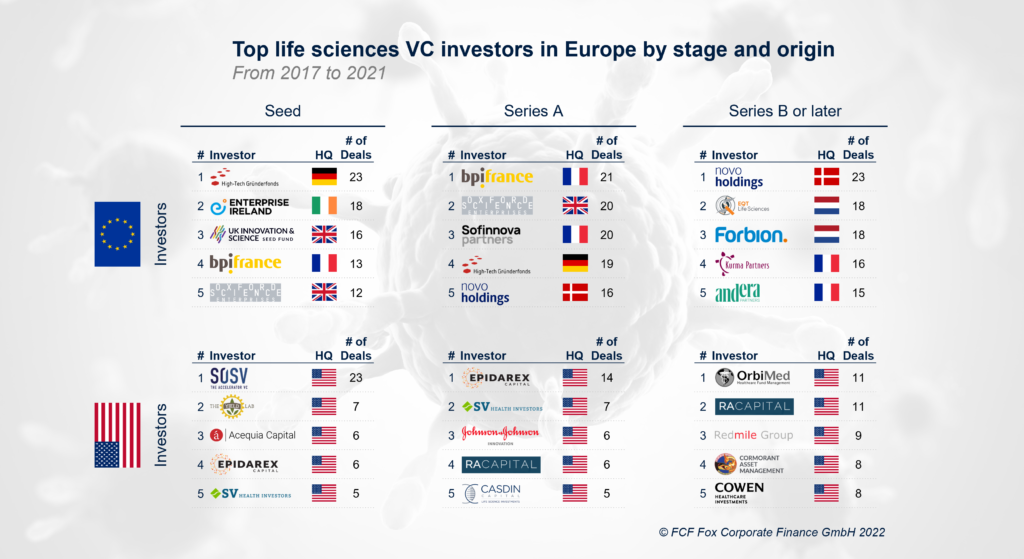

It is no surprise that the top 5 European investors have shown significantly higher activities than US investors in Europe from 2017 to 2021.

Nevertheless, US investors such as SOSV, Epidarex Capital, OrbiMed, and RA Capital Management, L.P., have a notable track record in the European life sciences space.

The top European seed investors are primarily public, operating with a regional focus. With 23 transactions, the High-Tech Gründerfonds is the most active Seed investor. The fund focuses predominately on German companies. Series A transactions in Europe are dominated by the French investors Bpifrance and Sofinnova Partners whereas Novo Holdings from Denmark is the most active later stage investor.

The only US-based investor participating in more than 20 deals in Europe from 2017 to 2021 was SOSV in seed transactions.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: