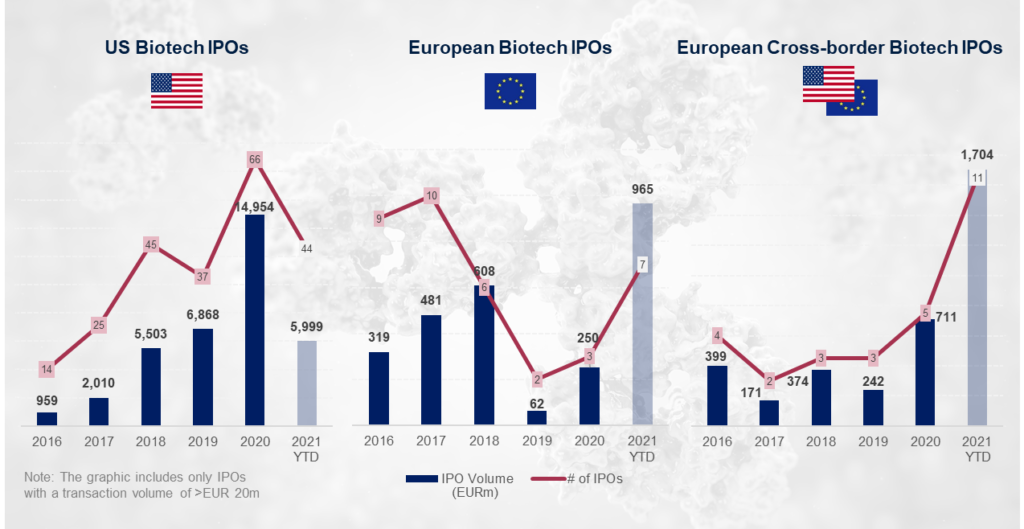

The situation in Europe draws a different picture, where IPO activity has been very volatile in the same period.

Nevertheless, current traction in public capital markets triggers higher activity of European companies to float on stock exchanges.

Since the beginning of this year, 7 European companies went public on European stock exchanges with a transaction volume of EUR 965m, while 11 European companies have been floated in cross-border IPOs on US exchanges with a volume of EUR 1,704m.

Not surprisingly, US capital markets have become increasingly attractive for European companies to float on US stock exchanges while less European companies favour an IPO on European stock exchanges.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: