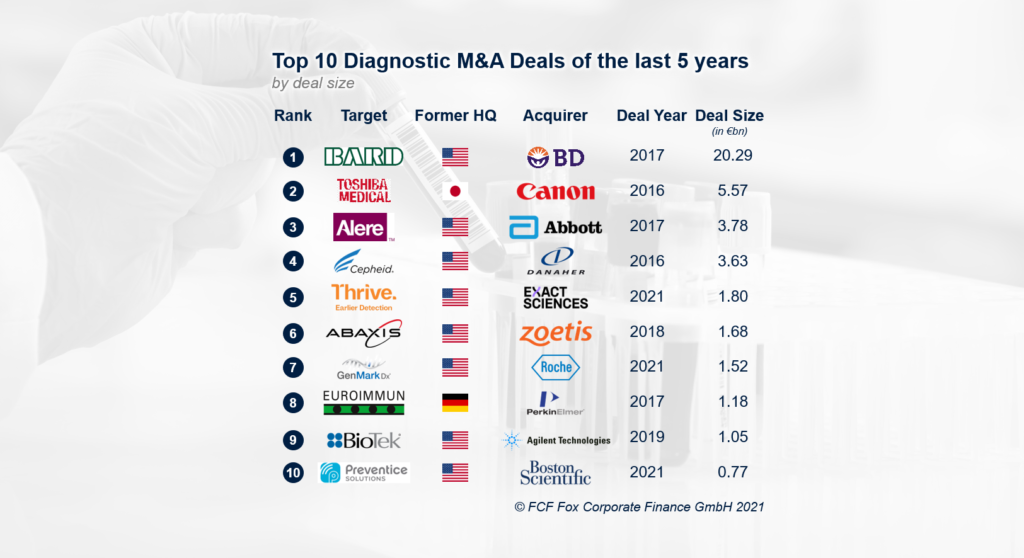

The top 10 diagnostics M&A deals of the last five years (by deal size) range from EUR 0.8bn to EUR 20.3bn, with an average deal size of EUR 4.1bn. The largest deal by far was the acquisition of C. R. Bard by Becton, Dickinson and Company in December 2017 for EUR 20.3bn.

The ranking is dominated by US targets, only two targets were located outside of the US. The acquisition of Japanese Toshiba Medical Systems by Canon Medical Systems in December 2016 for EUR 5.6bn is ranked second and the acquisition of German diagnostics company Euroimmun by PerkinElmer in December 2017 for EUR 1.2bn is ranked eighth.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: