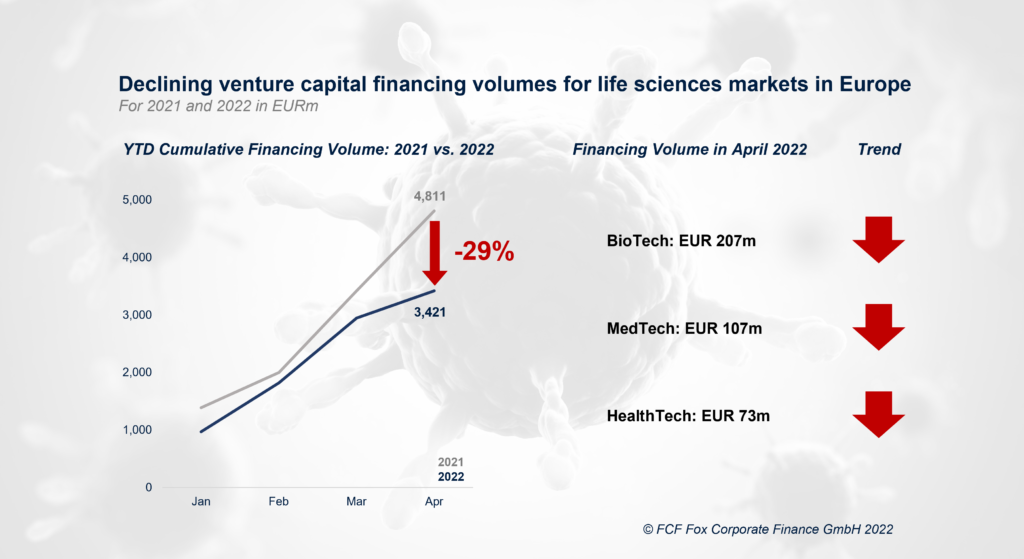

Venture capital deal volumes in the European life sciences sector reached a record-breaking level in 2021. However, financing volumes decreased significantly by 29% in the first four months of 2022 compared to 2021.

Our deal data and sentiment calculations suggest that the cooldown of the life sciences capital markets has now reached European venture markets. Based on these observations, we expect more challenging fundraising campaigns for European healthcare companies over the next couple of months.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: