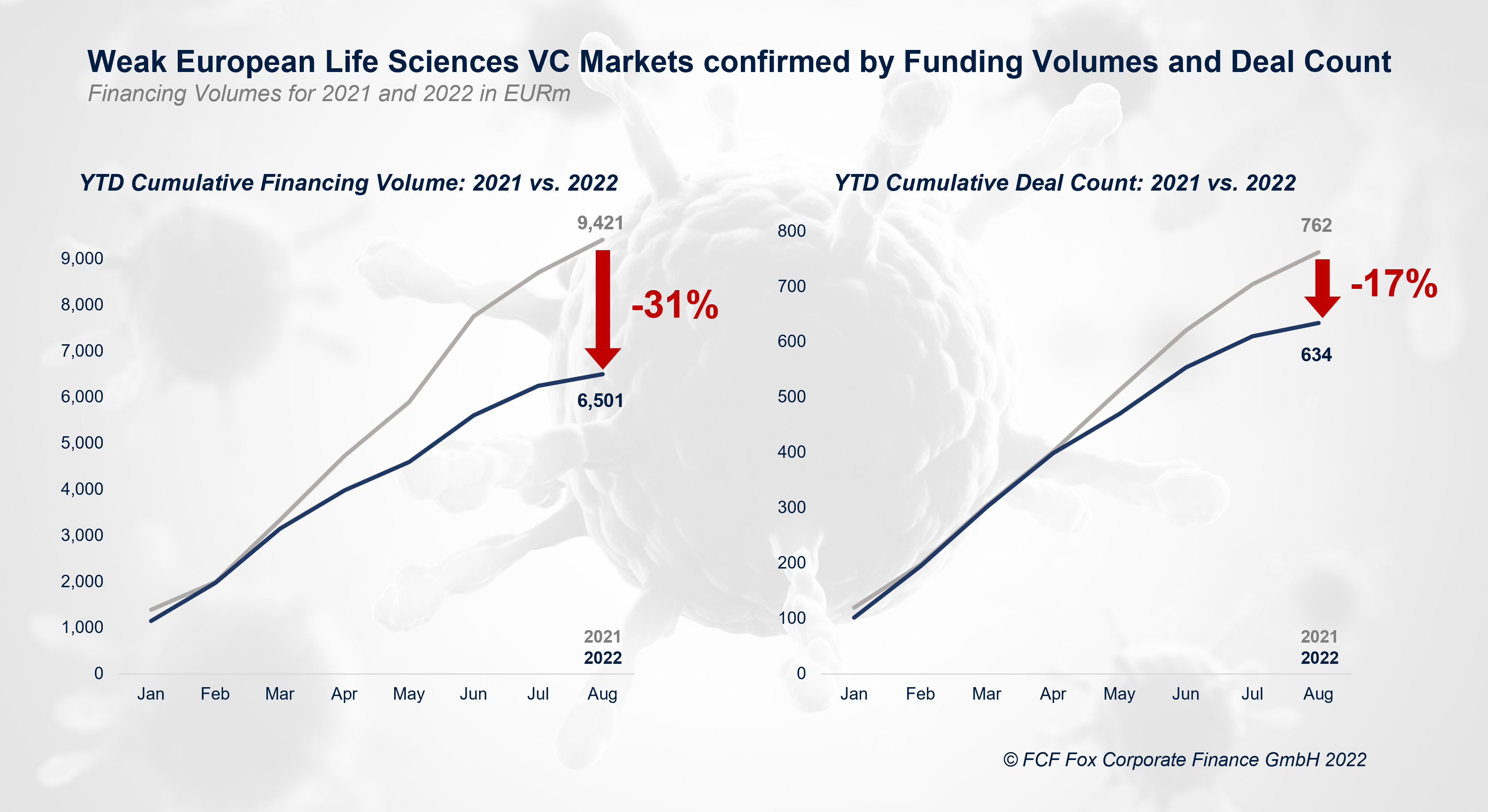

European VC life sciences funding continues to decline

In 2022, the venture capital funding for life sciences in Europe continues to weaken, further widening the gap to 2021 (EUR 9.4bn vs. EUR 6.5bn). The cumulative financing volume in August 2022 falls by more than -31% compared to August 2021. The cumulative number of closed deals in 2022 started to deviate from 2021 in May, leaving a gap of -17% in August compared to 2021. The numbers do not suggest a recovery over the last few weeks.

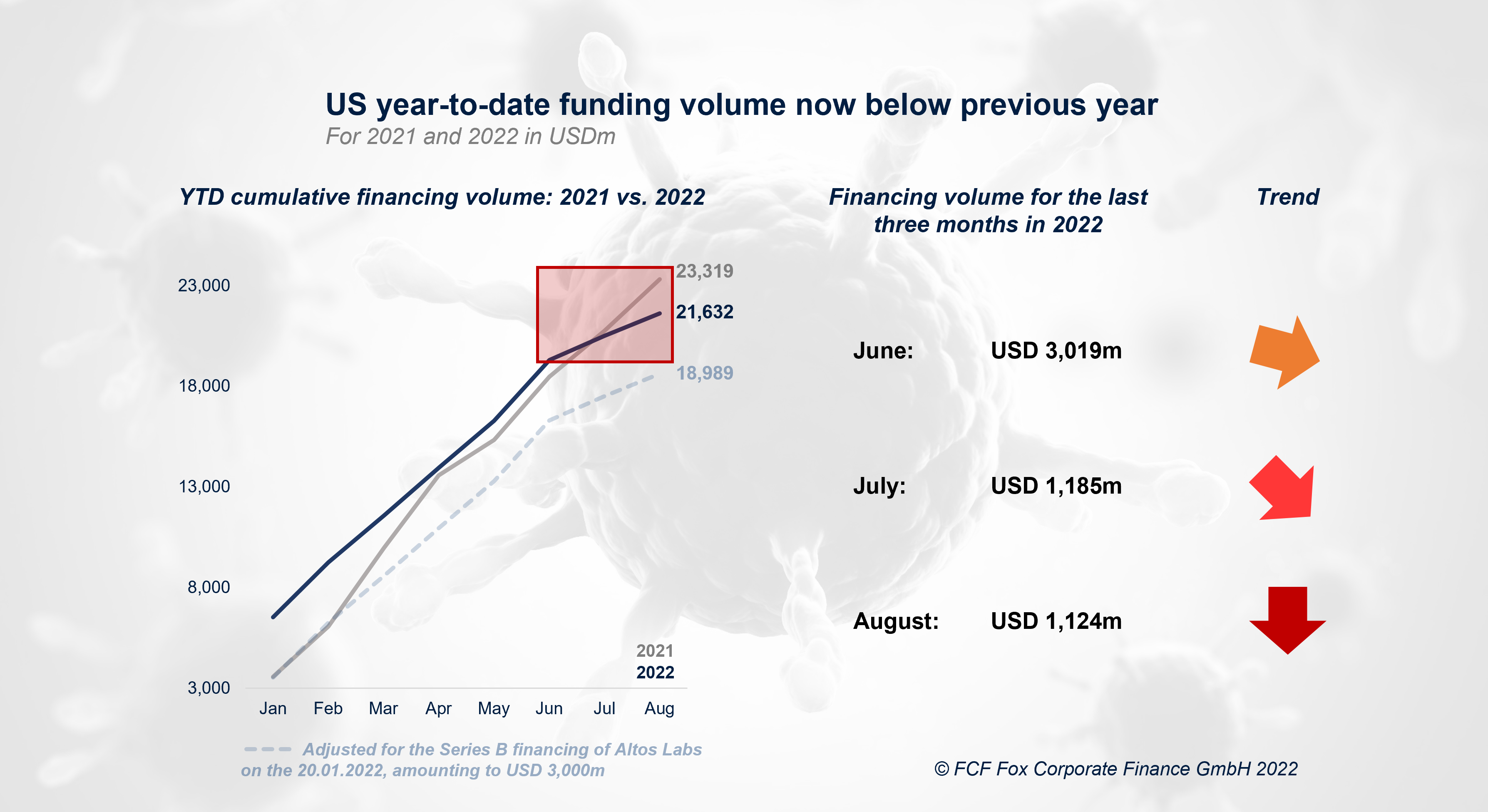

US year-to-date funding volume now below previous year’s level

After an exceptional year 2021 for venture capital funding in the US Biotech-sector, aggregated financing volumes in 2022 are for the first time lower than in 2021. During the last months funding volumes have declined significantly. Especially in June, funding volumes were almost three times as high compared August. Excluding the record-breaking Series B financing of Altos Labs in January 2022 (USD 3,000m), this year’s funding volumes would have already fallen behind in March on a year-to-year basis.

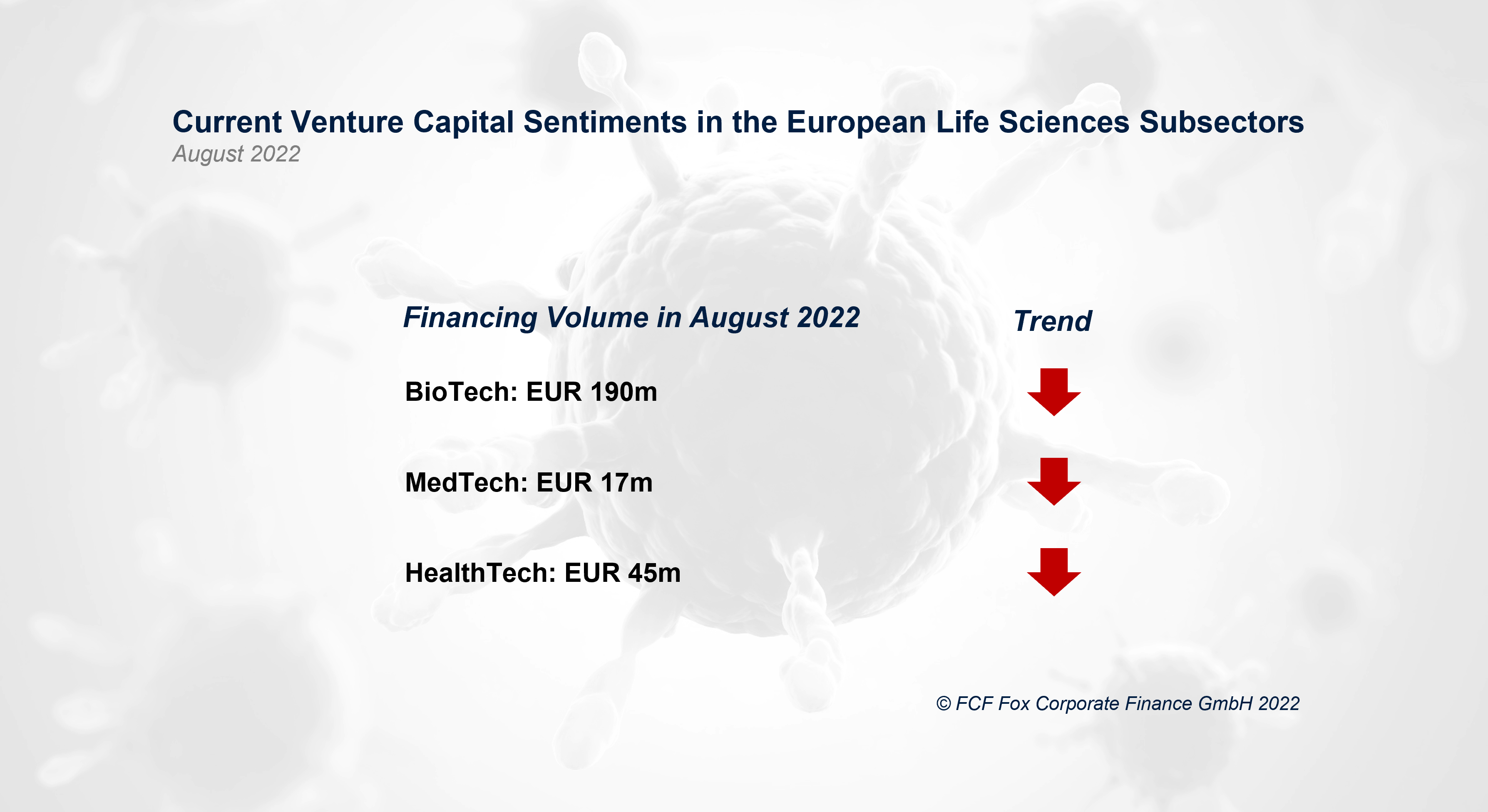

Overall negative Life Sciences Sentiments recorded in August 2022

The FCF Life Sciences team continuously analyses the current sentiments in the European life sciences venture capital funding sector. For August ’22, venture capital funding continues to decline. All life sciences subsectors (i.e. Biotech, HealthTech, and MedTech) are currently affected. According to our analysis, we expect this downward trend to persist in the coming months.

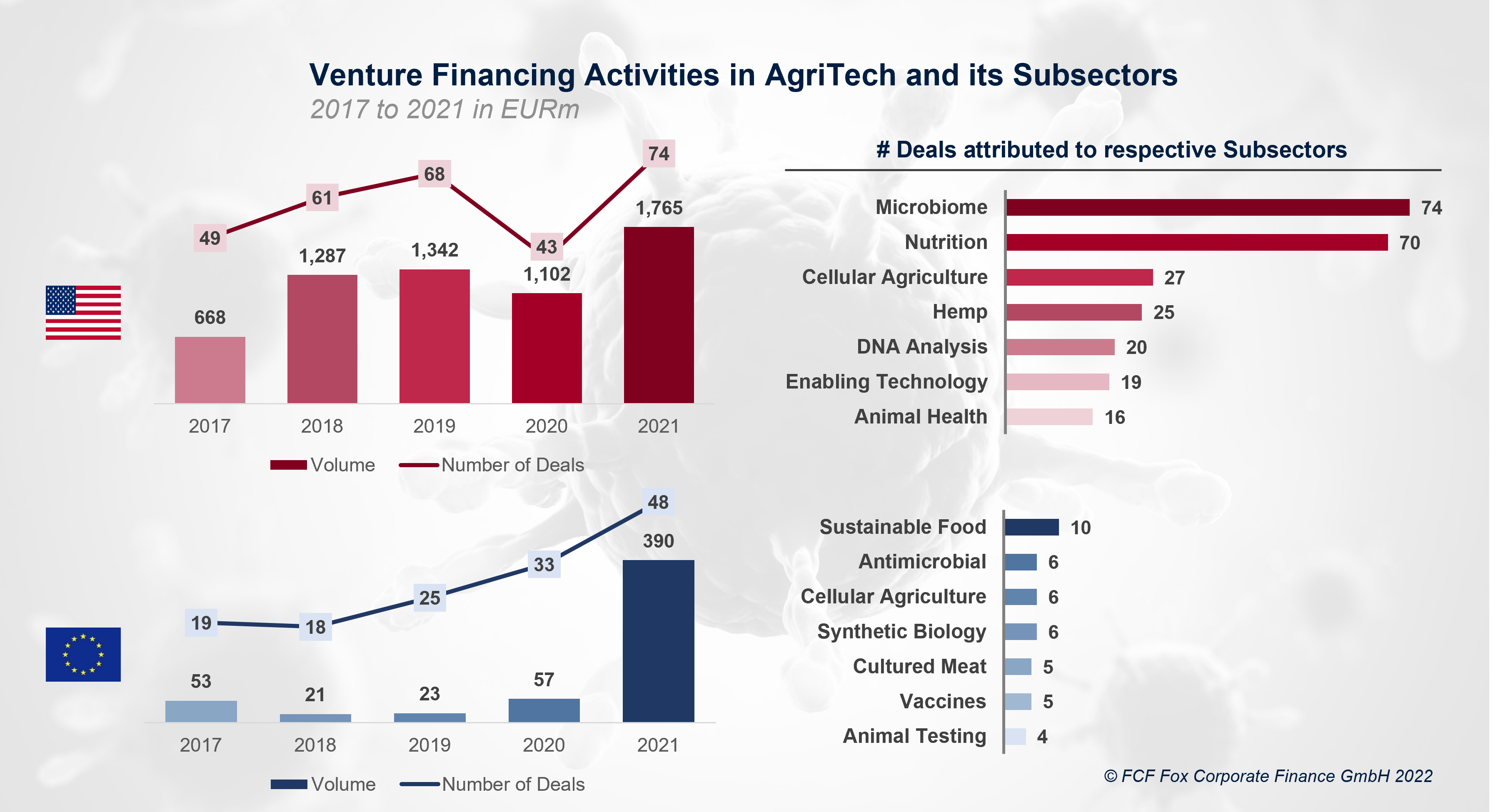

AgriTech sector on the rise with venture financing at record levels

Transaction volumes and the number of closed deals in the AgriTech space continued their steady growth in the US and massively surged in Europe. In the US, VC financing volumes in AgriTech more than doubled from EUR 668m to EUR 1.8bn since 2017. In Europe, the interest in the AgriTech sector significantly gained in importance in 2021 as financing volumes grew sevenfold from EUR 53m (2017) to EUR 390m (2021). This jump in 2021 is partly due to the first financing round of 21st.Bio, a manufacturer of proteins and peptides for sustainable food and agriculture solutions (EUR 89m), backed by

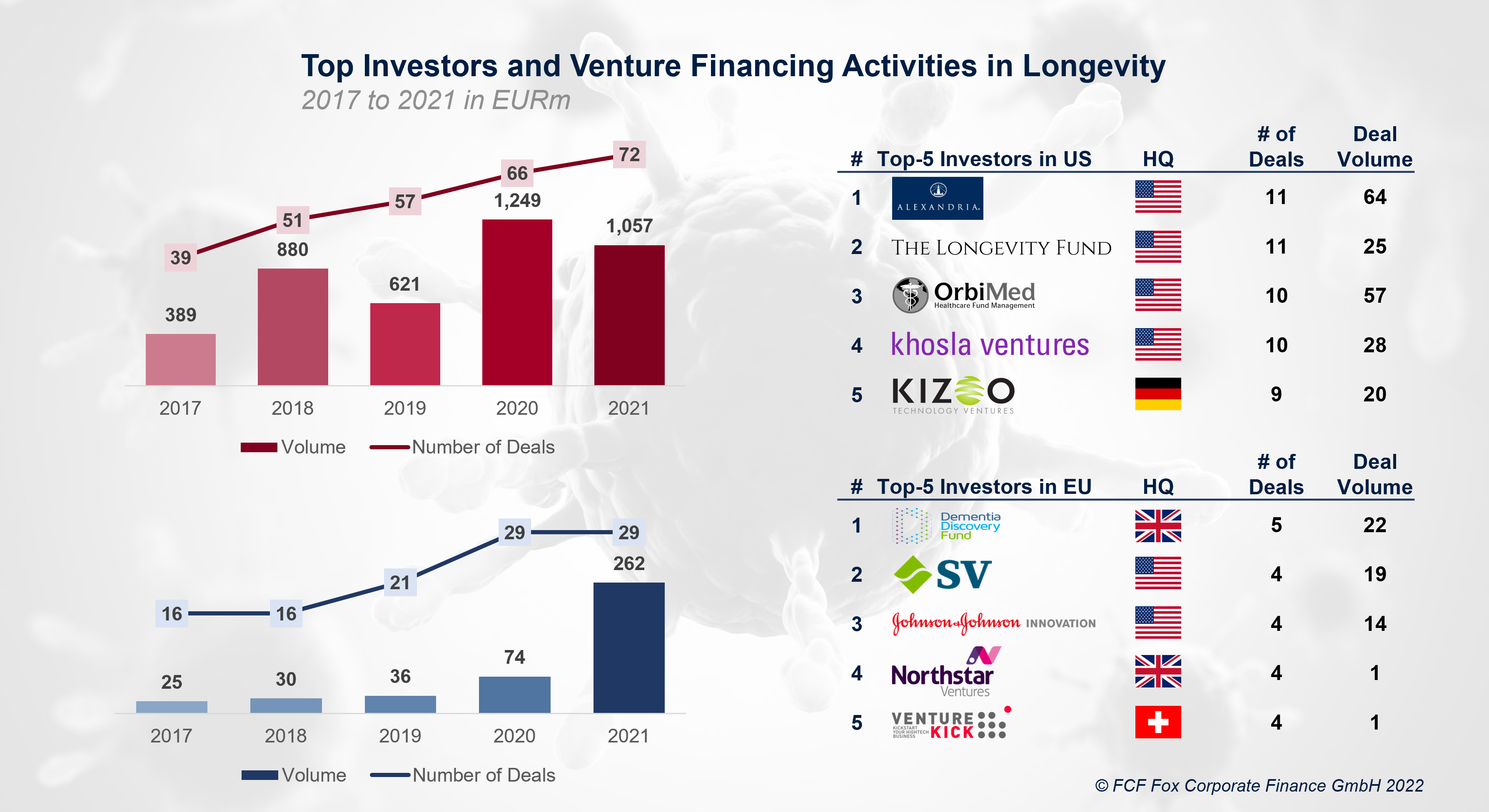

Longevity on the rise – Constant growth in the US and its arrival in Europe

The significant growth of transaction volumes and the number of deals closed from 2017 to 2021 confirms the increasing importance of longevity in the US and Europe. For both markets, the number of deals almost doubled since 2017. In the US, longevity has been an ongoing topic over the last five years. Financing volumes increased threefold from EUR 389m to EUR 1,057m. The data suggests that the interest in European longevity research has more recently arrived. While the annual financing volume in 2017 only amounted to EUR 25m (with 16 deals), financing volumes skyrocketed to EUR 262m (with 29 deals)

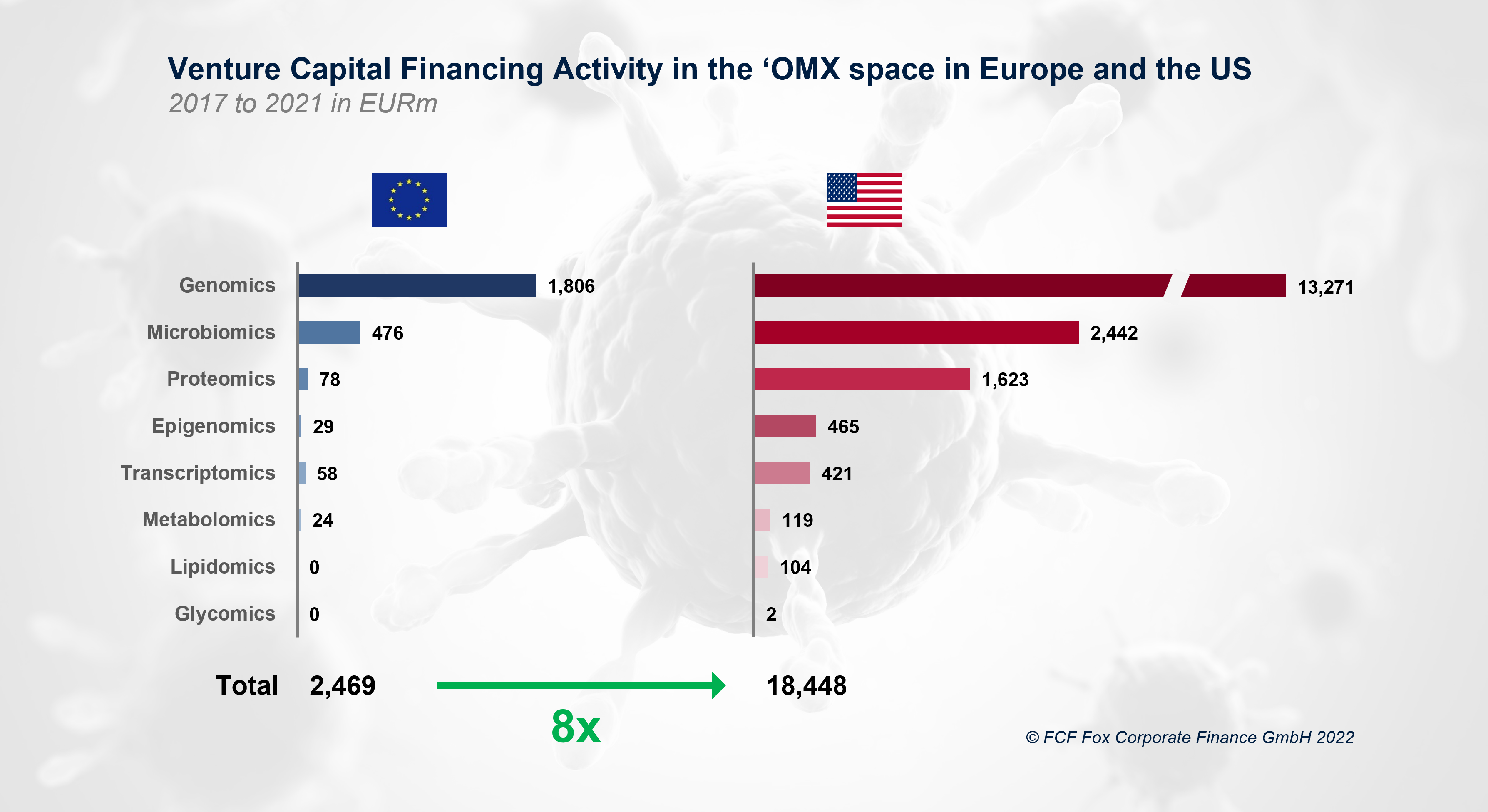

Funding for Genomics exceeds all other subsectors in the ‘OMX-space

Genomics represents the most crucial pillar in the ‘OMX-space and is the largest subsector in the US and Europe (EUR 13.3bn vs. EUR 1.8bn). The second and third largest subsectors are microbiomics and proteomics for both markets respectively. The aggregated venture capital financing volume over five years reveals the dominance of the US over European markets for the ‘OMX-space. The US surpasses Europe eightfold in terms of funding volume (EUR 18.4bn vs. EUR 2.5bn).

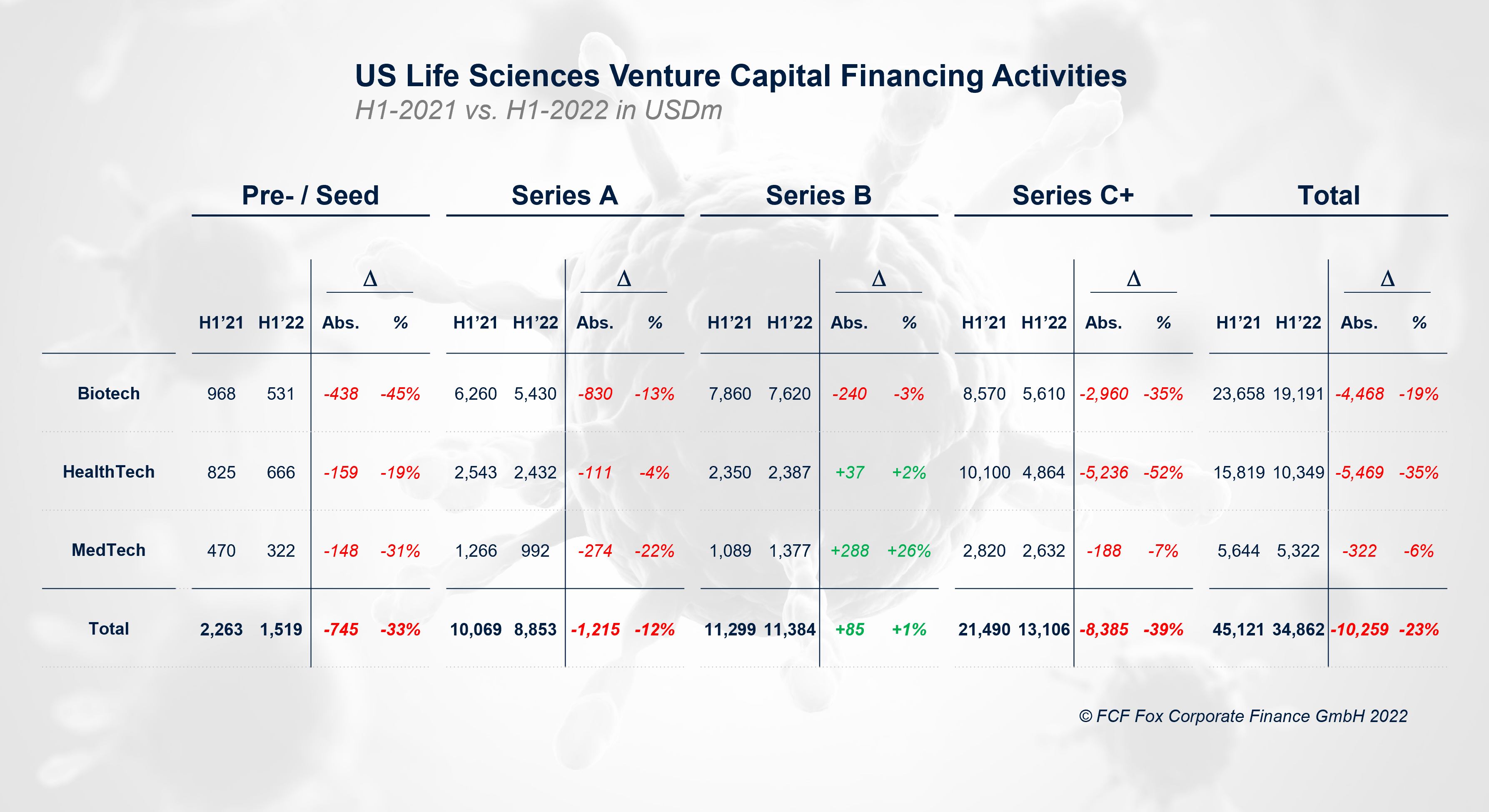

A continued downward spiral of financing volumes for life sciences in the US

A recent FCF Life Sciences analysis showed a significant decline in funding volumes for European life sciences markets in the first half of 2022 compared to 2021. This trend is now confirmed for the US life sciences markets as well. It affects all relevant subsectors, in particular Biotech and HealthTech. The total financing volumes declined by almost a quarter from USD 45.1bn to USD 34.9bn. The HealthTech subsector has been especially affected with a reduction in funding by more than -35 percent. Interestingly, only Series B companies were able to attract more funding. The surplus is partly attributable to two

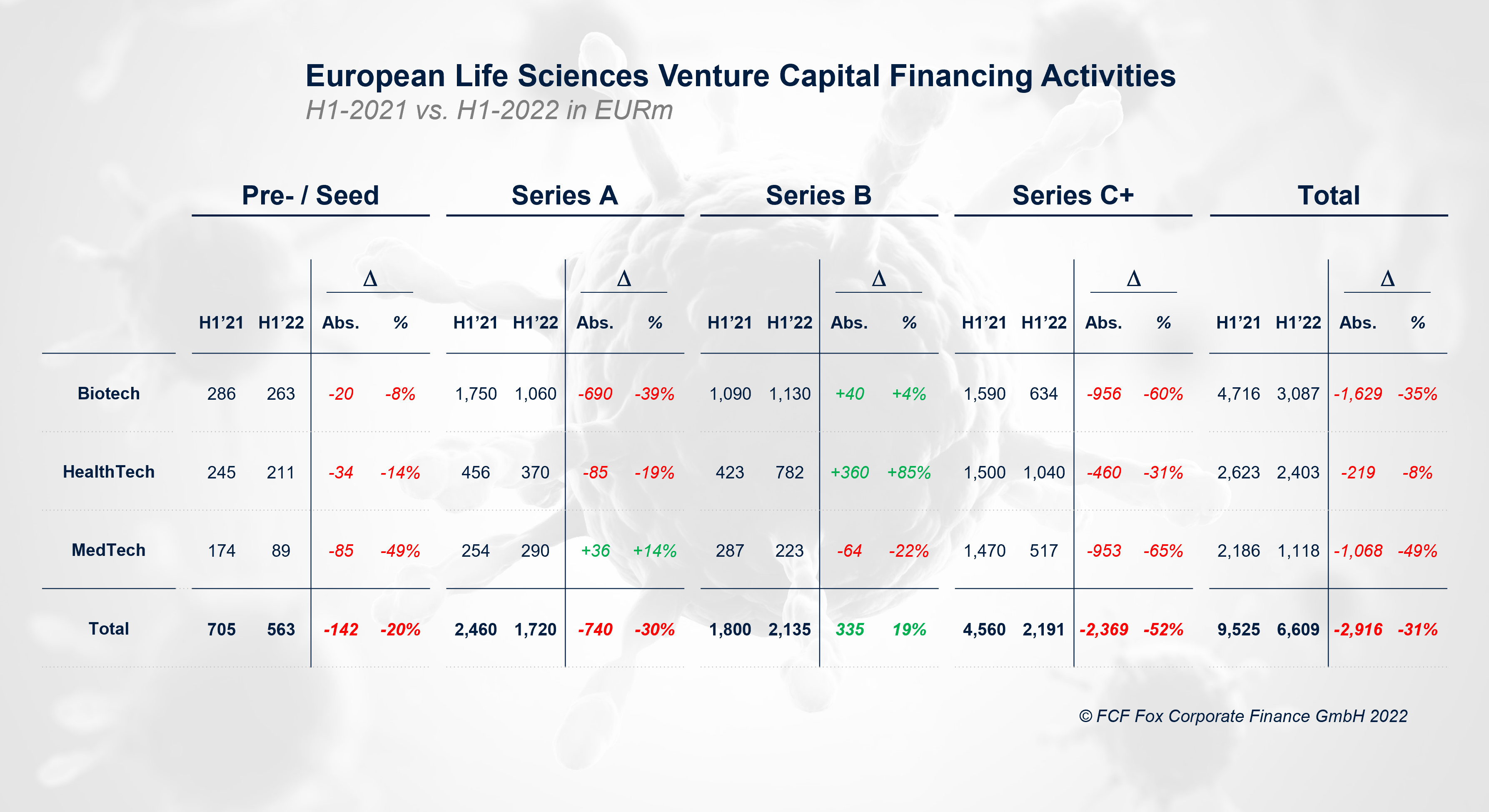

Significant decline of financing volumes for life sciences across all stages in Europe

During the first six months of 2022, we find that the funding for life sciences markets declined significantly compared to 2021. The trend affects all relevant life sciences subsectors of Biotech, HealthTech, and MedTech. The financing volumes reduced by almost one-third from EUR 9.5bn to EUR 6.6bn. Biotech and MedTech experienced the most significant reductions in funding activity. Except for Series B companies, this negative trend is consistent across all funding stages and ranges from -20 percent to -52 percent. Interestingly, Series B HealthTech financing increased by 85 percent.

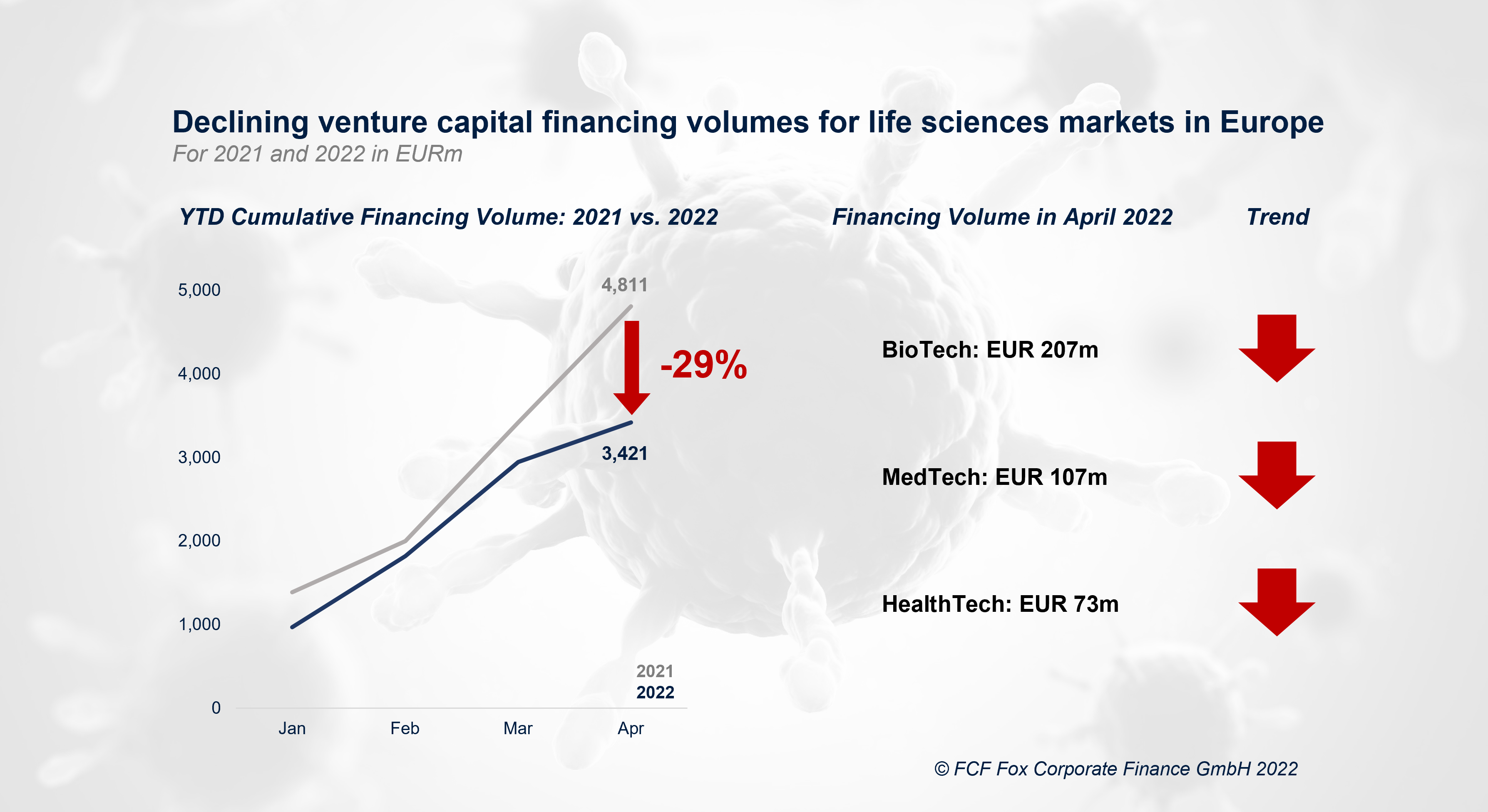

Significant cooldown of venture capital financing for European life sciences markets

Venture capital deal volumes in the European life sciences sector reached a record-breaking level in 2021. However, financing volumes decreased significantly by 29% in the first four months of 2022 compared to 2021. Our deal data and sentiment calculations suggest that the cooldown of the life sciences capital markets has now reached European venture markets. Based on these observations, we expect more challenging fundraising campaigns for European healthcare companies over the next couple of months.

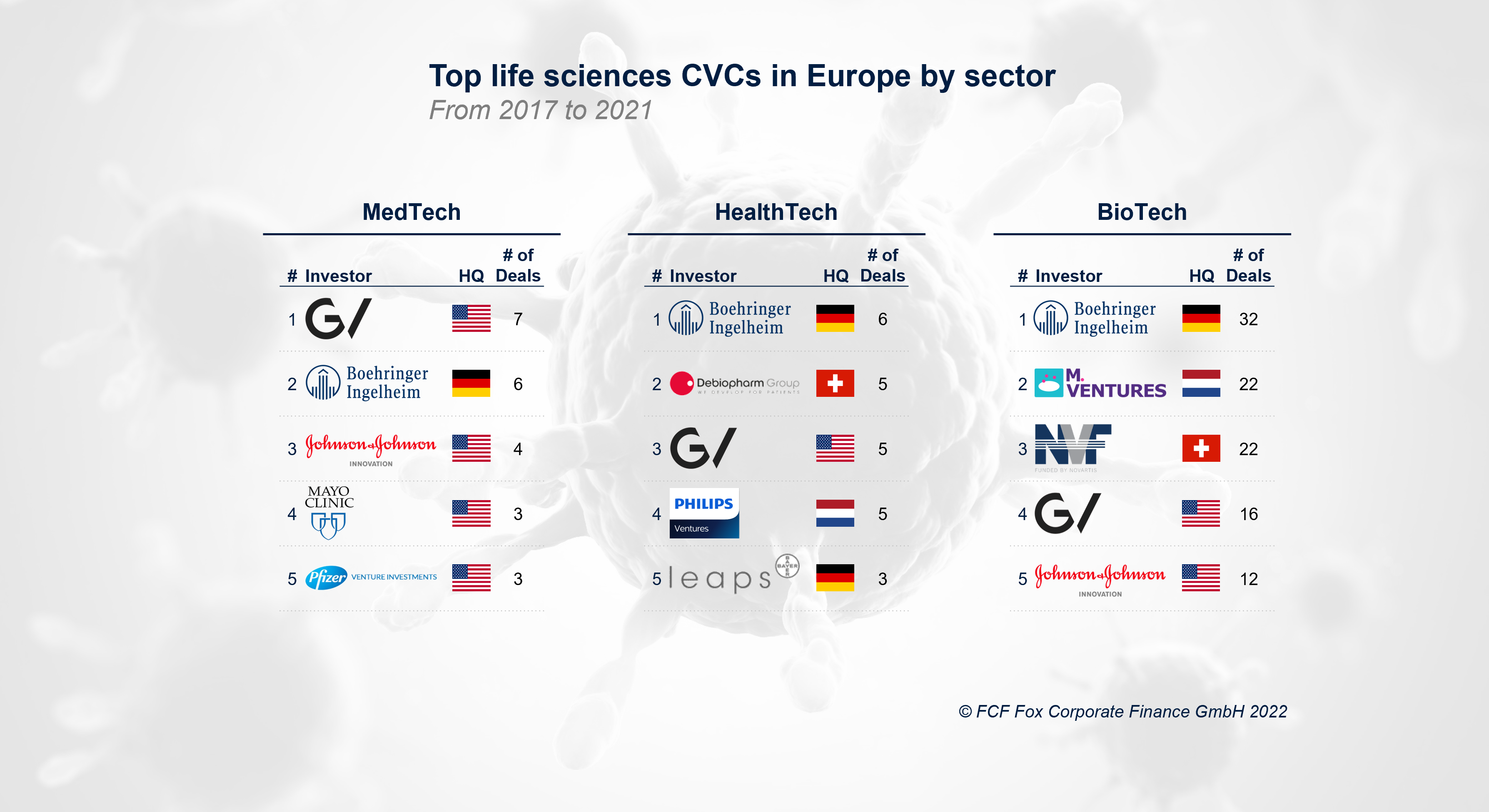

German CVC as most active corporate investor in the European life sciences sector

With 44 deals, the corporate venture arm of Boehringer Ingelheim was the most active corporate investor in the European life science market in the last five years. The only other investor having reached the top 5 ranking in all three sectors (MedTech, HealthTech, and BioTech) was GV, with a total of 29 deals. Compared to the Biotech sector, MedTech and HealthTech seem to be still driven by private institutional investors as CVC investments appear to be low. Large pharmaceutical companies such as Boehringer Ingelheim, Merck, Novartis, and Johnson & Johnson continue to play an important role in VC financing in

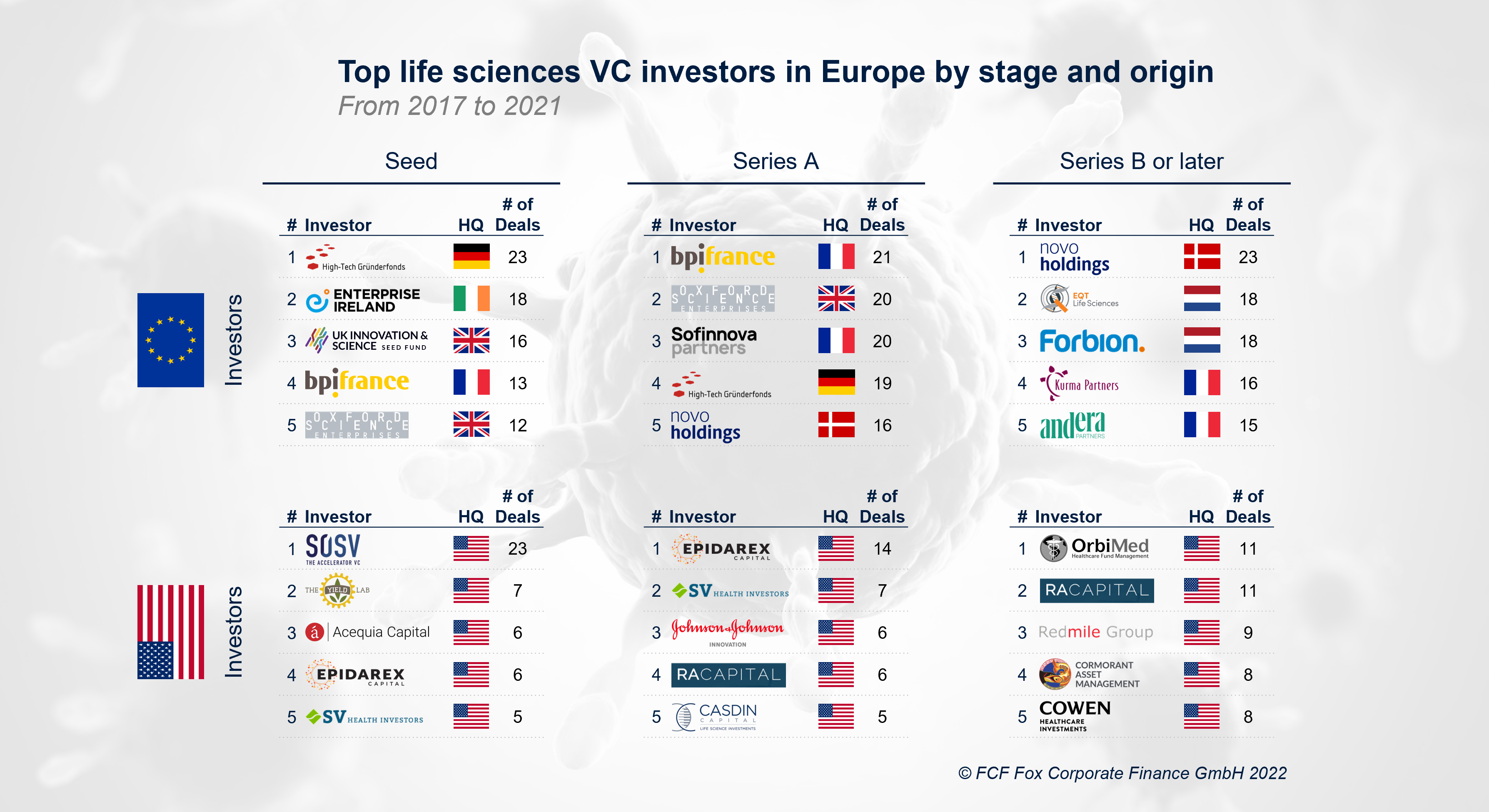

Overview of top VC investors in European life sciences markets

It is no surprise that the top 5 European investors have shown significantly higher activities than US investors in Europe from 2017 to 2021. Nevertheless, US investors such as SOSV, Epidarex Capital, OrbiMed, and RA Capital Management, L.P., have a notable track record in the European life sciences space. The top European seed investors are primarily public, operating with a regional focus. With 23 transactions, the High-Tech Gründerfonds is the most active Seed investor. The fund focuses predominately on German companies. Series A transactions in Europe are dominated by the French investors Bpifrance and Sofinnova Partners whereas Novo Holdings from

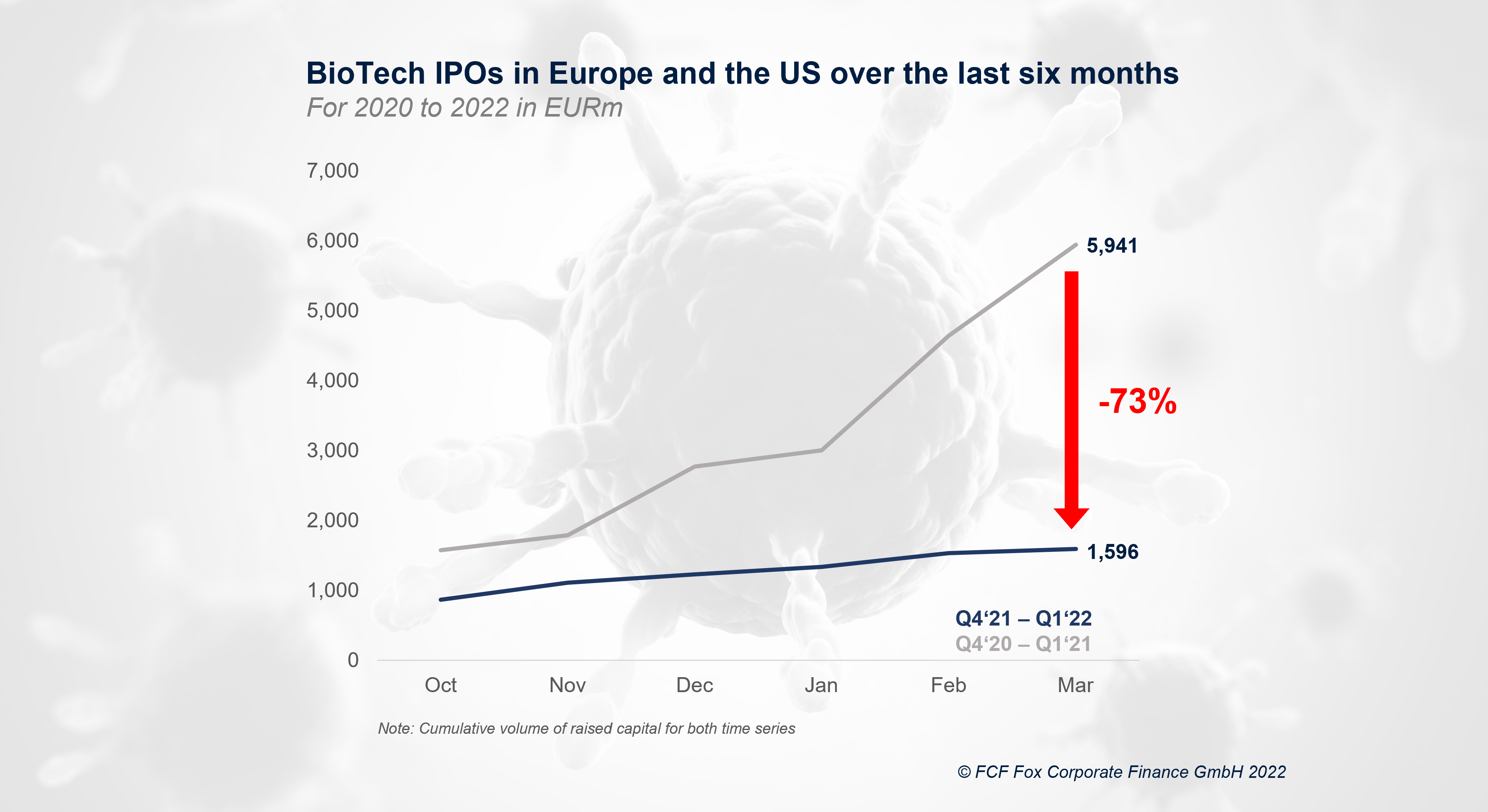

Significant cool-down of BioTech IPOs in Europe and the US

The capital raised in BioTech IPOs declined heavily in Europe and the US. For Q4’21 – Q1’22, the amount of raised capital declined by 73 percent compared to Q4’20 – Q1’21 (from EUR 5,941m to EUR 1,596m).

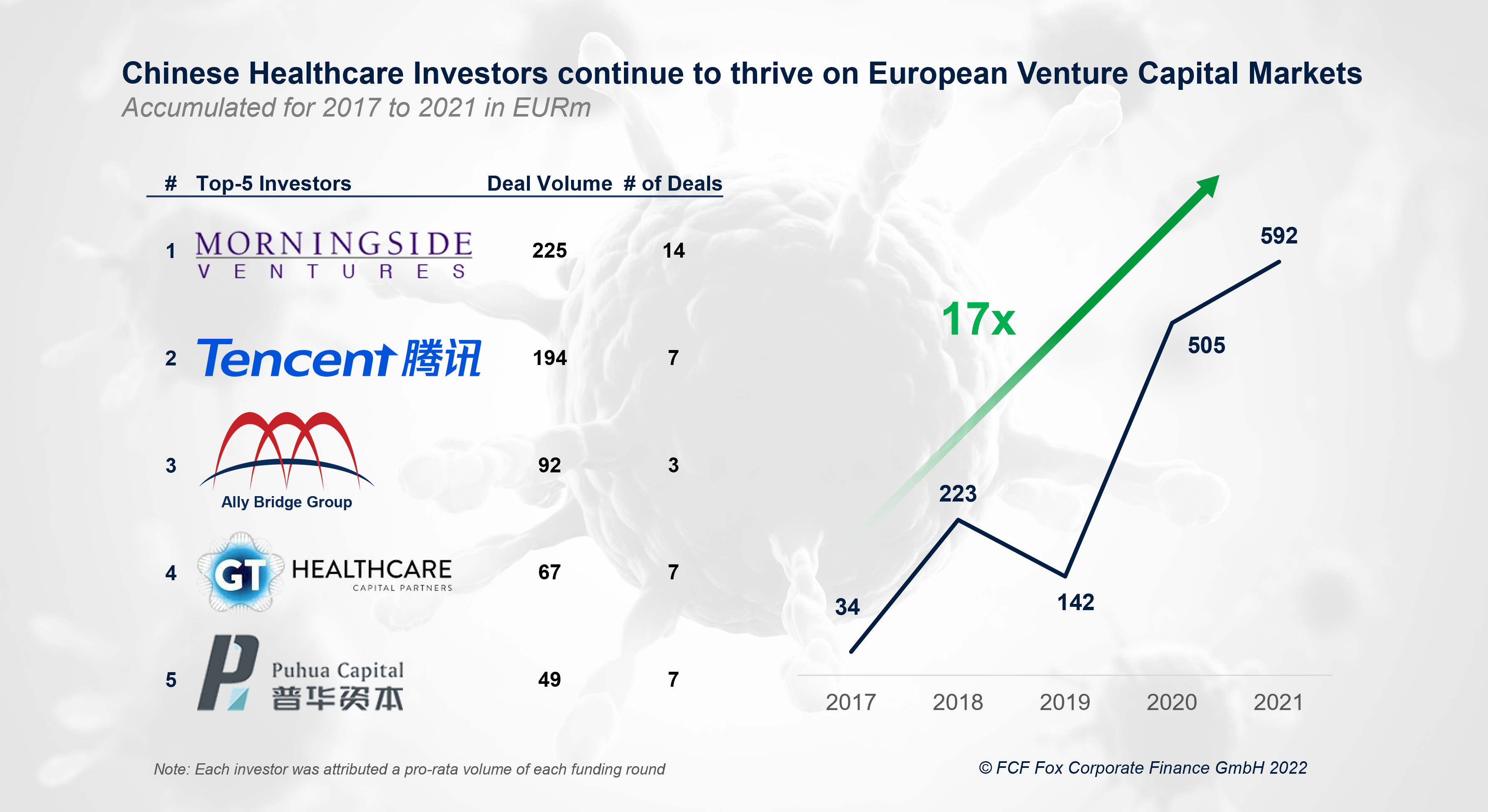

Chinese VCs continue to thrive on the European Healthcare market

Investors from China continue to show exceptional interest in young life science companies based in Europe. Investments made by Chinese VCs have significantly grown 17-fold over the last five years (from EUR 34m in 2017 to EUR 592m in 2021). The top investor were Morningside Group investing EUR 225m in fourteen deals, followed by Tencent Holdings (EUR 194m) in seven deals and the Ally Bridge Group (EUR 92m) in three deals. The observed trend indicates increasing interest in European healthcare technologies by Chinese VCs.

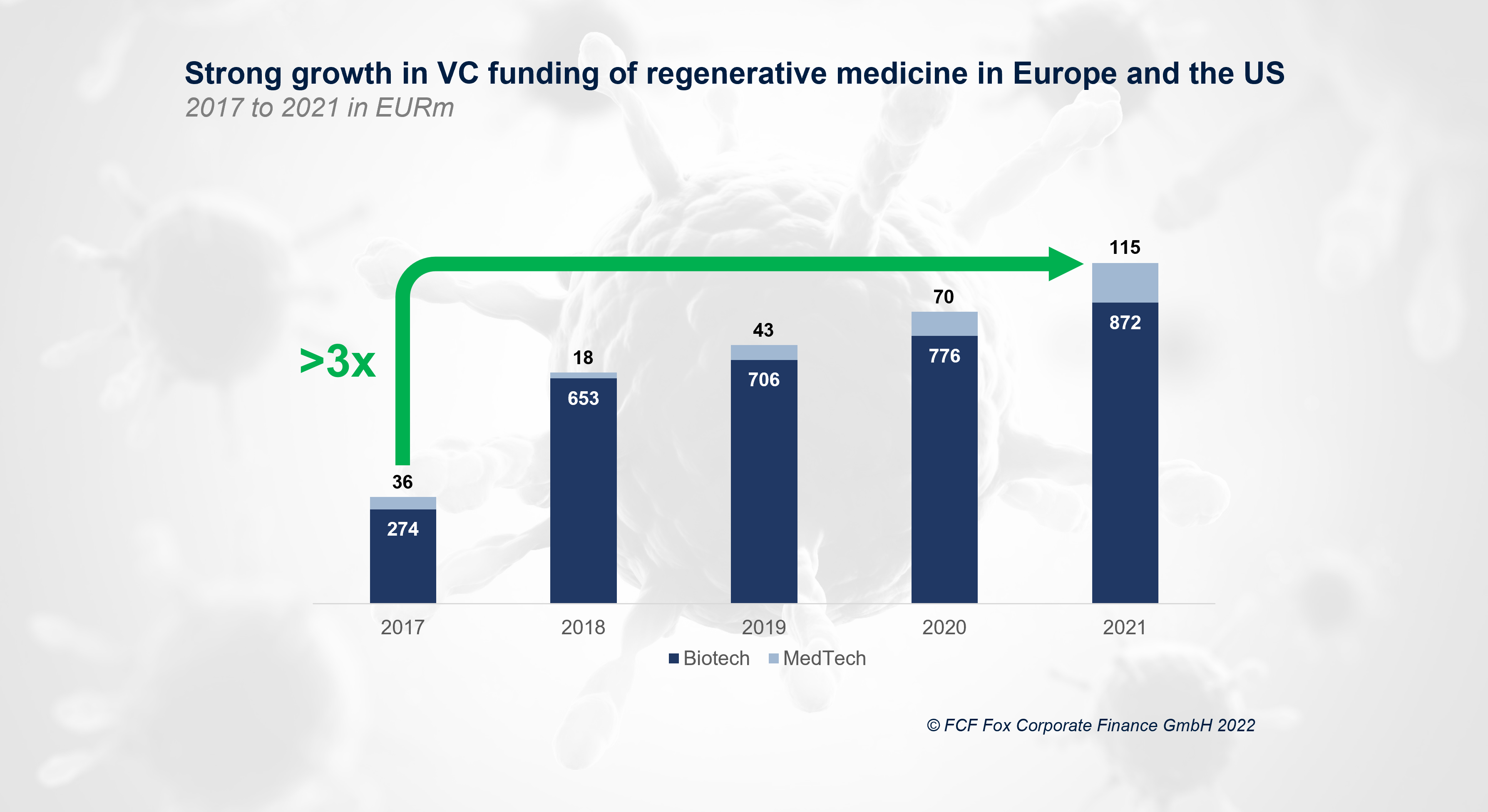

VC Markets for regenerative medicine continue strong growth in the US and Europe

Venture capital markets continue to show high interest in companies with a focus on regenerative medicine from Europe and the US. Since 2017 the market has shown exceptional growth, as funding volumes increased threefold to ca. EUR 1,000m in 2021. Especially gene and cell therapies in the Biotech sector continue to be main drivers in regenerative medicine. However, funding volumes of MedTech companies also have shown remarkable growth in recent years. These observations clearly indicate the future potential that is attributed to the market of regenerative medicine.

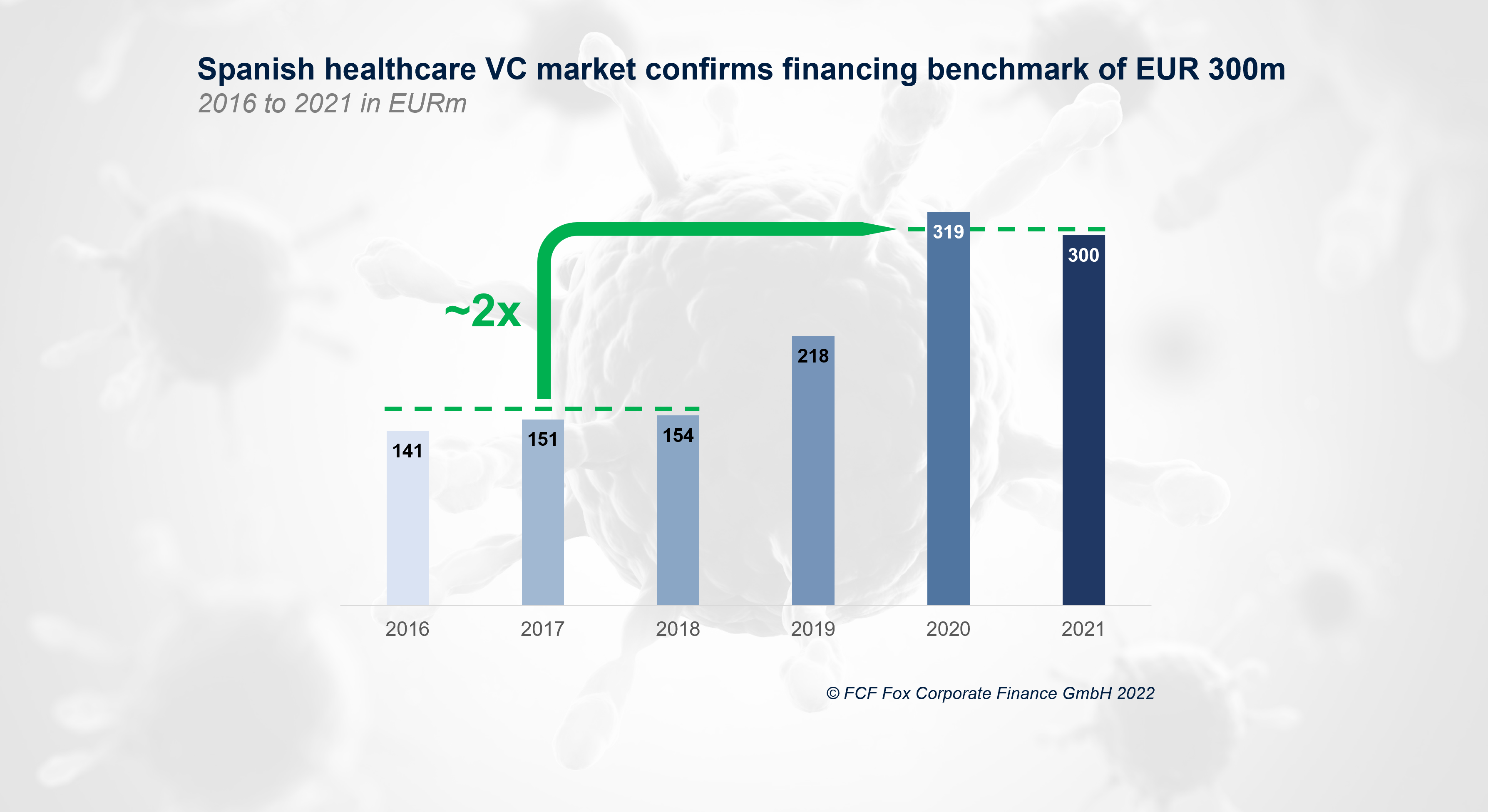

Spanish healthcare VC market confirming new heights of financing volumes

For the second time in a row, the Spanish healthcare VC market reaches a financing threshold of >EUR 300, doubling within only two years. From 2016 to 2018, the financing volumes totaled around EUR 150, experiencing a sharp increase to EUR 218m in 2019 and EUR 319m in 2020. With 2021, the healthcare VC market in Spain seems to have established a new financing level. Hopefully, Spanish healthcare companies continue to benefit from this trend in the future.

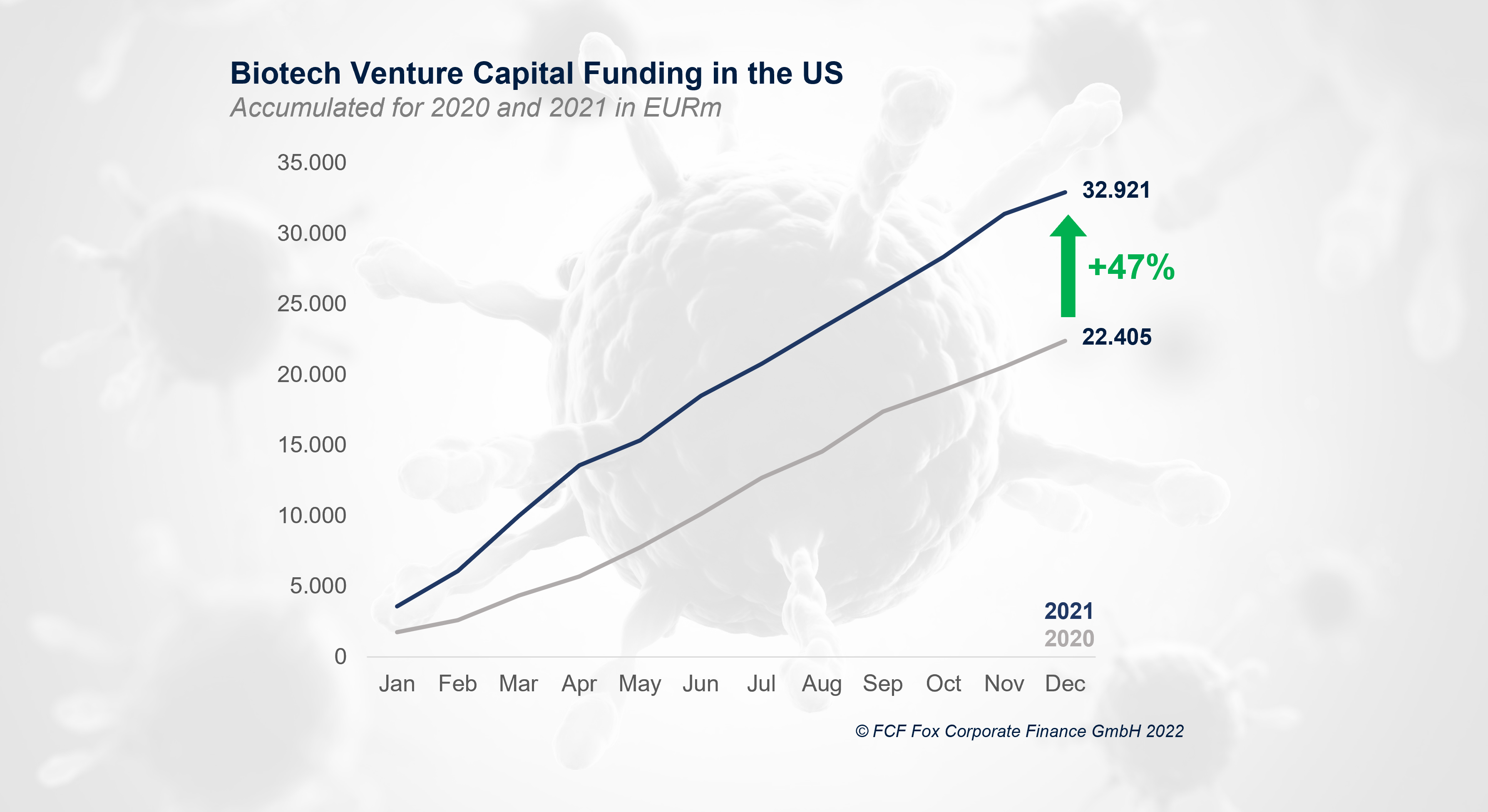

US Biotech Venture Capital Funding in 2021 significantly exceeds Funding in 2020

With a volume of roughly USD 33.0bn, the overall financing for US biotech companies in 2021 yet again surpassed the total funding of the previous year (USD 22.4bn). Compared to 2020, the funding volume increased significantly by 47%. With a total of USD 9.2bn, the oncology sector received the highest funding volume, followed by central nervous system (USD 6.0bn) and infectious diseases (USD 2.2bn). The largest deal of 2021 was the transaction of Treeline Biosciences (USD 735m), while the most active investor was Alexandria Venture Investments with 51 investments in 2021.

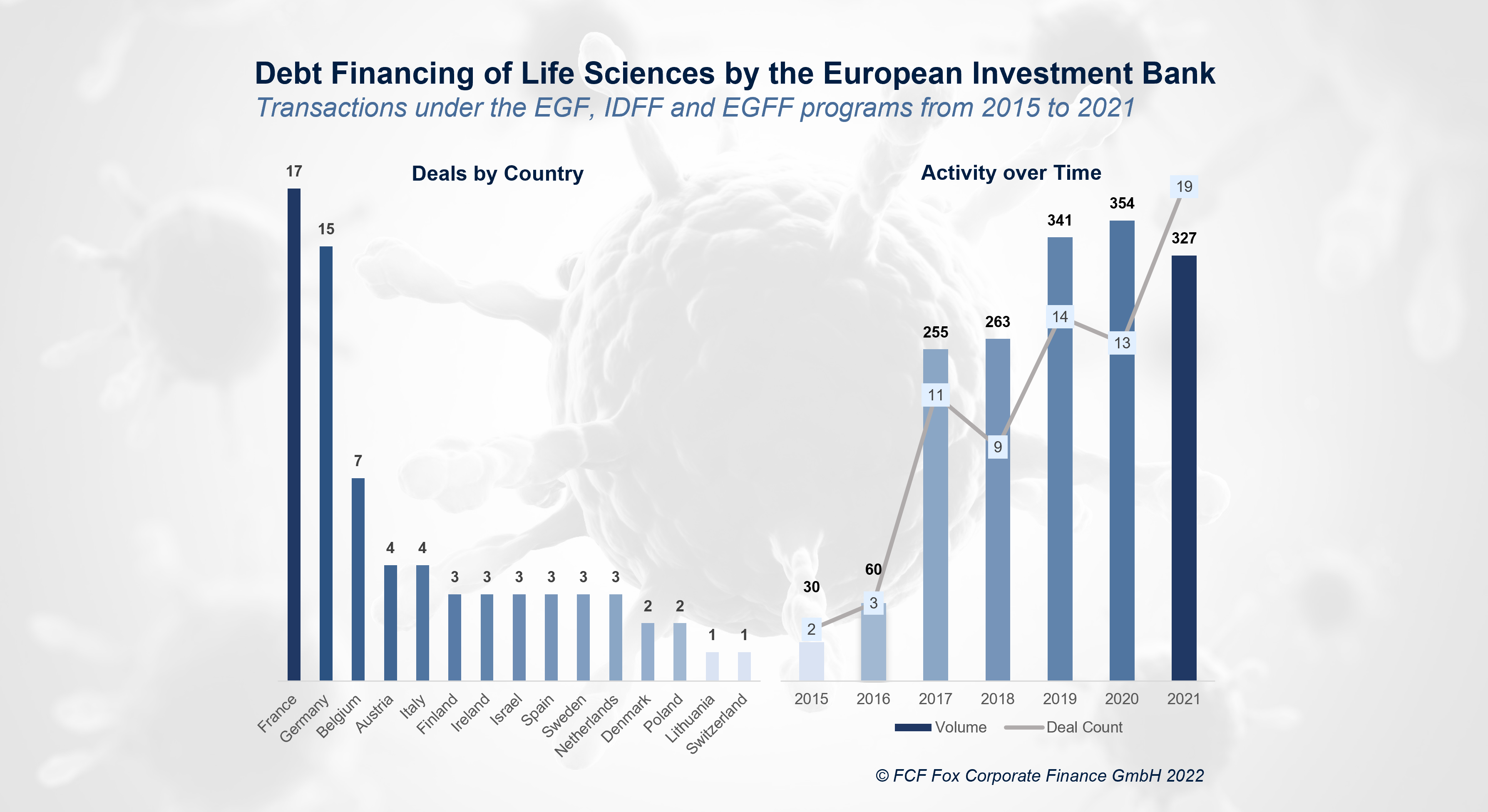

Increased deal activity by the European Investment Bank as the Horizon 2020 program phases out

The program has become an important pillar in the European venture financing landscape to promote R&D projects of fast-growing companies from sectors such as ICT, deep tech, and life sciences. Starting in 2015, the EIB has supported over 71 life sciences deals with their debt financing programs, providing a total funding volume of EUR 1.6bn over its lifetime. As the program came to an end in 2021, the EIB has financed a record of 19 life sciences companies in its last year with a total funding volume of EUR 327m.

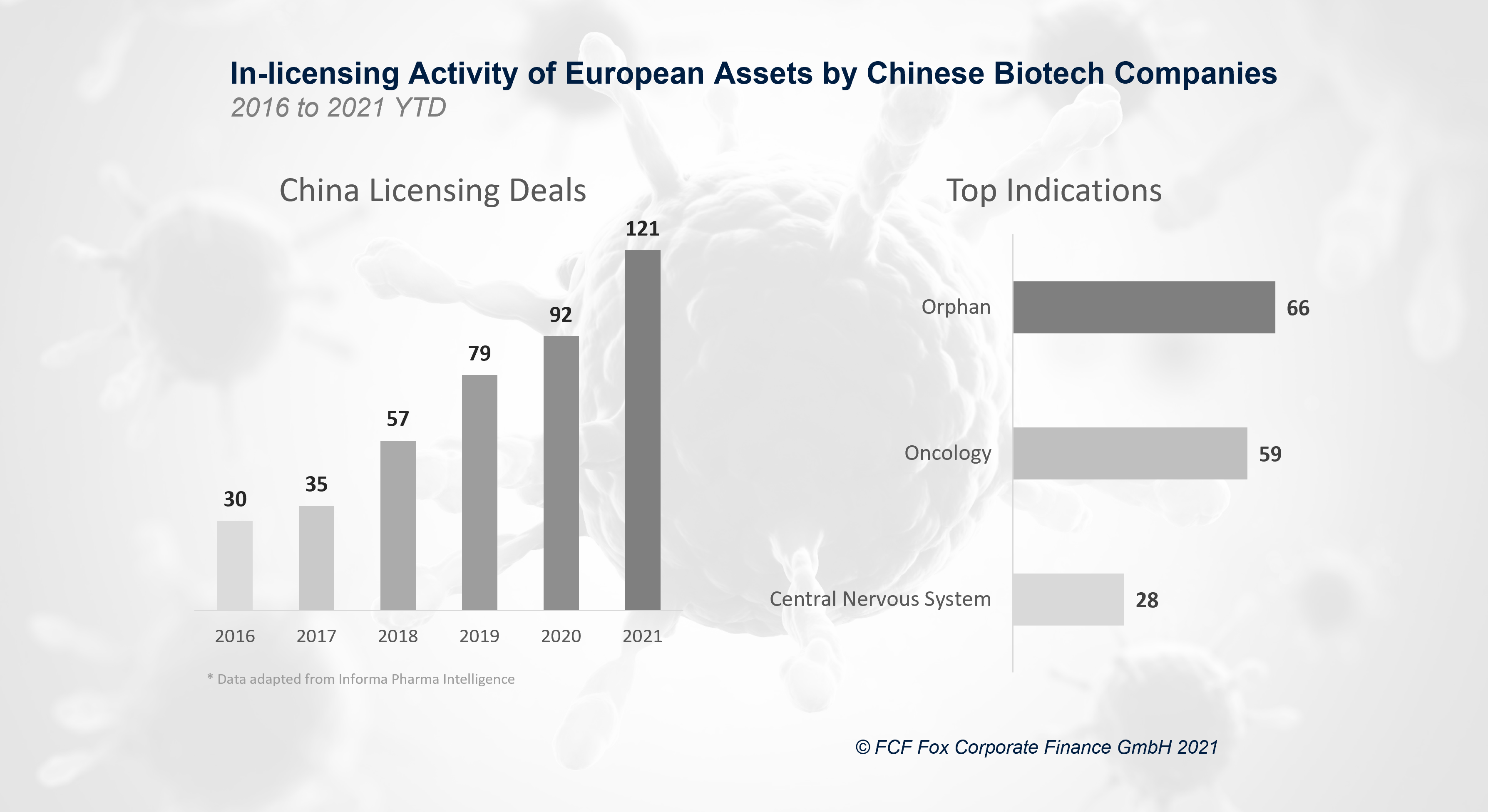

In-Licensing by Chinese Biotech Companies on the rise

An increasing number of drugs of European origin have been in-licensed to Chinese biotechnology companies. Over the last five years, a steady increase in the number of yearly in-licensed assets from Europe can be observed. Whereas only 30 drugs were in-licensed in 2016, the number more than quadrupled in 2021 (YTD) to 121. Most sought-after assets have been in orphan diseases, oncology and CNS.

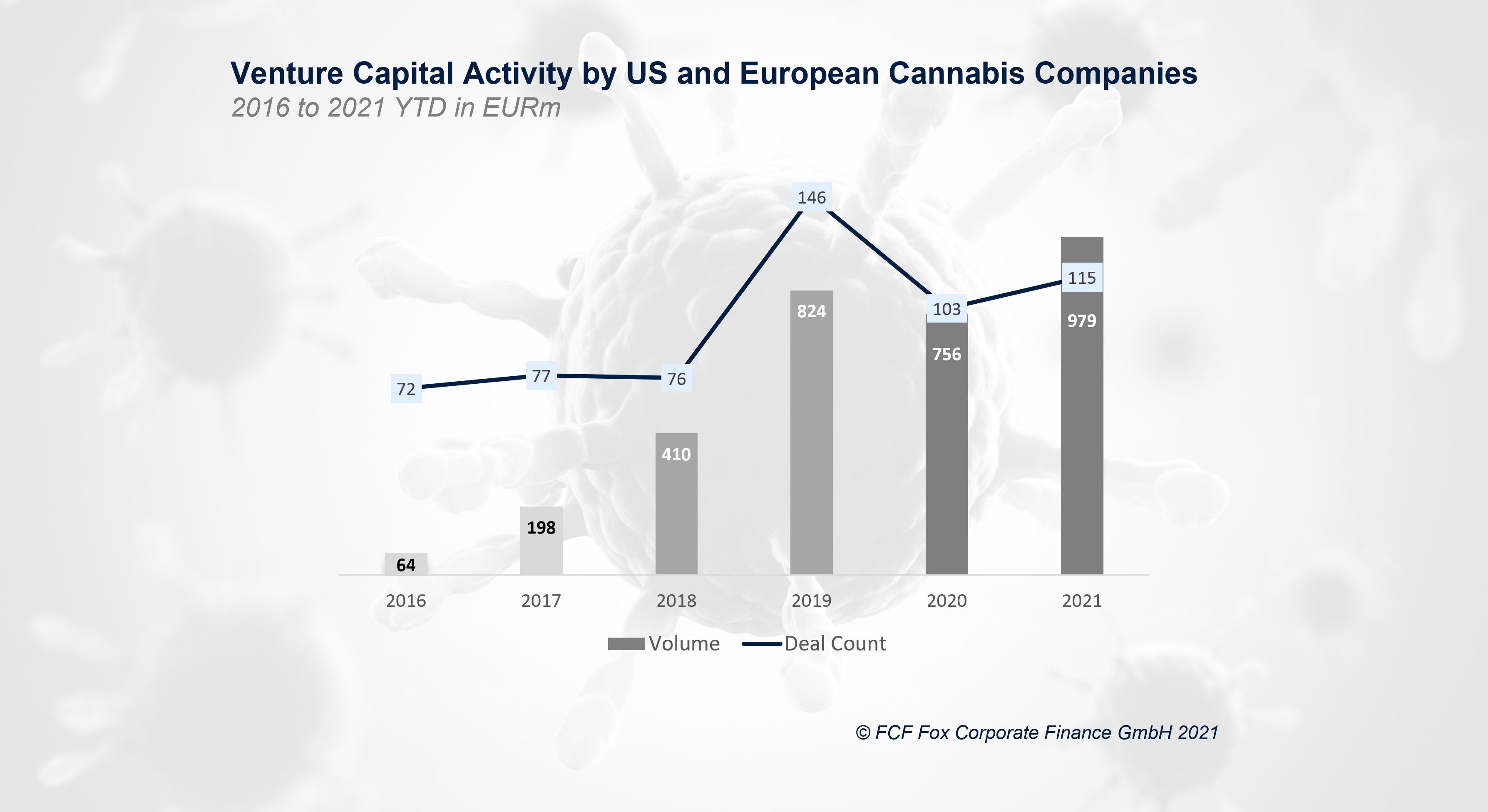

VC market for cannabis gains momentum

Investment into US and European cannabis companies have been continuously increasing over the past years. Whereas 72 venture capital transactions were conducted in 2016, the number of transactions in 2021 (YTD) have increased by almost 60 percent to 115. A significant peak in 2019 can be attributed to the first-ever congressional vote on federally legalizing cannabis and a widespread amount of cannabis reform legislation in twenty-seven US states. In addition, US and European companies from the cannabis space were able to attract significantly higher volumes in the last five years. The overall transaction volume increased from 64m in 2016 to

Psychedelics attract more VC investments

Investment into US and European psychedelics companies have been continuously increasing over the past years as mental health gains in importance. Whereas only 12 venture capital transactions were conducted in 2016, the number of transactions in 2021 (YTD) have almost five-folded to 56. In addition, US and European companies from the psychedelic space were able to attract significantly higher volumes in the last five years. The transaction volume has almost ten-folded, from EUR 53m in 2016 to EUR 489m in 2021 (YTD).

Positive performance of venture capital funding for European life sciences companies

In the third quarter of 2021, European life sciences companies raised a total of EUR 2.2bn in venture capital funding. Although the performance is almost the same as in the same quarter last year, the accumulated funding volume in 2021 increased by 65% compared to the first three quarters of 2020. In addition, the accumulated volume of 2021 already exceeds the total funding volume of 2020 by 23%. In 2021 to date, the largest transaction has been the Series D venture funding of UK-based CMR Surgical in the amount of EUR 497m.

Cumulated US Biotech Venture Capital Funding exceeds total volume of 2020 already in the third quarter of 2021

With a volume of roughly USD 24bn, US biotech companies have already raised more venture capital in the first three quarters of 2021 than in the whole year 2020 (USD 22.4bn). Compared to the first three quarters of 2020, the funding volume increased by 38%. The largest transaction in the 3rd quarter amounted to USD 440m in Laronde Inc.

European Biotech seed assets attract increasing interest from investors

The financing volume of European Biotech seed stage companies has significantly increased in recent years. Since 2017, the funding volume has increased by roughly 200% to EUR 296m in 2021 to date. In June this year, the accumulated volume in 2021 had already exceeded the total volume of 2020. In addition, the average seed financing volume in 2021 to date is EUR 4.7m compared to EUR 2.9m in 2020 which indicates a tendency to larger seed funding rounds in the European Biotech space. The largest seed round since 2017 has been raised by Mestag Therapeutics in May 2021 in the

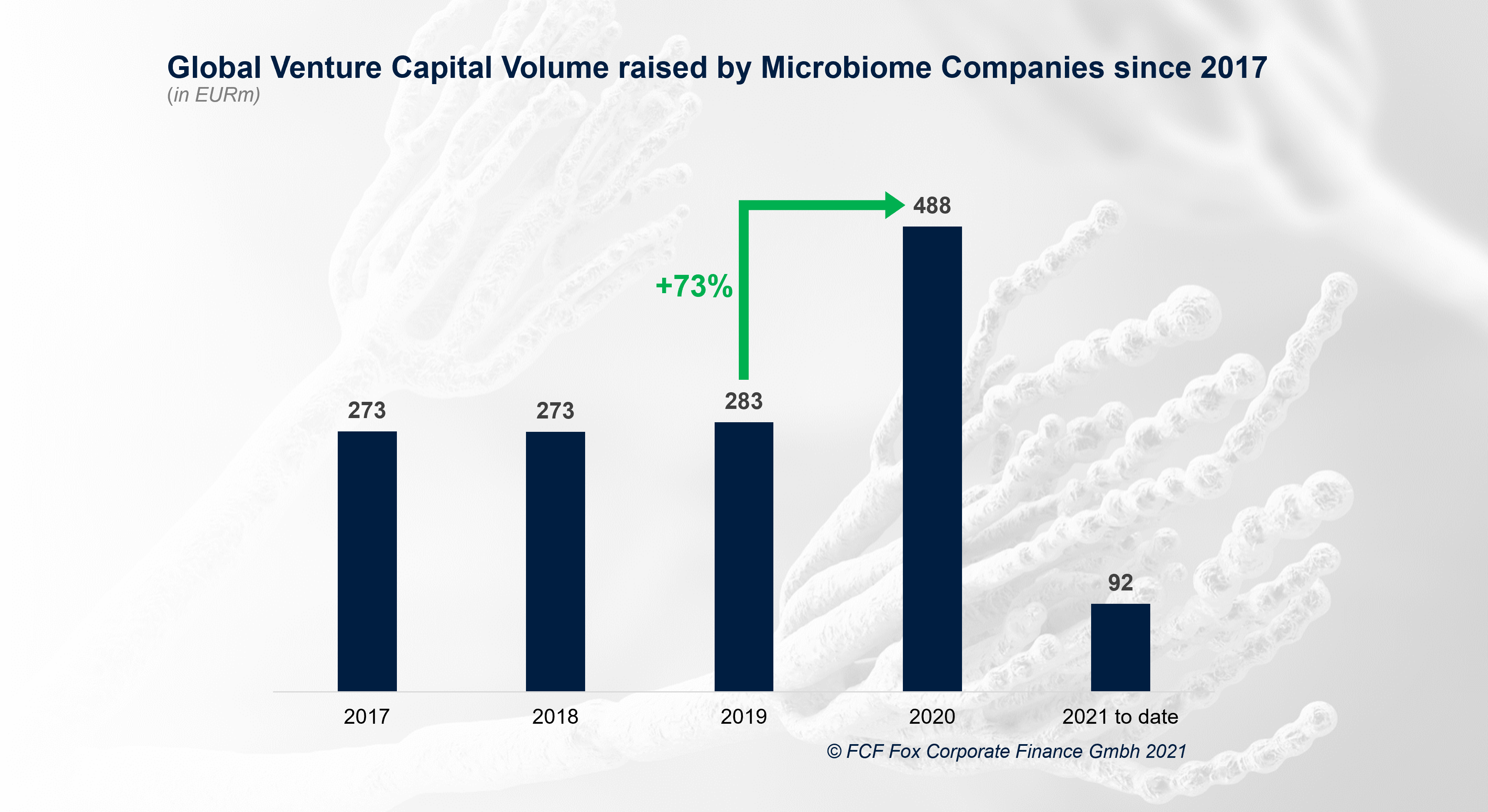

Extraordinary growth in global VC financing of microbiome companies in 2020!

While the investment activity from 2017 to 2019 was relatively stable, ranging from EUR 273m to EUR 283m, a significant increase in global VC financing of microbiome companies in 2020 is observable. The volume increased by 73% to EUR 488m. This was mainly caused by a higher number of large deals. The average deal volume from 2017 to 2019 amounted to EUR 11m compared to an average deal volume of EUR 20m in 2020. The largest deal in 2020 was the Series D financing of Finch Therapeutics Group in the amount of EUR 76m. In 2021, only EUR 91m have

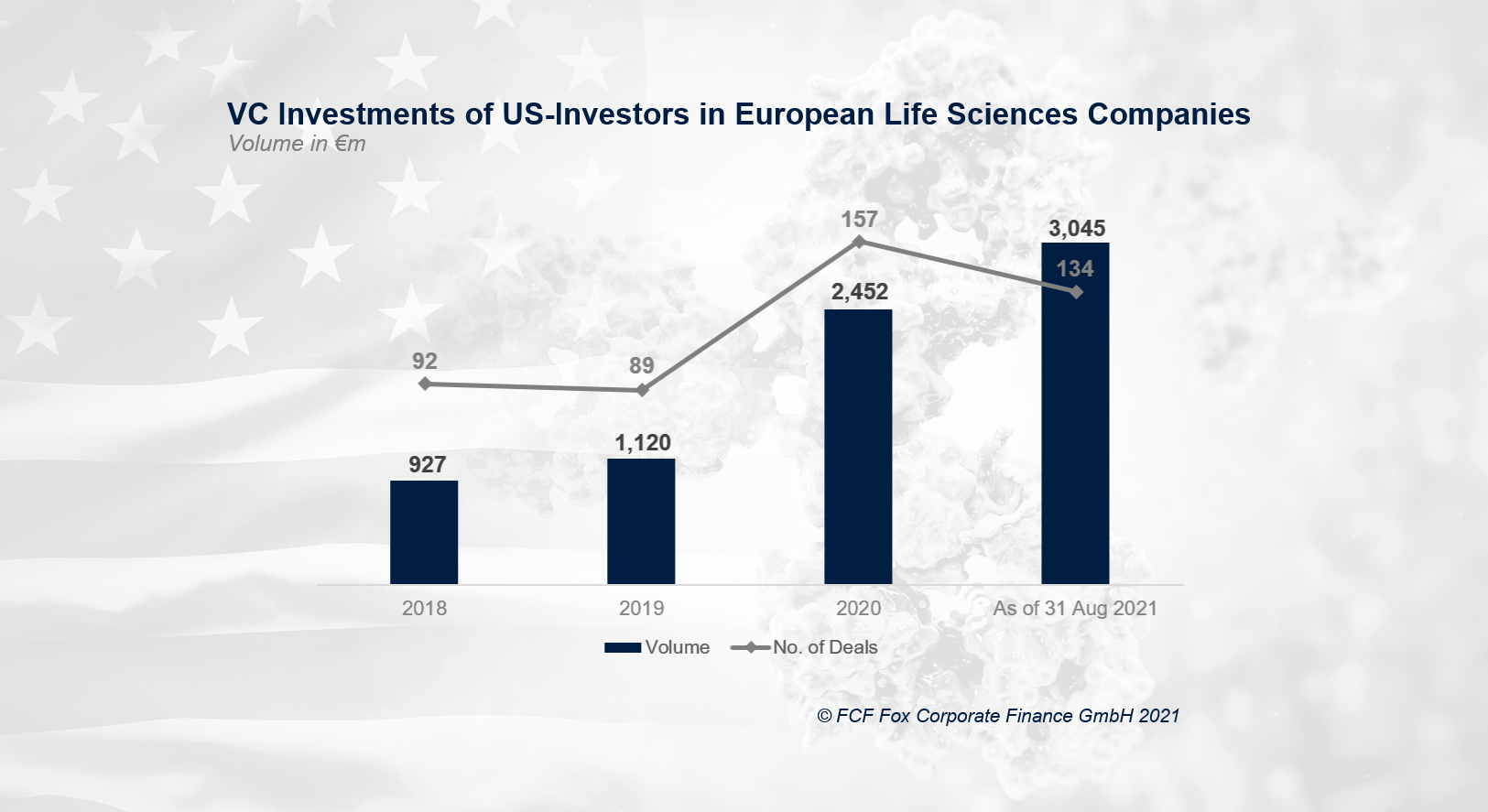

New record high in VC funding from U.S. investors raised by European life sciences companies

The venture capital funding volume raised by European life sciences companies from U.S. investors has experienced an extraordinary growth so far. As of end of August 2021, the gross volume amounts to EUR 3.1bn, which has already exceeded the volume of the whole year 2020 by 24% (EUR 2.5bn). However, the number of deals with U.S. participation only amounts to 134 in 2021 so far which is still below the total number of 2020 (157 deals). It is notable that the number of larger deals with U.S. participation has significantly increased within the last years. The number of deals with

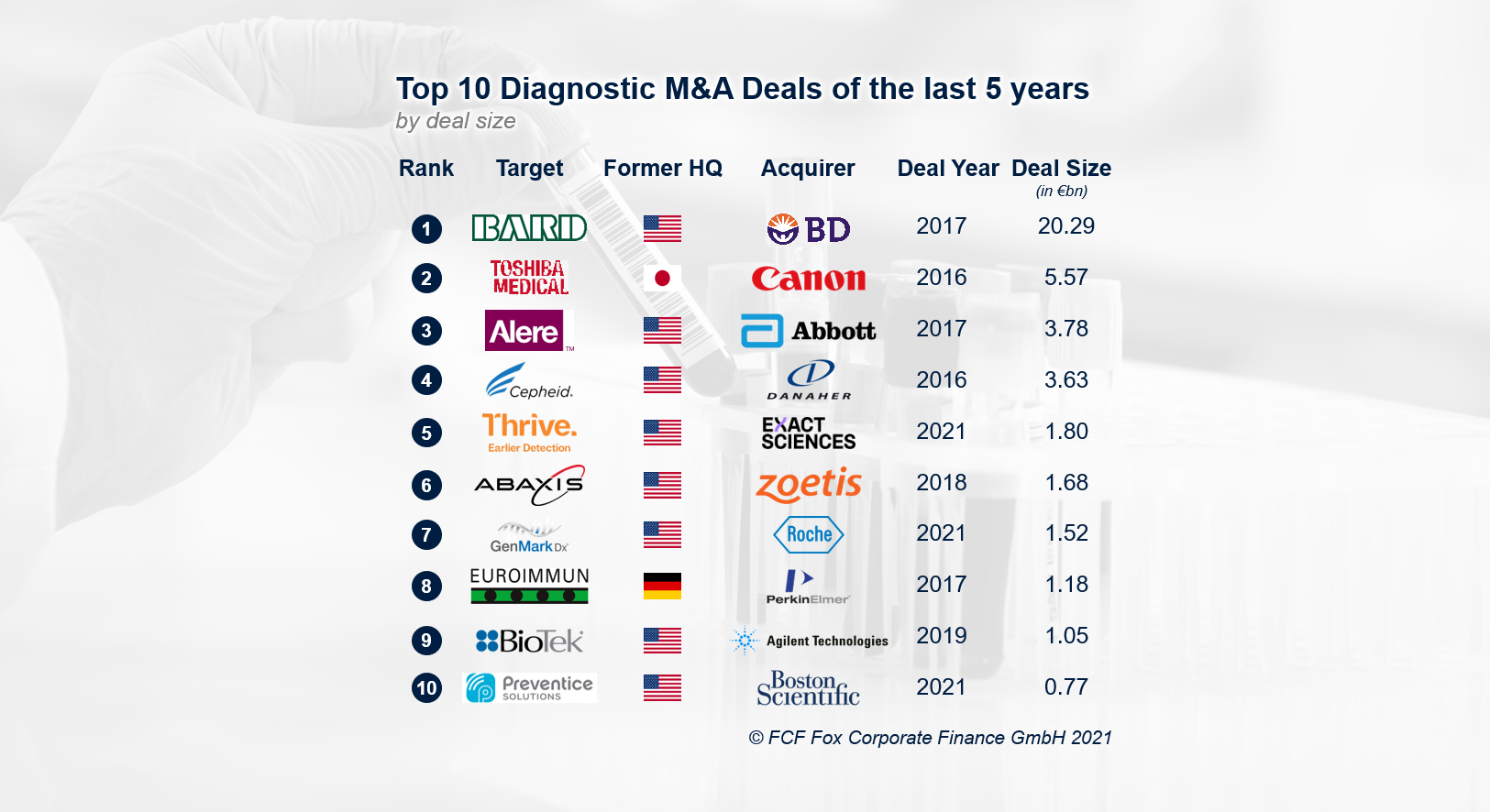

Acquisition of German diagnostics company EUROIMMUN by PerkinElmer in the top 10 diagnostics M&A deals ranking

The top 10 diagnostics M&A deals of the last five years (by deal size) range from EUR 0.8bn to EUR 20.3bn, with an average deal size of EUR 4.1bn. The largest deal by far was the acquisition of C. R. Bard by Becton, Dickinson and Company in December 2017 for EUR 20.3bn. The ranking is dominated by US targets, only two targets were located outside of the US. The acquisition of Japanese Toshiba Medical Systems by Canon Medical Systems in December 2016 for EUR 5.6bn is ranked second and the acquisition of German diagnostics company Euroimmun by PerkinElmer in December

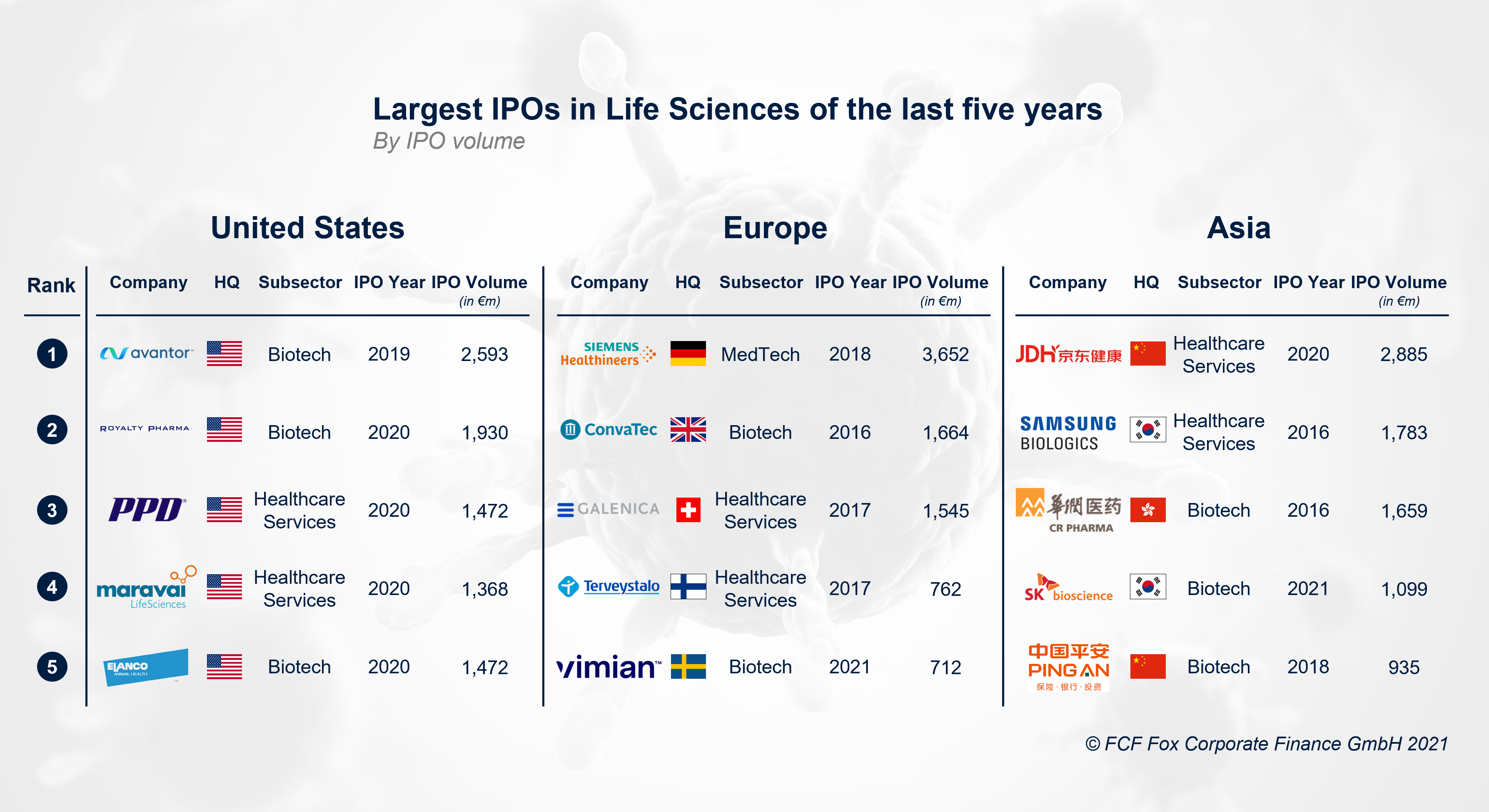

World’s largest IPO in life sciences since 2016 (by volume) on German stock exchange

With an IPO volume of EUR 3,652m, the IPO of MDax member Siemens Healthineers AG in March 2018 has been the largest offering of the last five years in Life Sciences. The second largest IPO volume amounted to EUR 2,885m at JD Health International Inc. in December 2020. The IPO of Avantor, Inc. in May 2019 is ranked third with an IPO volume of EUR 2,593m. Overall, the biotech sub-sector is dominating the top 5 rankings with 8 IPOs, followed by companies operating in the healthcare services sub-sector with 6 IPOs. Unsurprisingly, the smallest volume range in the top 5 ranking

U.S. biotech funding volume suggests another record-breaking year

After an astonishing development in Q1 2021 with an increase of 106% compared to Q1 2020, the accumulated biotech venture capital funding volume still exceeds the performance of the previous year. In the 1st half of 2021, the funding volume increased by 69% compared to the first half of 2020, reaching USD 17,136m by the end of June. The largest transaction in the 2nd quarter amounted to USD 735m in Treeline Biosciences, Inc.

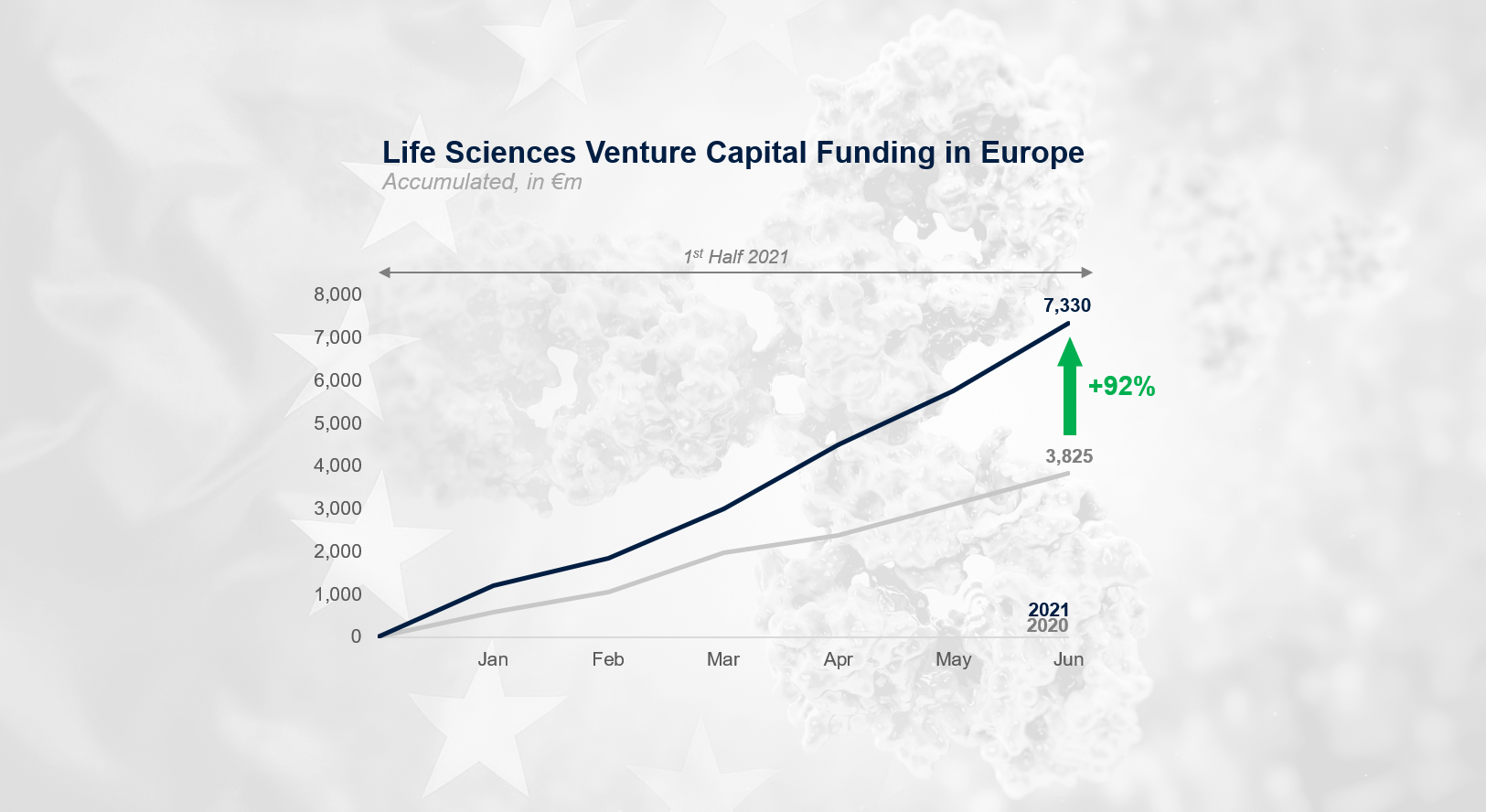

Extraordinary performance in European Life Sciences VC funding continues

The aggregated venture capital funding of Life Sciences companies in Europe has significantly increased during the second quarter of 2021, reaching EUR 7,330 million so far (EUR 3,825 million in the first half of 2020). The total funding volume in the first half of 2021 is 93% higher than in the first half of 2020. With 485 Deals in the first half of 2021 compared to 512 Deals in the same period of the previous year, the total number of deals decreased. However, the average deal size more than doubled (EUR 15.1 million in the first half of 2021 compared

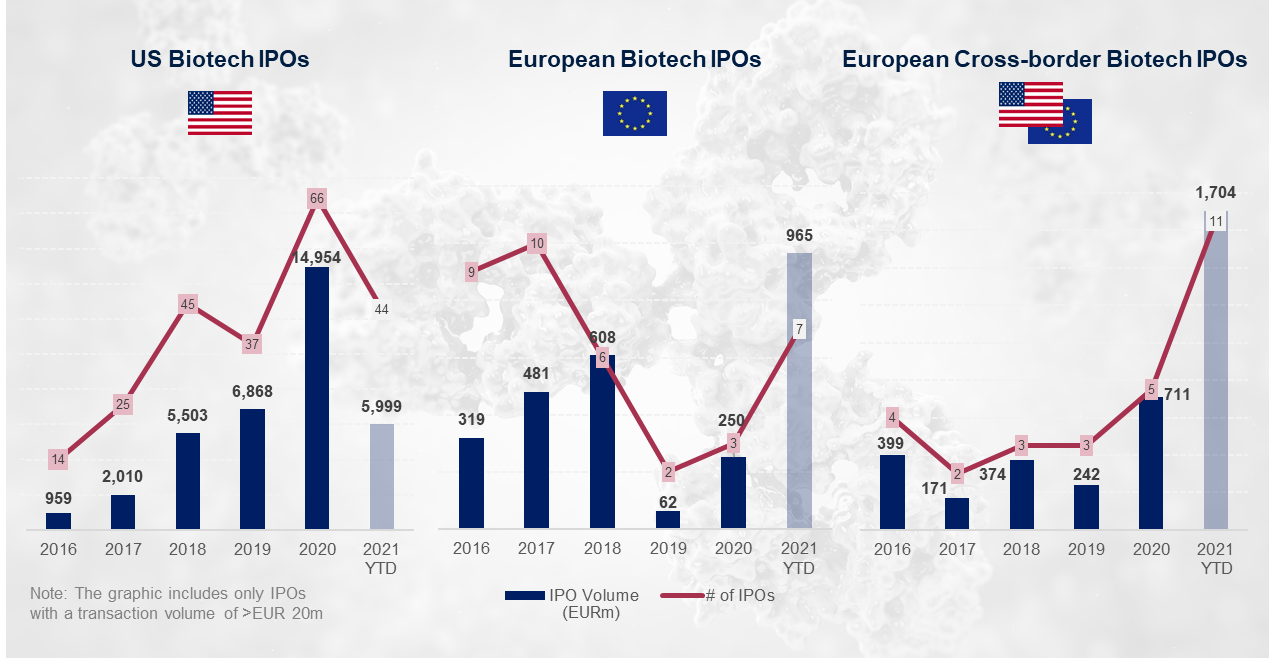

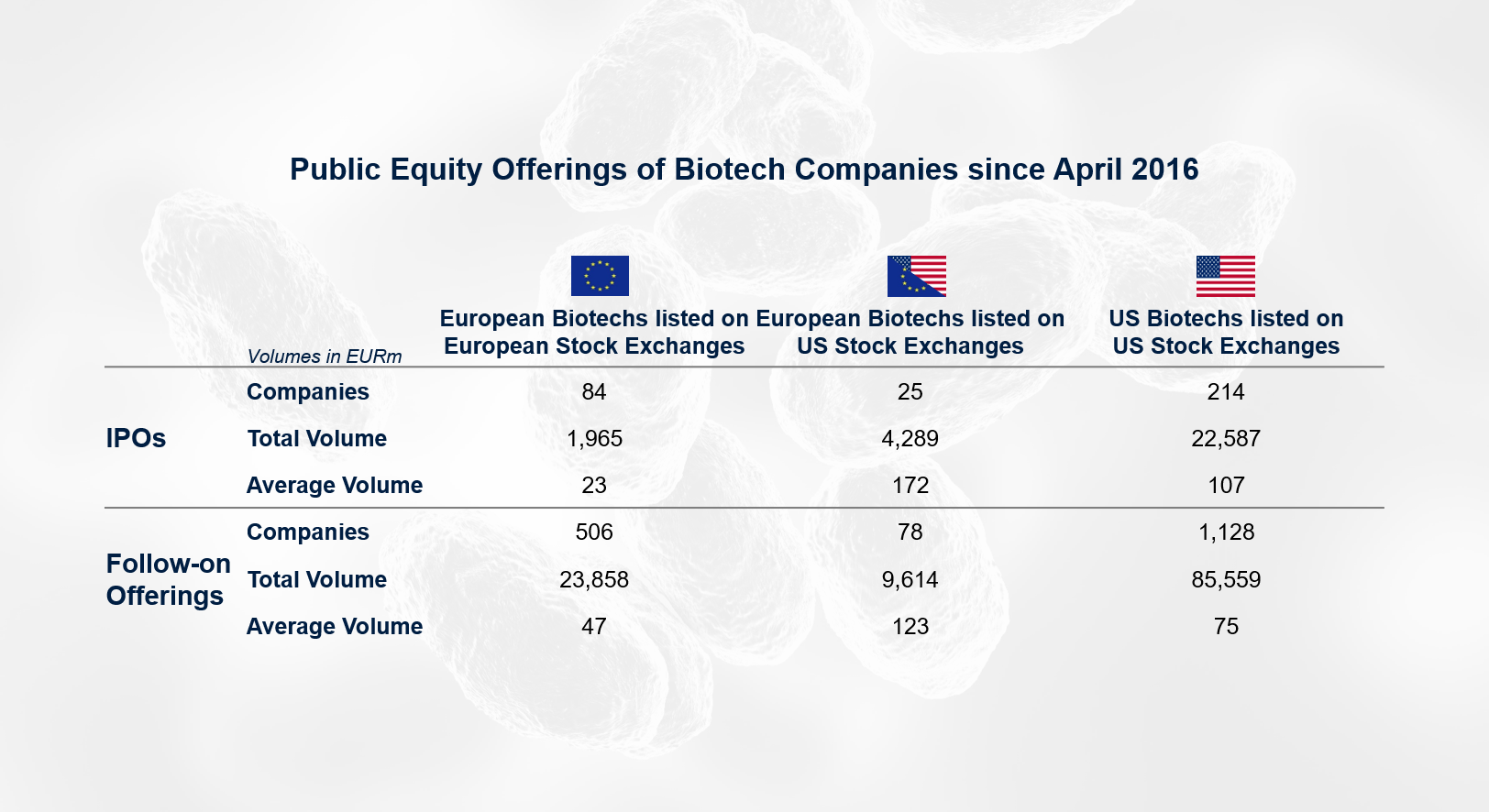

European biotechs favor IPOs in the U.S. over Europe

The activity of US Biotech IPOs has steadily increased within the last five years, having registered a record-high in 2020 with EUR 15.0bn raised in 66 IPOs. The situation in Europe draws a different picture, where IPO activity has been very volatile in the same period. Nevertheless, current traction in public capital markets triggers higher activity of European companies to float on stock exchanges. Since the beginning of this year, 7 European companies went public on European stock exchanges with a transaction volume of EUR 965m, while 11 European companies have been floated in cross-border IPOs on US exchanges with

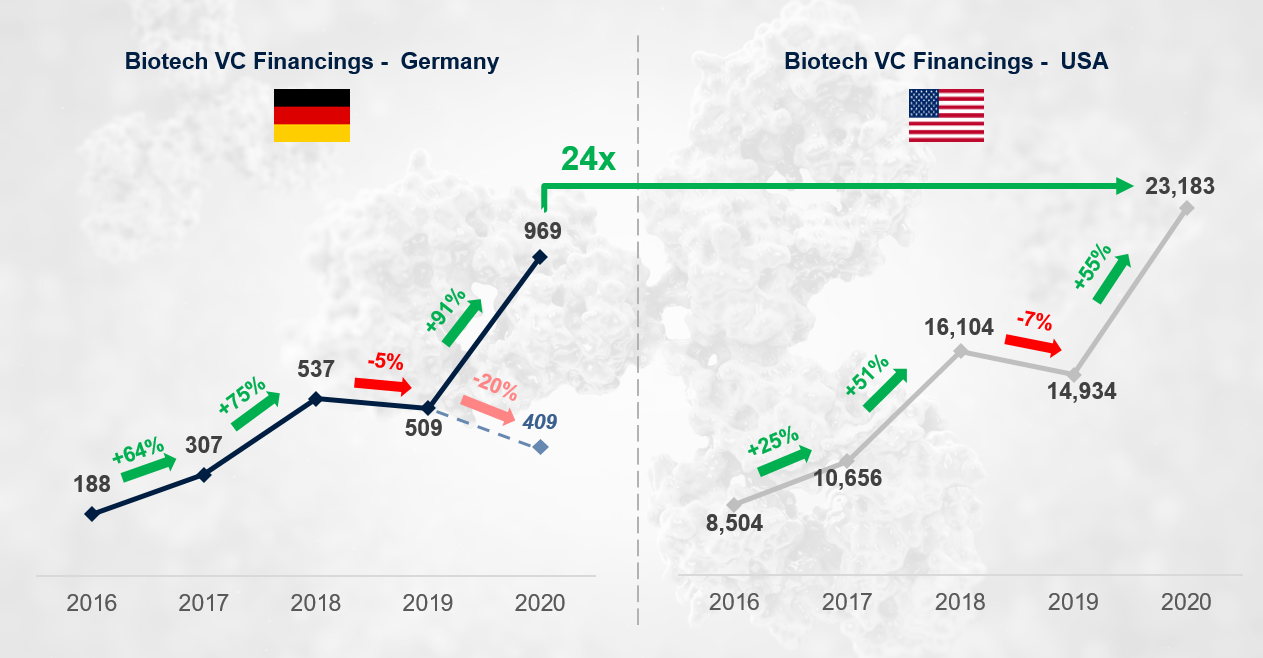

Is Germany closing in on the U.S. funding gap?

Biotech VC financings in Germany and USA have shown the same positive development over the past five years. In 2020, both countries have increased their biotech VC financings compared to the previous year 2019. But appearances are deceptive: In 2020, CureVac has raised a massive crossover round of EUR 560m. Without CureVac’s transaction, biotech VC financings in Germany would have decreased by -20%. Germany could well need more transactions such as CureVac to close the gap with the USA and reduce the funding deficit of 24x.

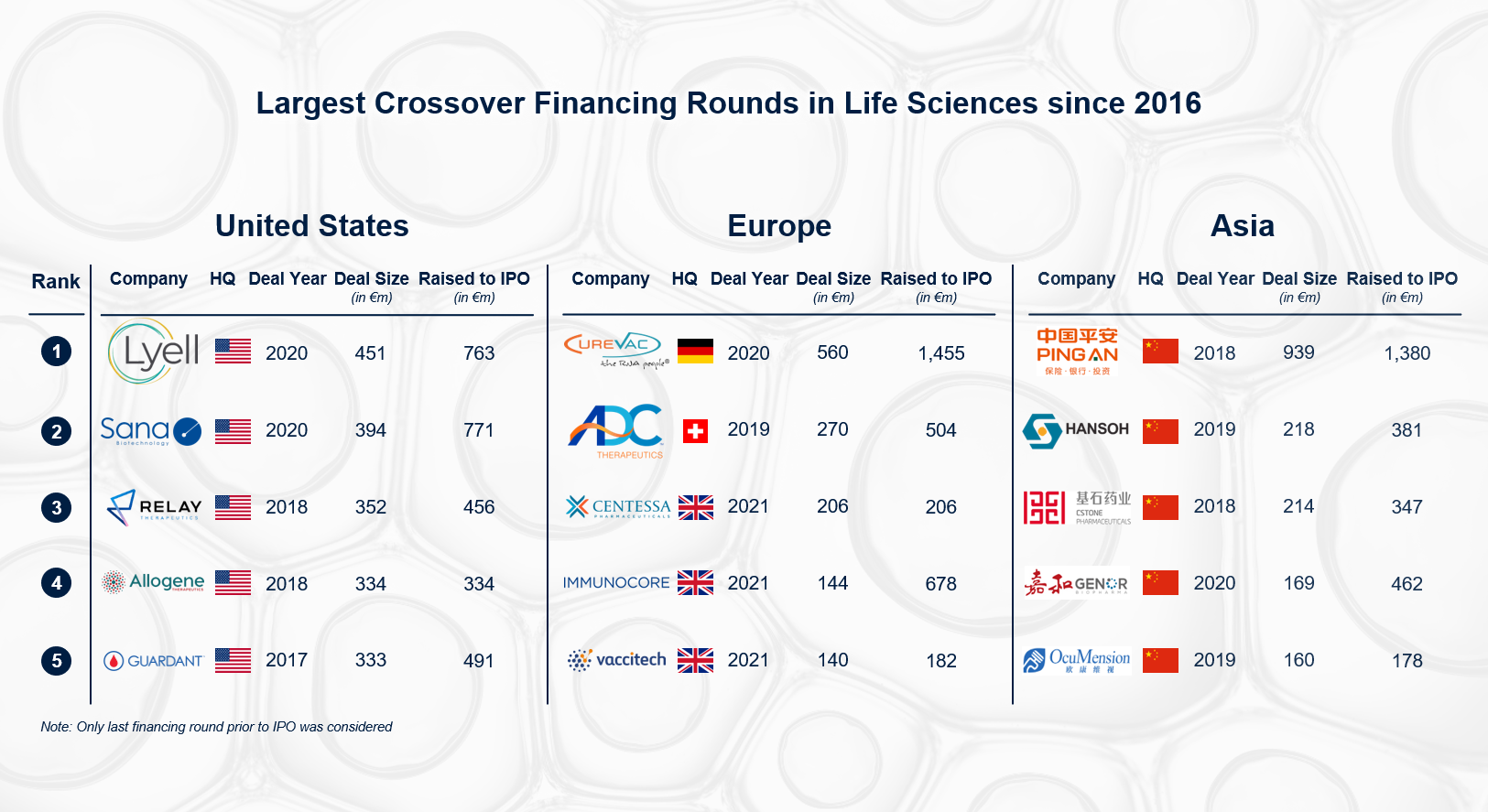

Largest crossover financing rounds well above EUR 130m

With 13 out of 15 companies, the largest crossover rounds in Life Sciences since 2016 are clearly dominated by biotech companies. However, the largest crossover financing was raised by the Chinese healthcare services company Ping An Good Doctor in the amount of EUR 939m. Until its IPO in 2018, the company had raised in total astonishing EUR 1,380m. In Europe, CureVac received the largest crossover financing in the amount of EUR 560m and even exceeds the total capital raised until IPO of Ping An Good Doctor by EUR 75m! In the US, Lyell Immunopharma leads the ranking with its EUR

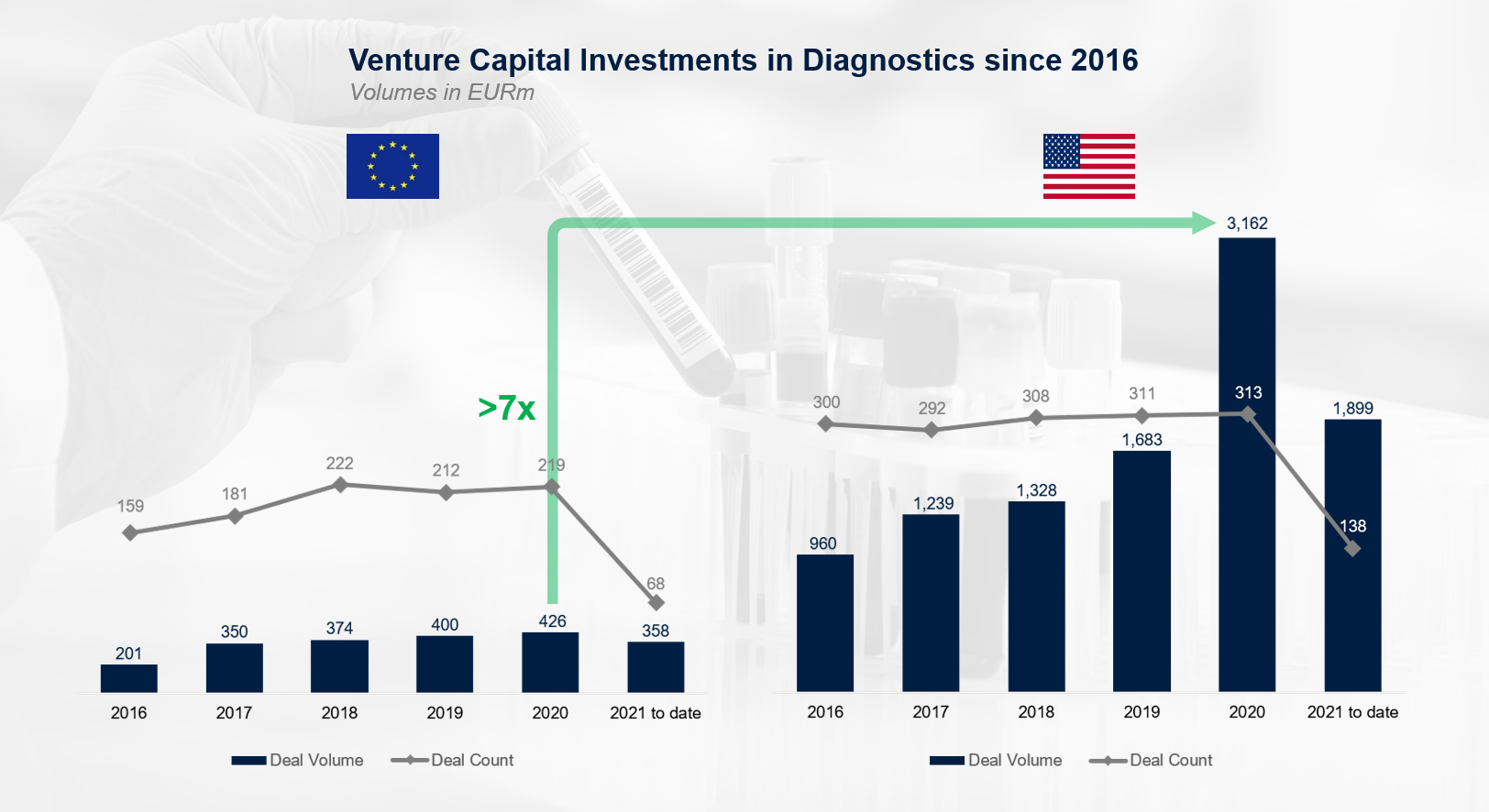

Venture capital funding for Diagnostics on the rise

Since 2016, the number of venture capital deals and the total deal volume per year have significantly increased in the Diagnostics sector. In Europe, the deal volume doubled, while the number of deals rose by ~1.4 times. By comparison, the deal volume in the United States tripled while the number of deals remained relatively stable. Unsurprisingly, the 2020 deal volume in the U.S. significantly exceeds that in Europe, by 7.4 times to be precise. Another interesting development is the nearly doubled deal volume in the U.S. between 2019 and 2020 while the number of deals only increased by 2 deals.

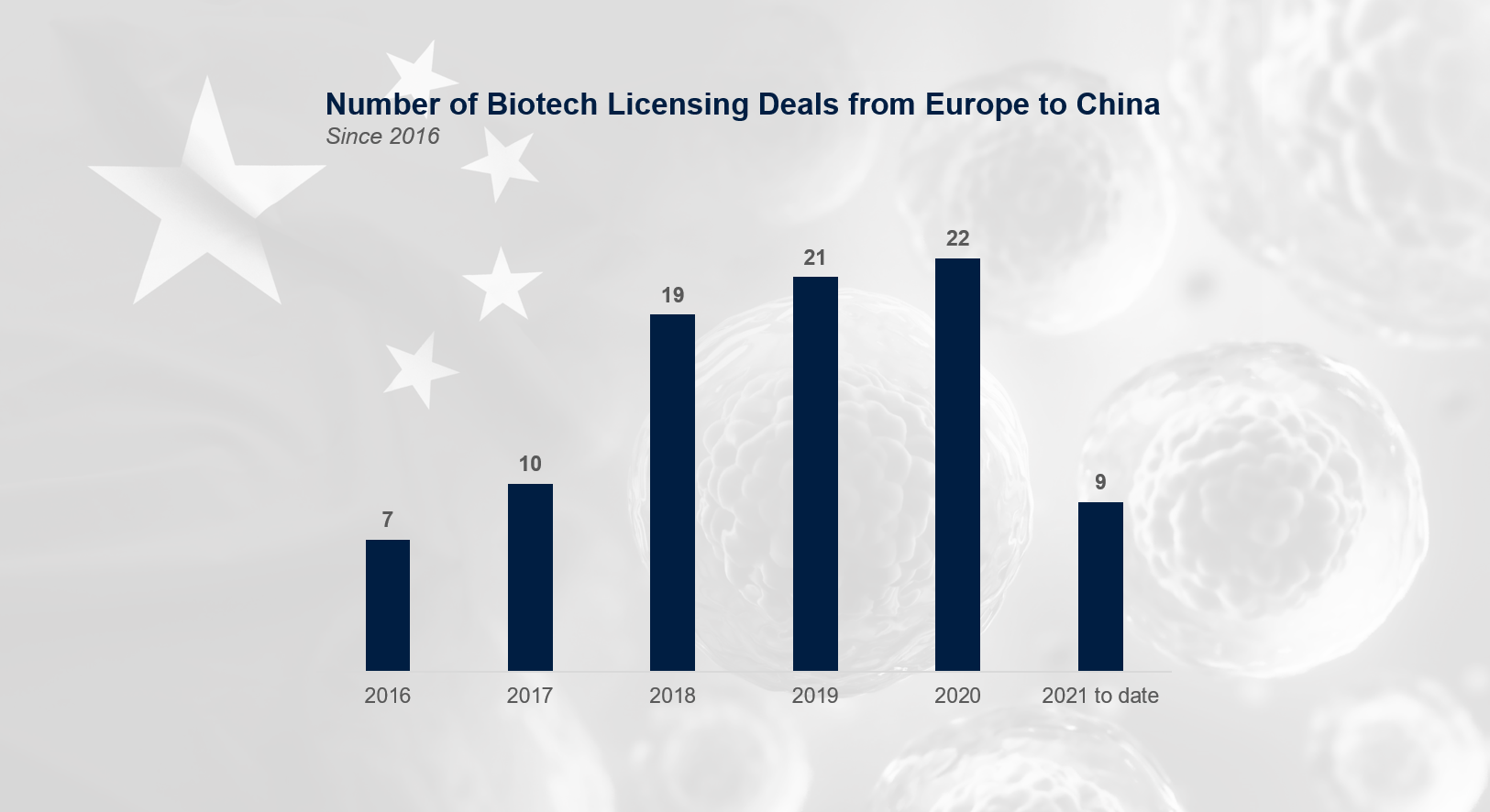

Increasing interest in European Biotech from China

Between 2016 and 2020, the number of Biotech licensing deals between European licensors and Chinese licensees has more than tripled. The largest deal was the agreement between MediGene AG and Cytovant Sciences HK Ltd for at least USD 1,010m in April 2019. Cytovant were granted exclusive licenses to develop, manufacture, and commercialize Medigene’s research-stage T cell immunotherapy targeting NY-ESO-1 as well as a DC vaccine targeting WT-1 and PRAME, in Greater China, South Korea, and Japan.

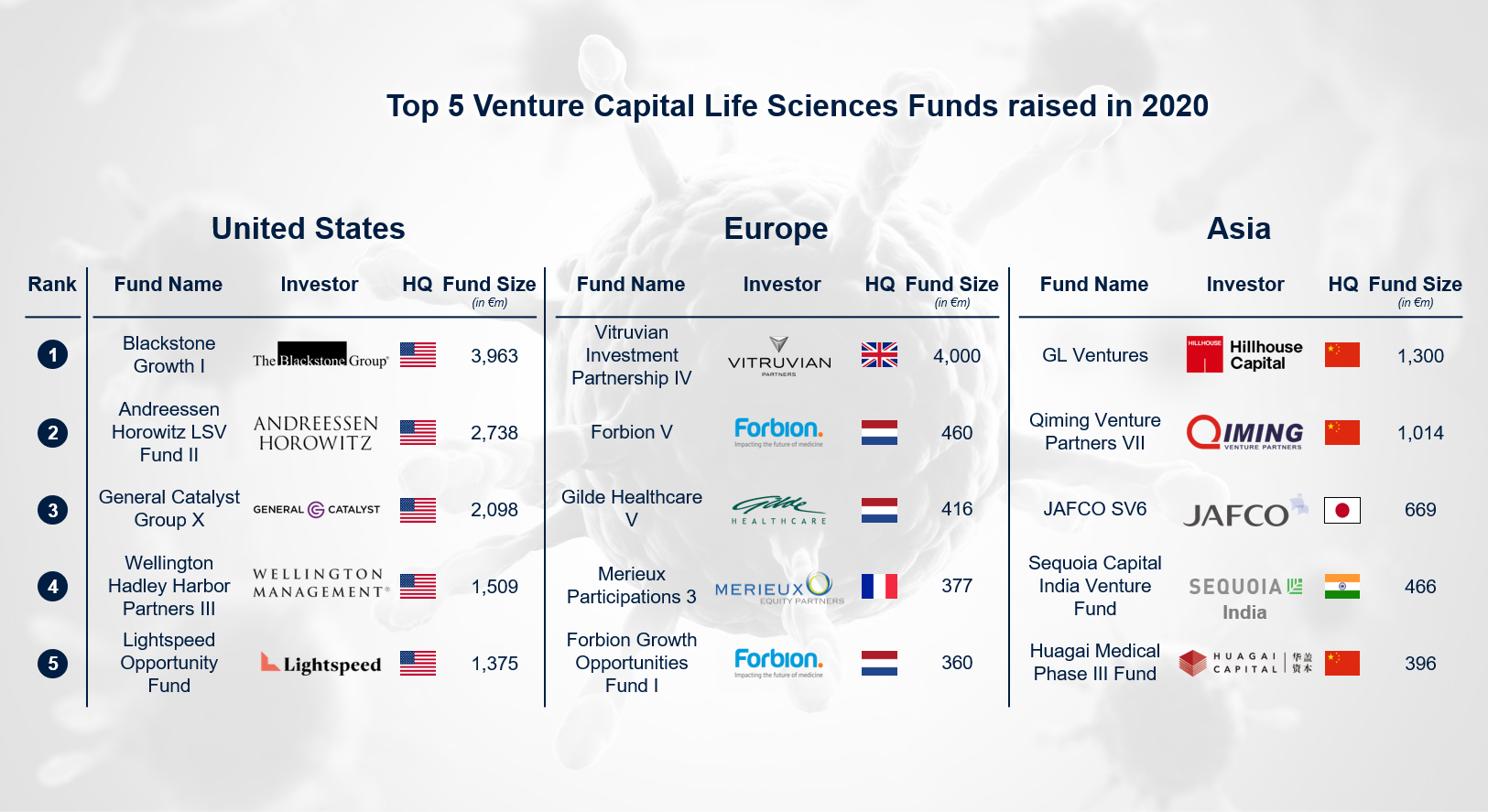

Asian VC funds gain global significance

US Life Sciences venture capital funds raised in 2020 significantly exceed European and Asian funds! The volumes of the 5 largest US Life Sciences venture capital funds raised in 2020 range between EUR 3,963m and EUR 1,375m. In comparison, the volumes of European funds range from EUR 4,000 to EUR 360m and of Asian funds between EUR 1,300m and EUR 396m. The fifth largest US fund even exceeds the largest Asian fund!

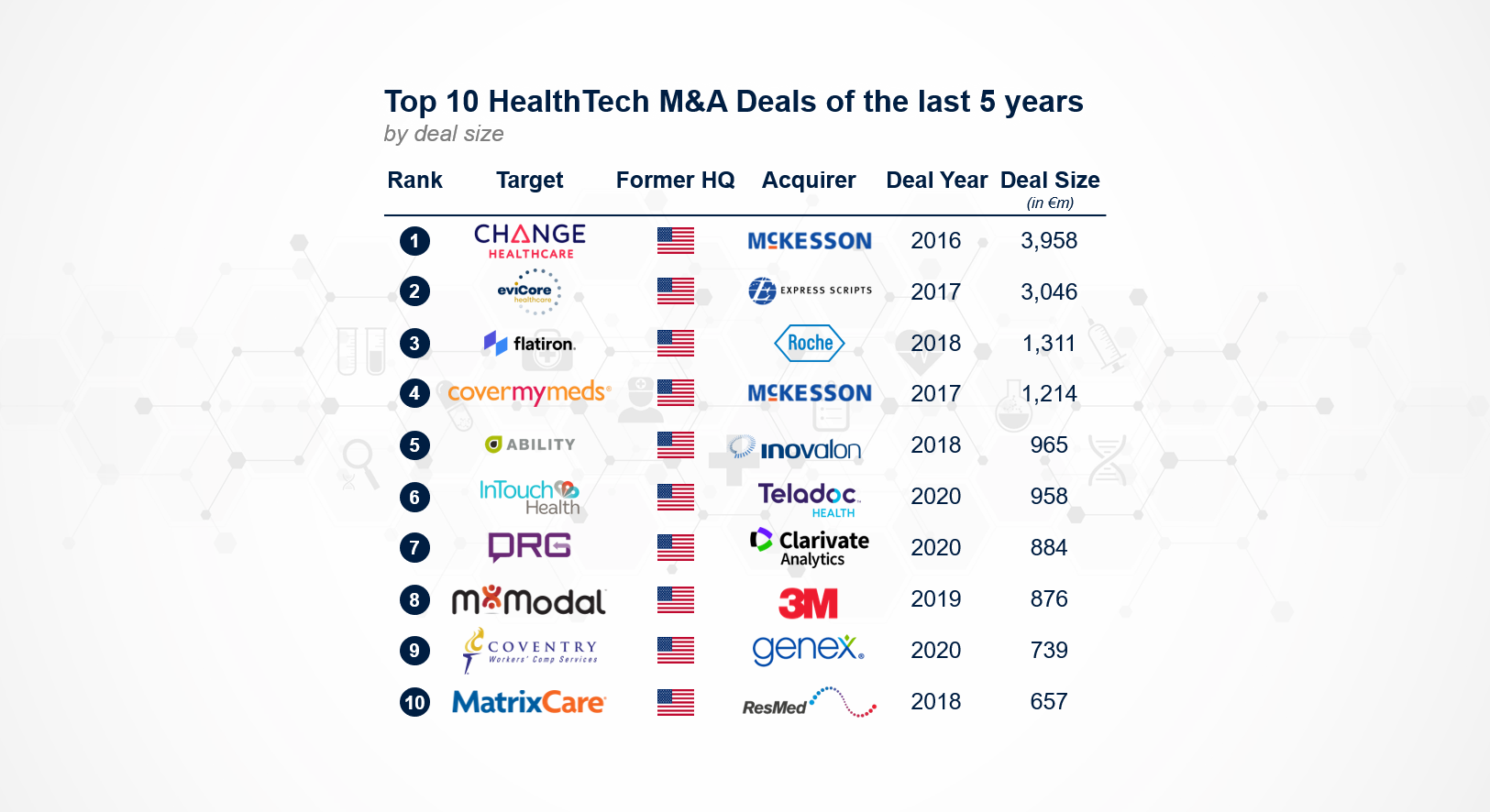

Largest HealthTech M&A targets all from the U.S.

The top 10 HealthTech M&A deals (by deal size) range from EUR 3.96bn to EUR 667m, with an average deal size of EUR 1.46bn. All top 10 targets were headquartered in the US. The largest deal was the acquisition of Change Healthcare by McKesson in June 2016 for EUR 3.96bn. Compared to the average deal sizes of the previous top 10 M&A rankings in Biotech (EUR 32bn) and MedTech (EUR 11bn), the top 10 HealthTech M&A ranking recorded the smallest average deal size (EUR 1.46bn).

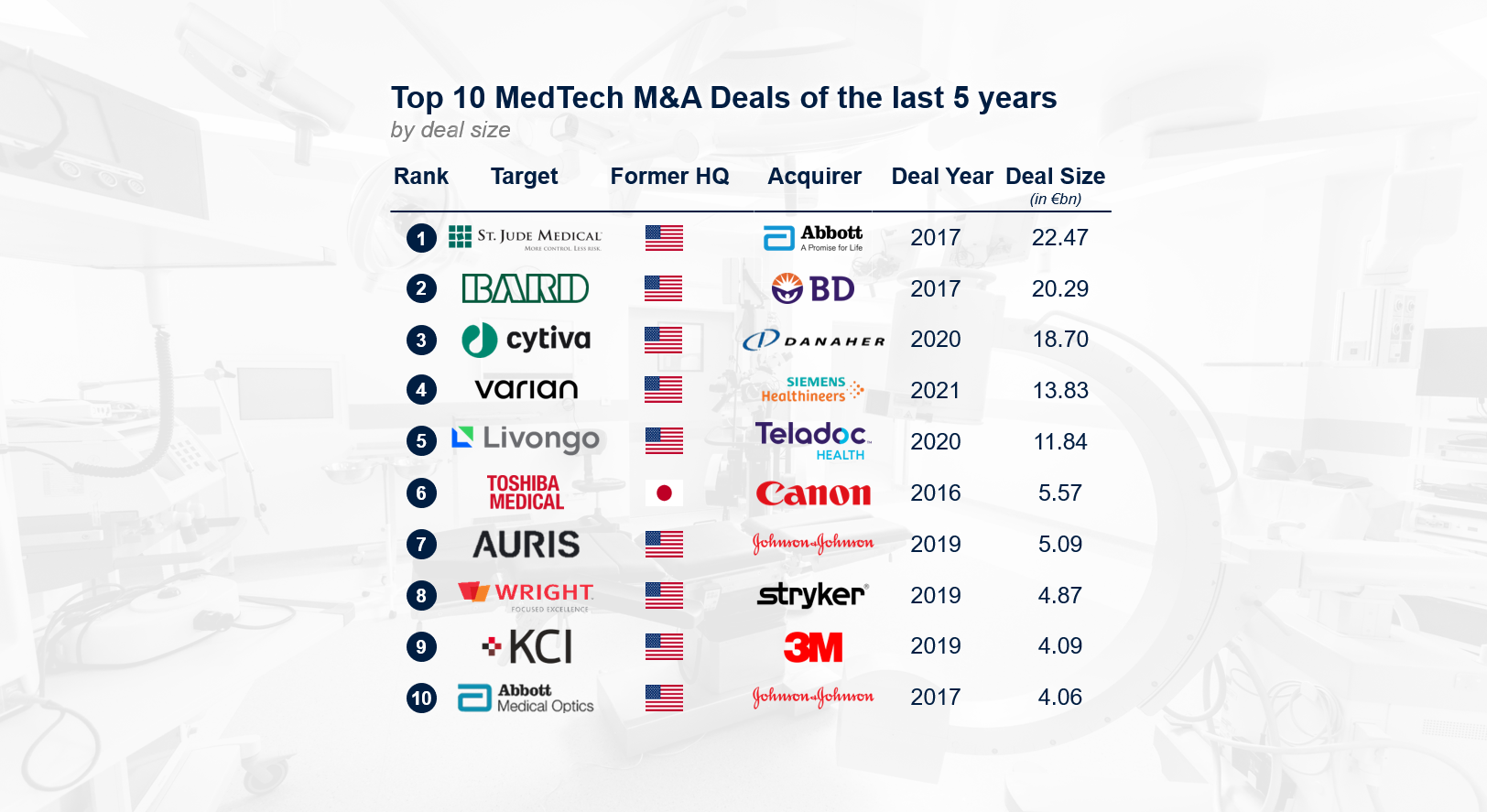

MedTech M&A deal sizes lag behind Biotech

Top 10 MedTech M&A deals dominated by US targets! The top 10 MedTech M&A deals (by ticket size) range from EUR 22.5bn to EUR 4.1bn, with an average deal size of EUR 11bn. With 9 out of the top 10, the ranking is dominated US target companies. The largest deal was the acquisition of St. Jude Medical by Abbott in January 2017 for EUR 22.47bn. By comparison, the top 10 Biotech M&A deals posted two weeks ago ranged between EUR 72.4bn and EUR 10.2bn with an average deal size of EUR 32bn, showing the significant difference to the top 10 MedTech M&A deals.

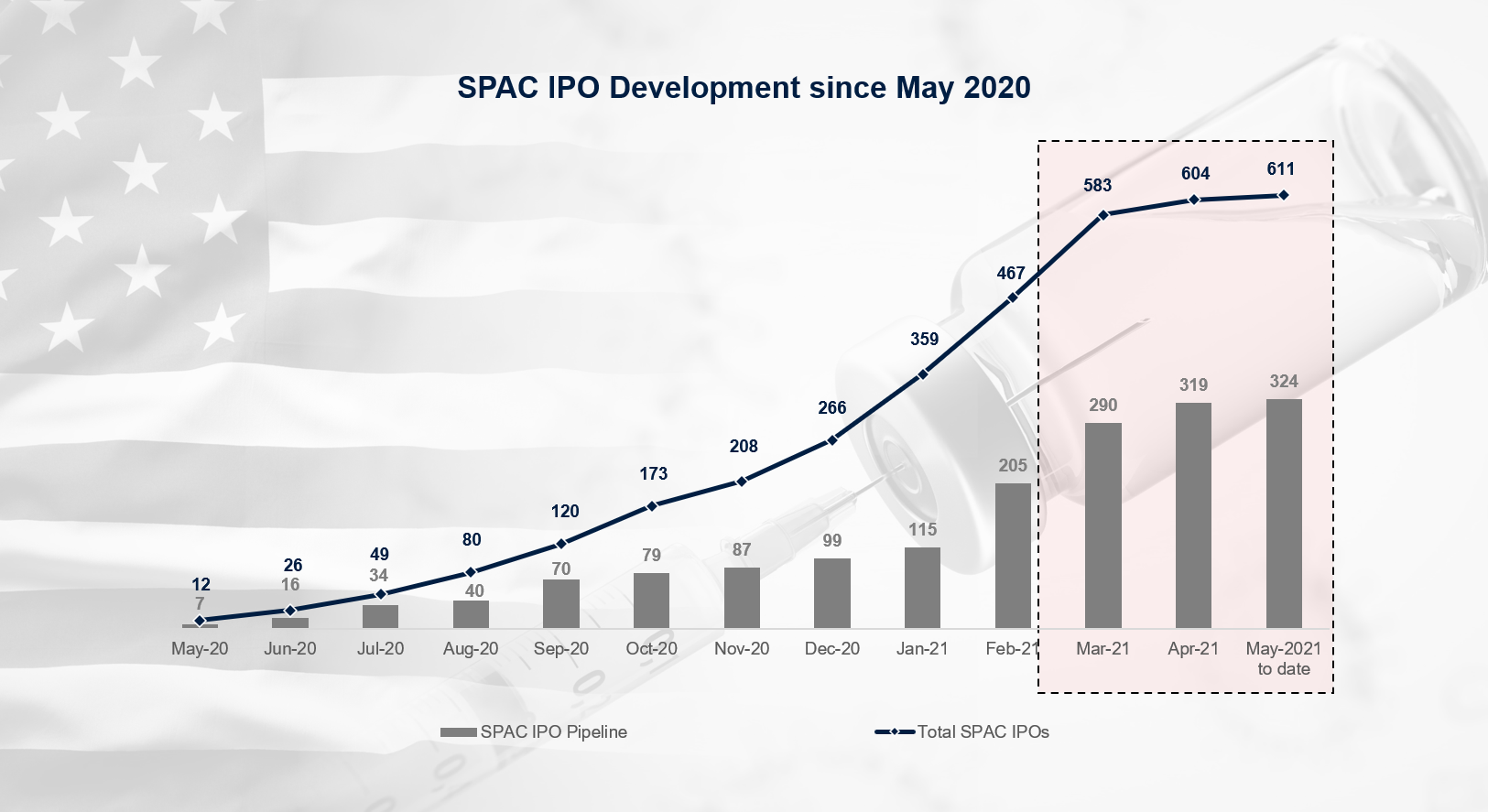

Cool off for SPAC-Boom?

Is the boom around Special Purpose Acquisition Companies (SPAC) currently suffering a cool off? The number of SPAC IPOs as well as the number of new SPACs in the IPO pipeline have significantly declined since last month. A potential reason could be an official SEC statement published in mid-April 2021. The SEC expresses its concerns about the current treatment of SPAC warrants as equity. Since May 2020, 611 SPACs have been successfully listed on a public stock exchange. More than half of the IPOs took place within the 1st Quarter of 2021 (317 IPOs). The current SPAC IPO pipeline consists

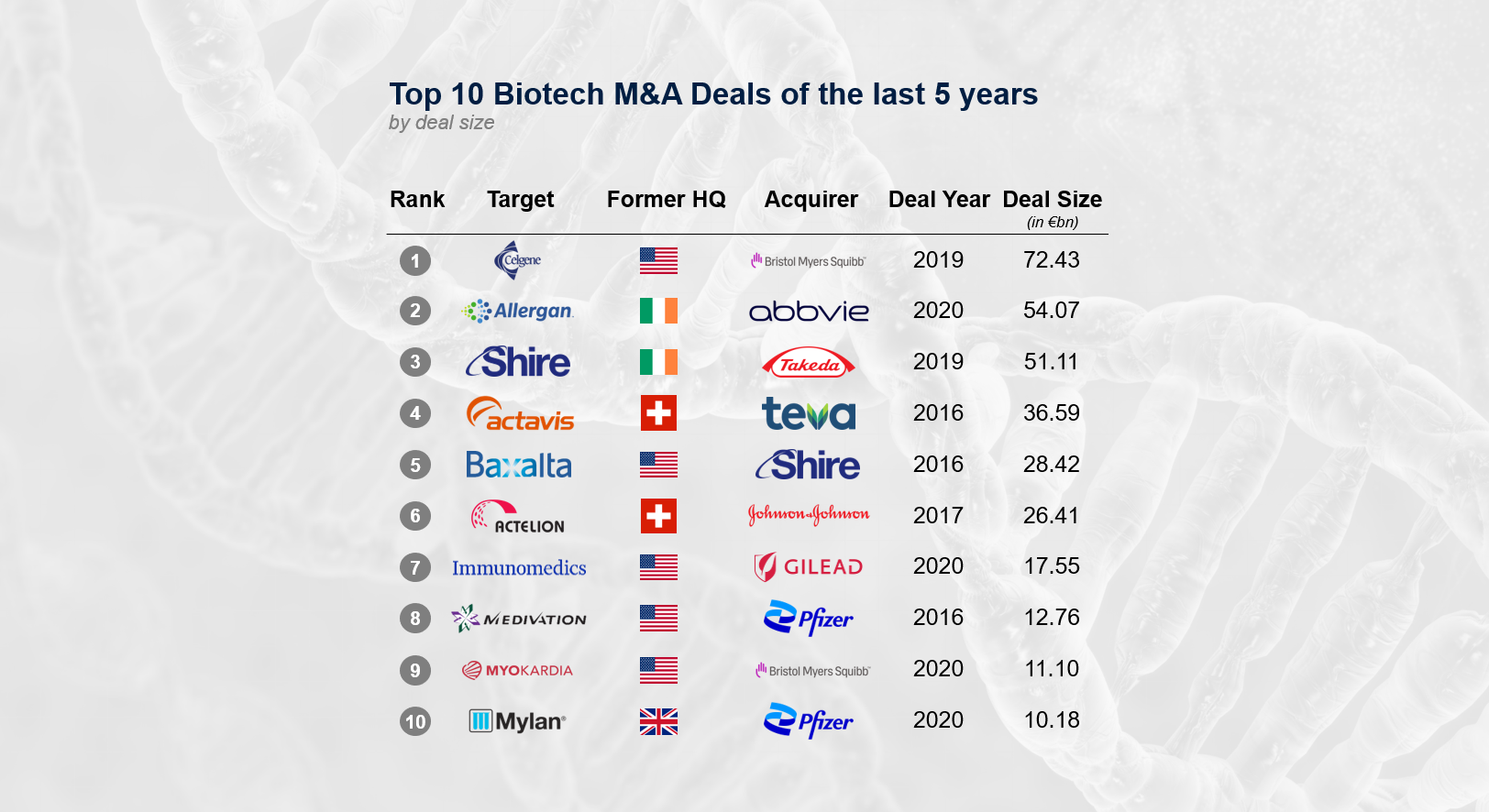

Top 10 Biotech M&A deals all above EUR 10bn

The Top 10 biotech M&A deals ranking (by ticket size) shows that there have been exceptionally large deals in the biotech sector over the last years. The largest deal was the acquisition of Celgene by Bristol Myers Squibb in November 2019 at EUR 72.43bn. The breakdown by target location shows that half of the targets were located in the US, while the other half were headquartered in Europe. In addition, it is observed that 2020 has been the year with the most Top 10 deals (4 deals).

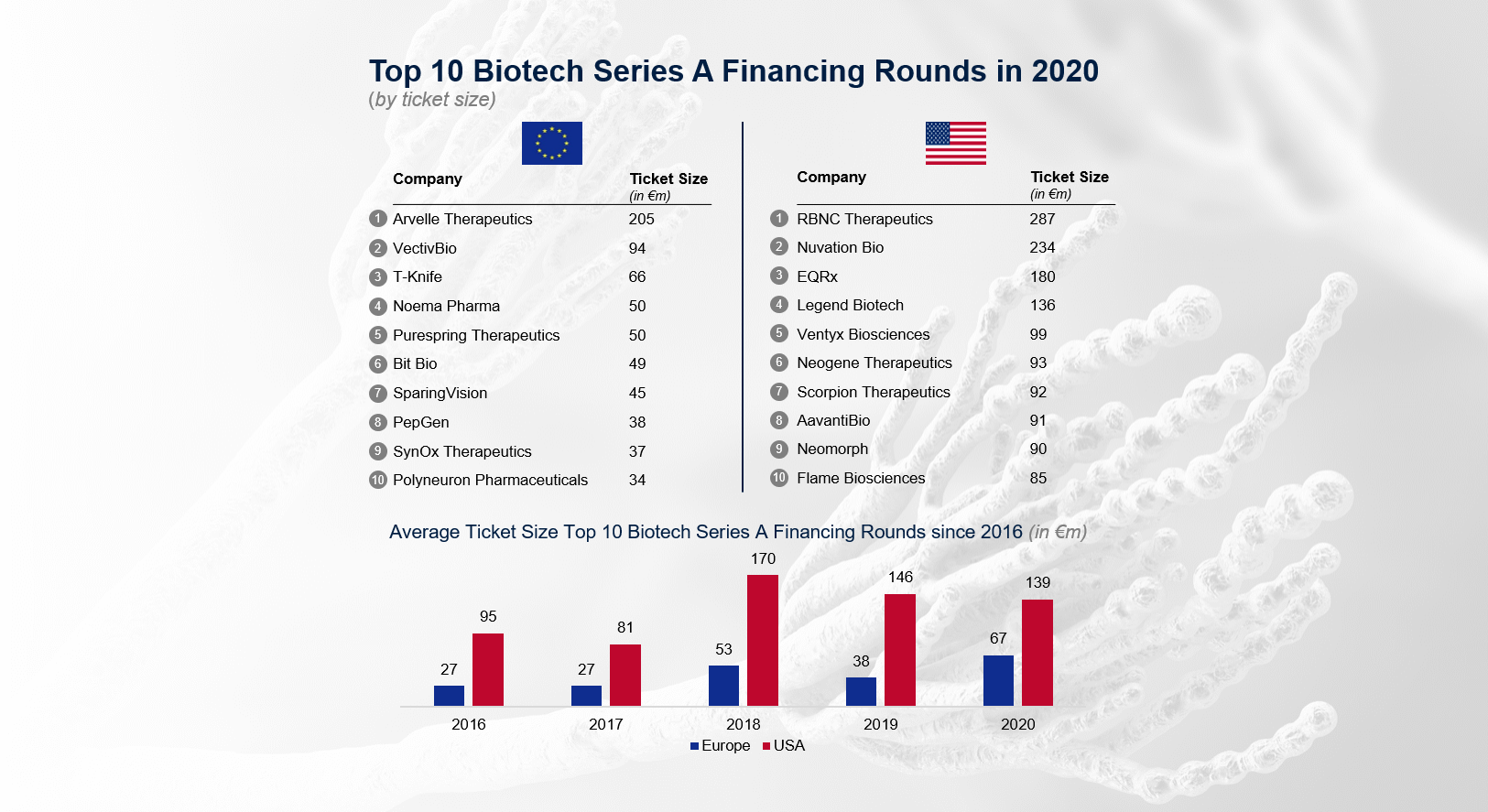

Series A rounds in Biotech have significantly increased

As expected, the top US Series A rounds in Biotech substantially outperformed the top European rounds. In 2020, the average ticket size of the top 10 Series A deals in Biotech (by ticket size) in the U.S. is twice that of Europe. The largest Series A Biotech deal in Europe was closed by Arvelle Therapeutics at EUR 205m. In contrast, the largest deal in the U.S. was EUR 287m by RBNC Therapeutics. The average ticket size of the top 10 Series A deals in Biotech has significantly increased over the last 5 years. Compared to 2016, the average ticket size in Europe

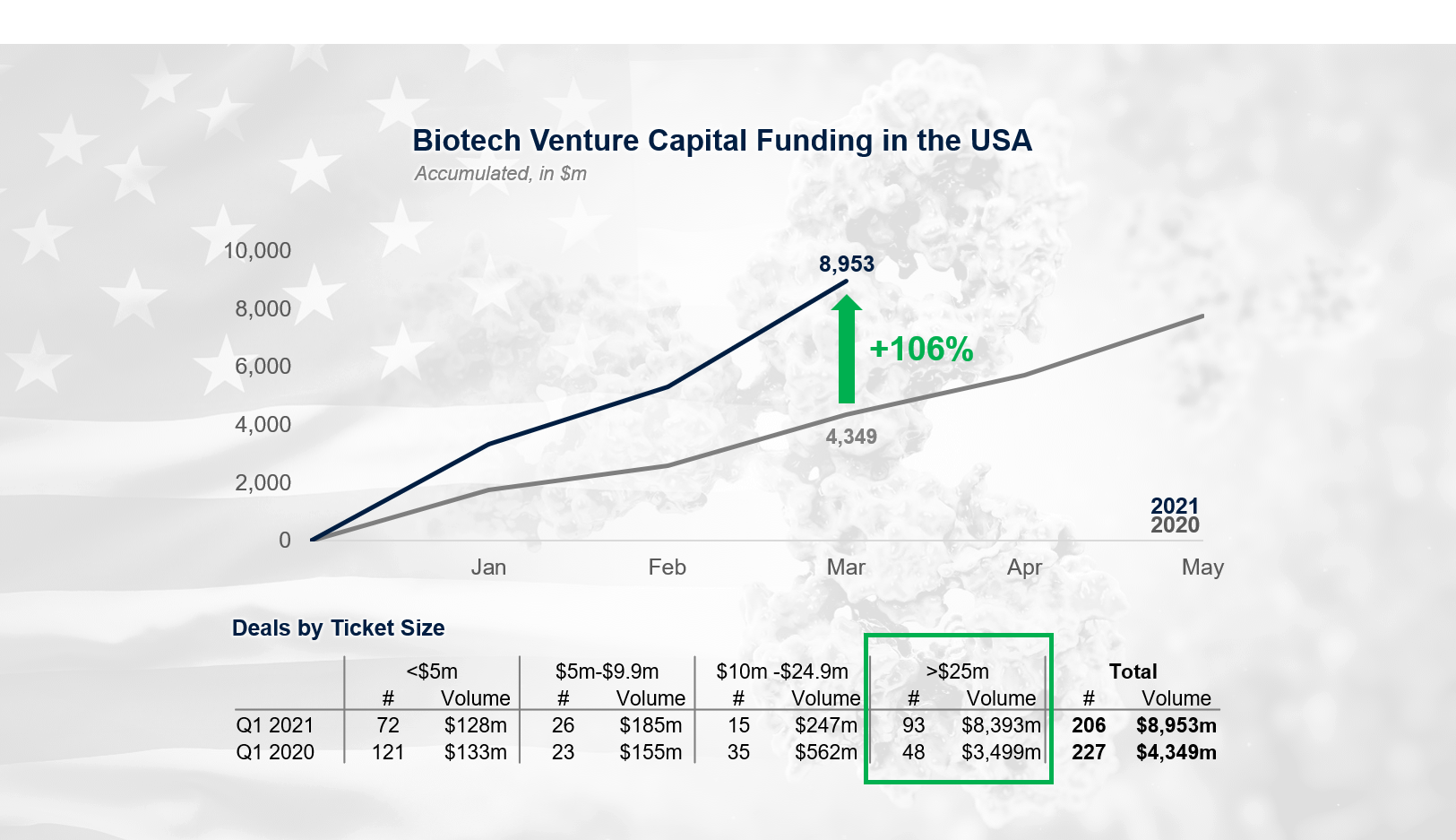

Extraordinary growth in U.S. Biotech venture capital funding

This week we report an exceptional increase in U.S. Biotech venture capital funding. Compared to the 1st quarter of last year, accumulated biotech venture capital funding in the United States has increased by staggering 106%, reaching USD 8,953m so far (USD 4,349m in Q1 2020). The analysis of deal count and funding volume by ticket size reveals the main driver of the significant growth: The number of deals with a ticket size greater than USD 25m nearly doubled while the funding volume increased from USD 3,499m to USD 8,393m (+140%).

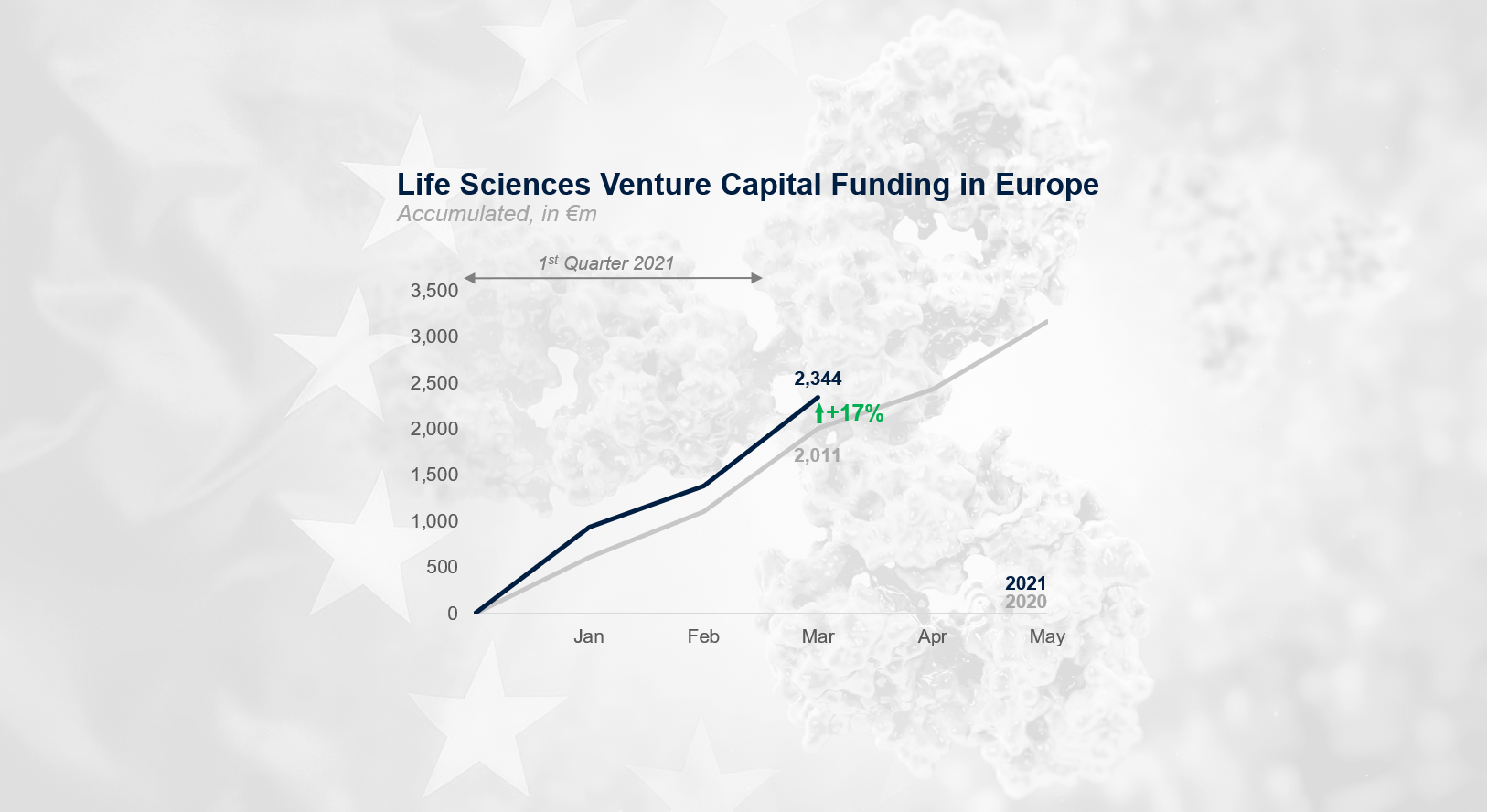

The increase in Life Sciences venture capital funding in Europe continues

Venture capital funding in the European Life Sciences industry in the 1st quarter of 2021 remains unaffected by the negative impact of the COVID-19 pandemic. Compared to the 1st quarter of the previous year, accumulated Life Sciences venture capital funding in Europe has increased by 17%, reaching EUR 2,344 million so far (EUR 2,011m in Q1 2020). 76% of the accumulated funding volume was allocated to European Biotech companies (56% in Q1 2020).

European Biotechs benefit from public equity offerings in the U.S.

Without a doubt, our analysis confirms the hypothesis that U.S. stock exchanges are more attractive for Biotech companies seeking public equity due to a larger capital environment with a higher number of investors and research analysts. The table shows that during the last five years, U.S. stock exchanges hosted 3 times more Biotech IPOs than European stock exchanges. In addition, the average IPO volume was about 6 times higher. Overall, total public equity raised by European and U.S. Biotech companies on U.S. exchanges via IPOs and follow-on offerings is roughly 5 times higher compared to their European counterparts.

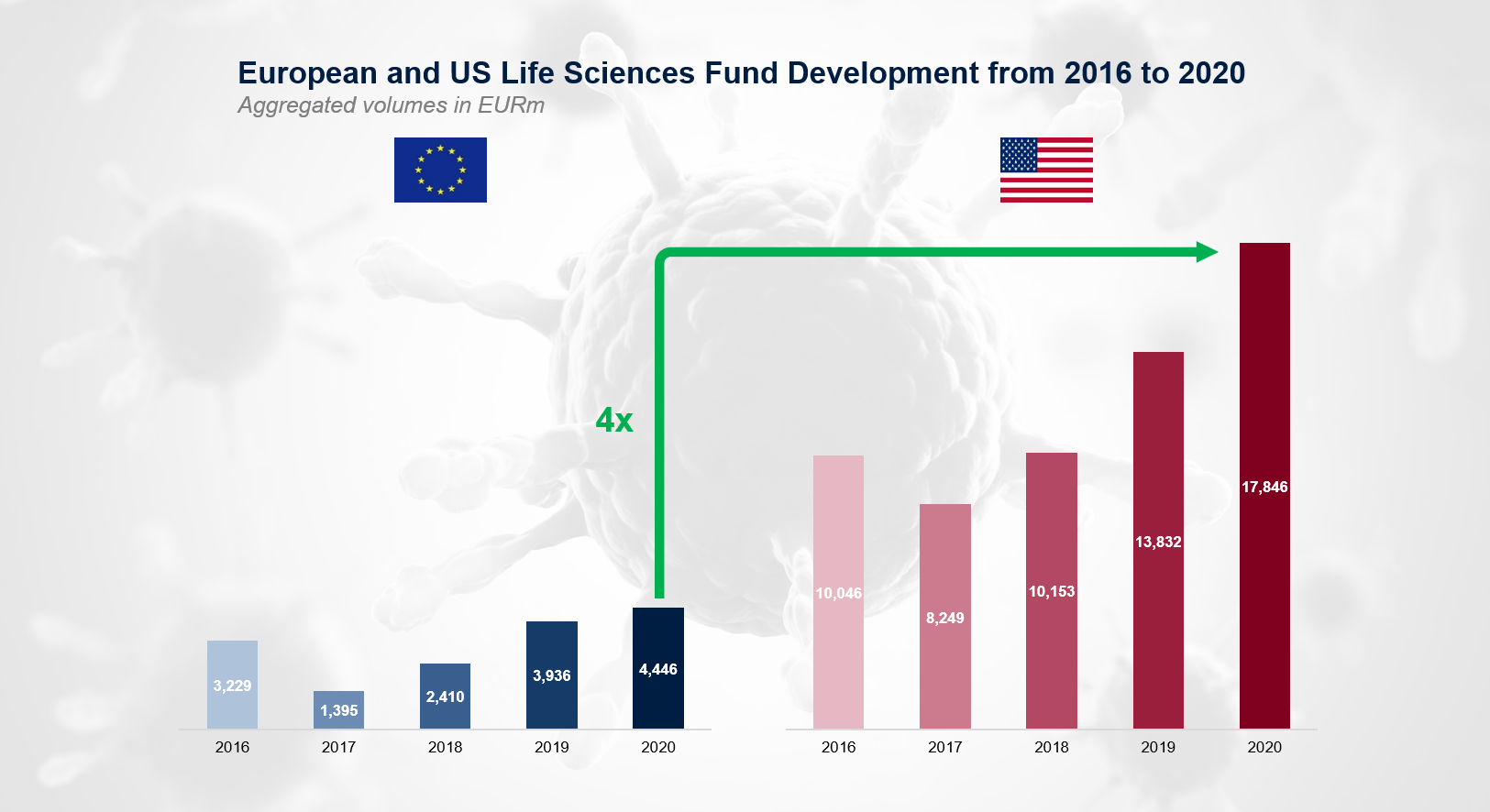

The funding volume of new U.S. funds is 4x larger than in Europe

Except for a small setback in 2017, the aggregated fund volume raised by life sciences funds per year has developed very well over the last five years. In Europe, the volume in 2020 increased by 38% compared to 2016. U.S. Life Sciences funds were able to increase their aggregated fund volume by even 78%.

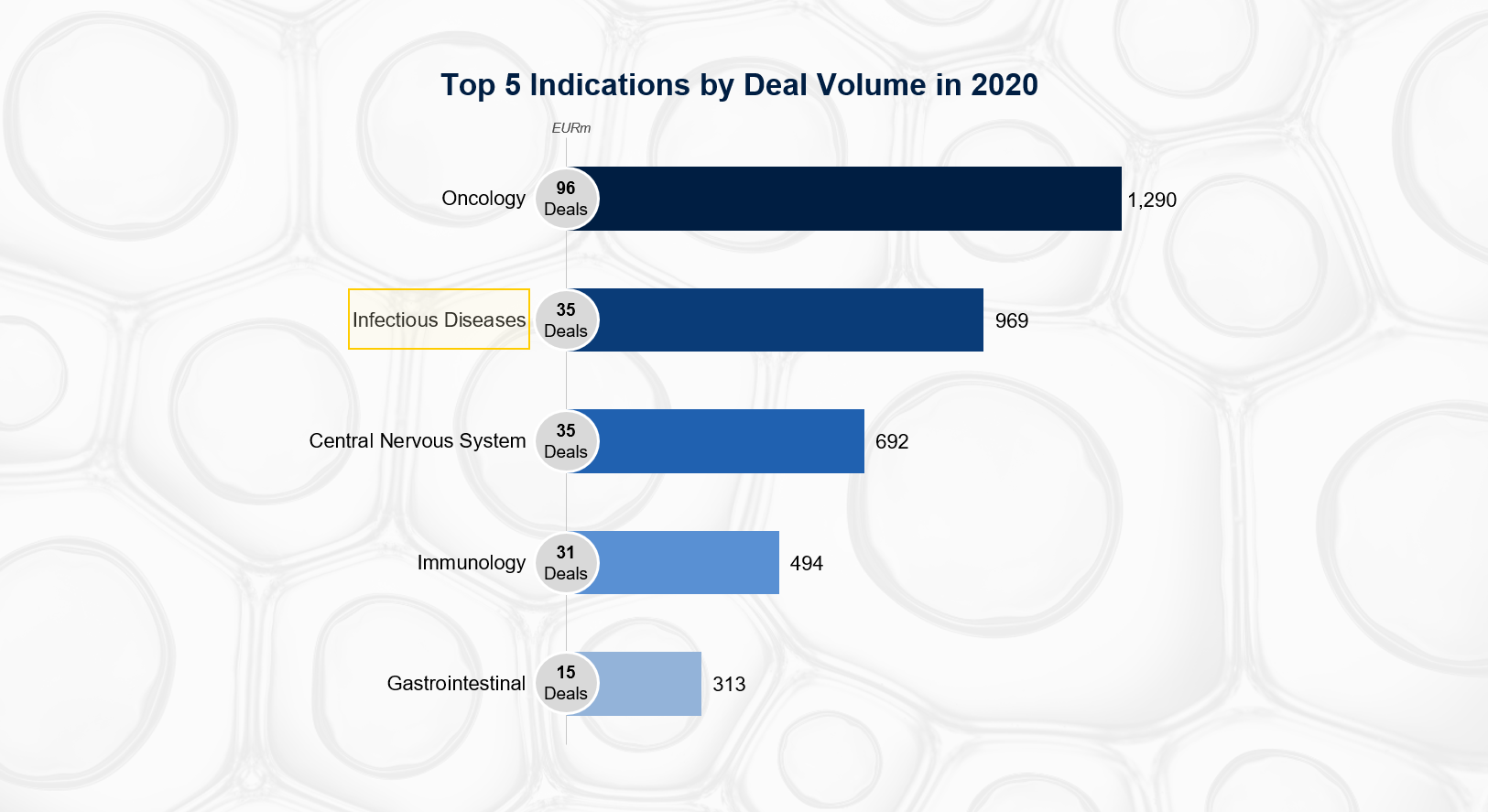

COVID-19 pushes Infectious Diseases in 2020

In 2020, investors invested millions in the development of vaccines and medications to fight the COVID-19 pandemic. This is also reflected in our top 5 indications ranking by deal volume, where Infectious Diseases ranked 2nd, after Oncology.

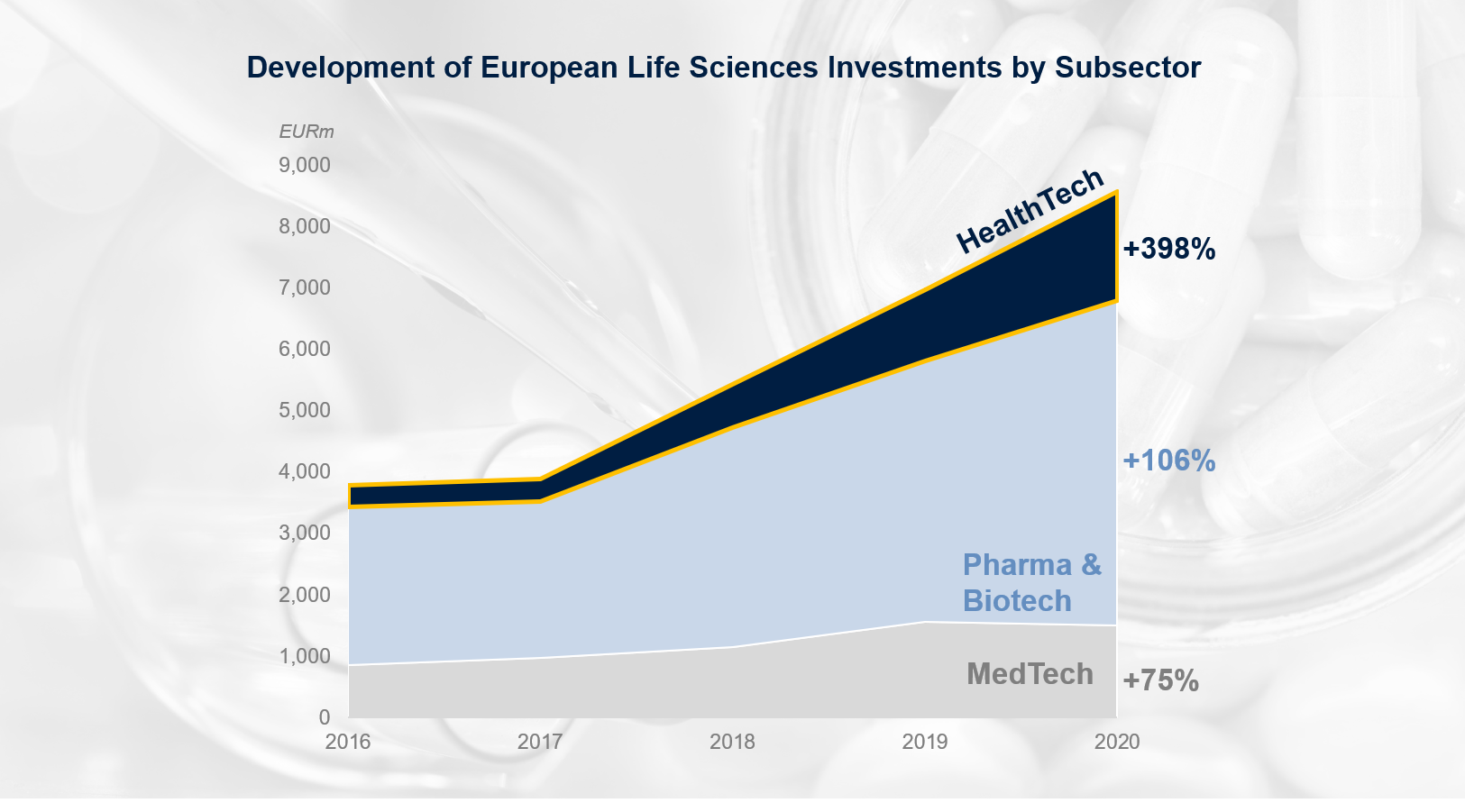

HealthTech shows highest growth rate in funding volumes

Many technologies such as IoT, SaaS, AI and machine learning spill over to the Healthcare sector, advancing the digitalization of the industry. This trend is reflected by a rapid increase of venture capital investments in the European HealhTech sector, which have increased by +400% over the last five years. For reference, investments in the Pharma & Biotech sector increased by +106% and in the MedTech sector by +75%.

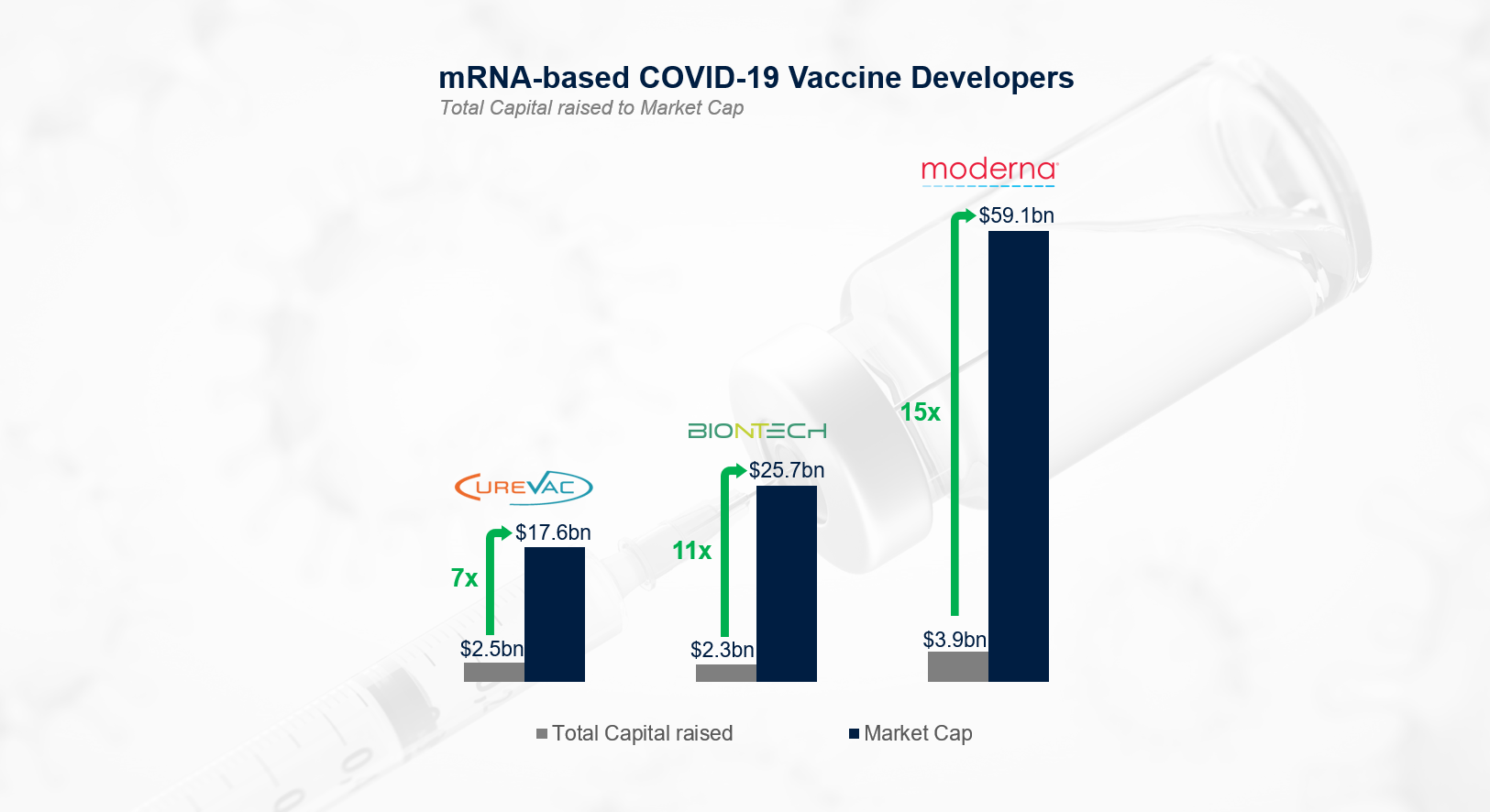

3 mRNA-based COVID-19 vaccine developers under the spotlight

BioNTech, CureVac and Moderna have probably benefited the most from the pandemic. Publicity aside, shareholders risked a lot of capital prior to the pandemic, with uncertain outcomes. All companies have shown great clinical success so far, but which one used its capital most efficiently? BioNTech, CureVac and Moderna have raised staggering USD 8.7bn from private and public capital markets so far and a total market capitalization of USD 102.4bn. Moderna rewards its shareholders by returning 15x on the capital employed, followed by BioNTech (11x) and CureVac (7x).

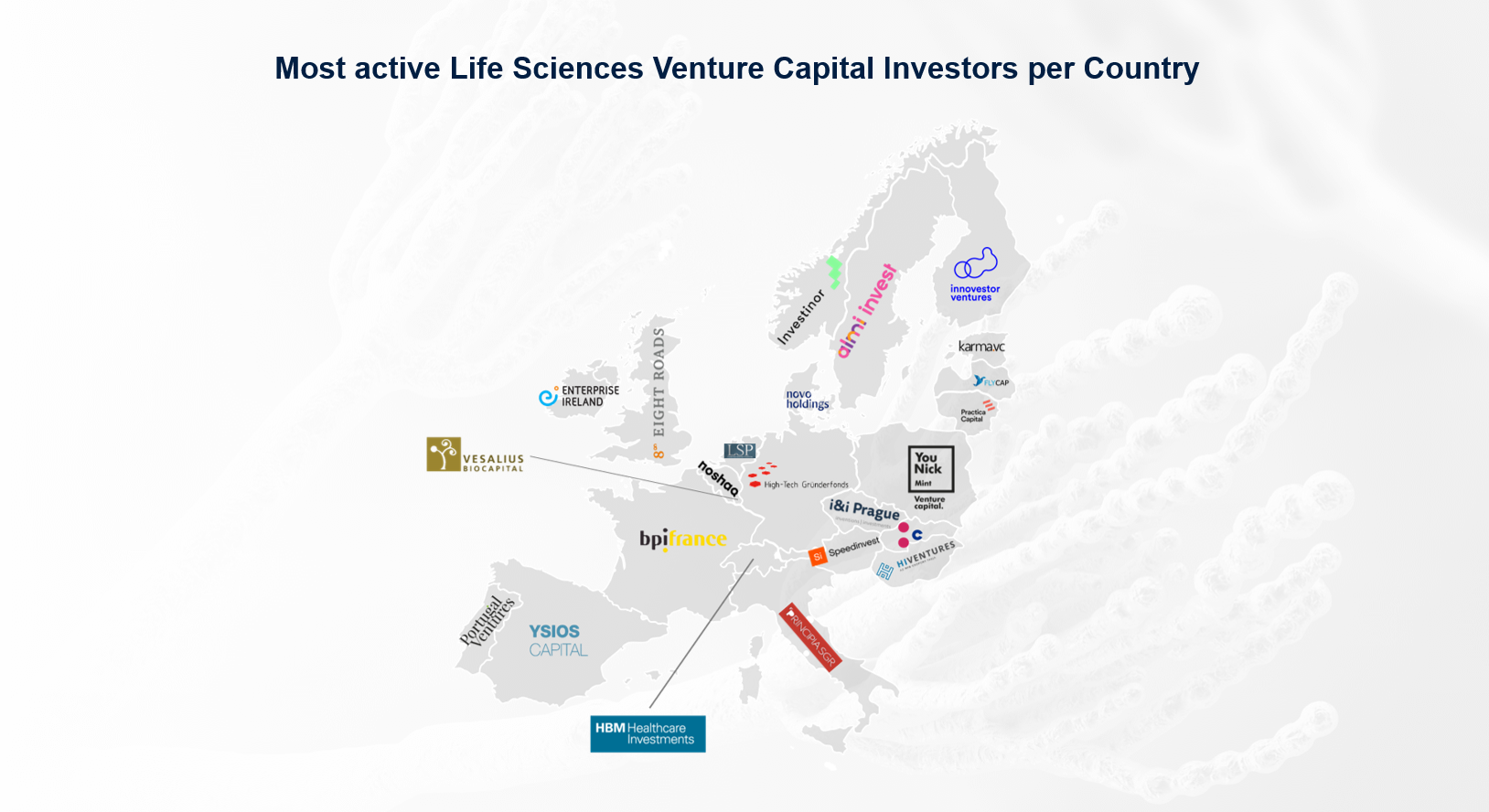

Novo Holdings most active Life Sciences investor in Europe

The map shows the most active Life Sciences investors in Europe measured by the number of closed deals within the last five years. Novo Holdings has been the most active investor with in total 126 closed deals in Life Sciences, followed by Bpifrance with 111 deals and Enterprise Ireland with 98 transactions. In Germany, High-Tech Gründerfonds was the most active investor with 68 closed deals.

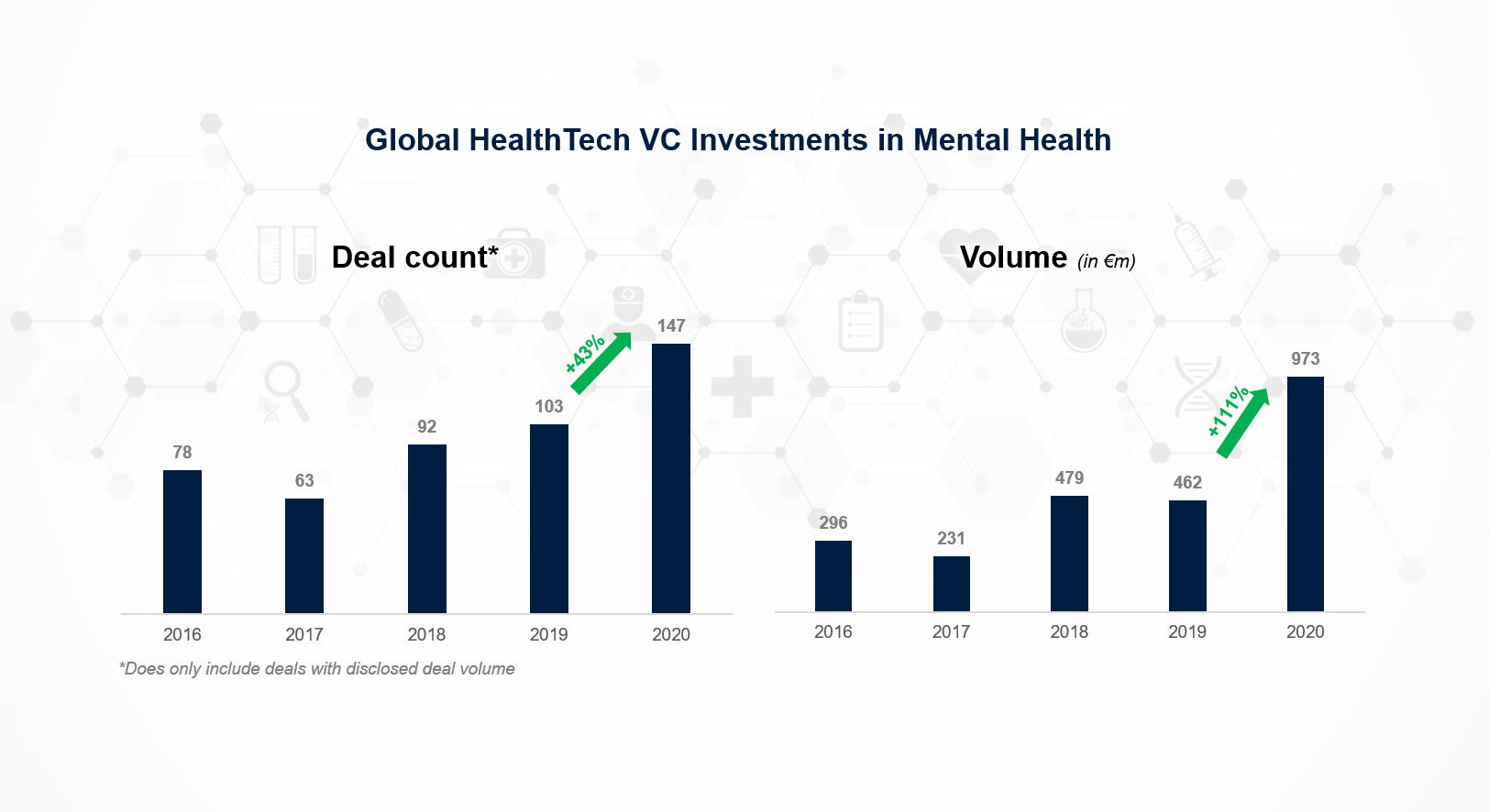

Mental health investments soaring since start of COVID-19 pandemic

Unsurprisingly, studies show that social distancing during the COVID-19 pandemic has a significant negative impact on mental well-being. The rapidly growing demand from affected people for mental health services and technologies was immediately picked up by the venture capital industry. While investments in mental health startups (HealthTech) remained stable in 2018 and 2019, the number of deals increased by +43% and total deal volume more than doubled in 2020.