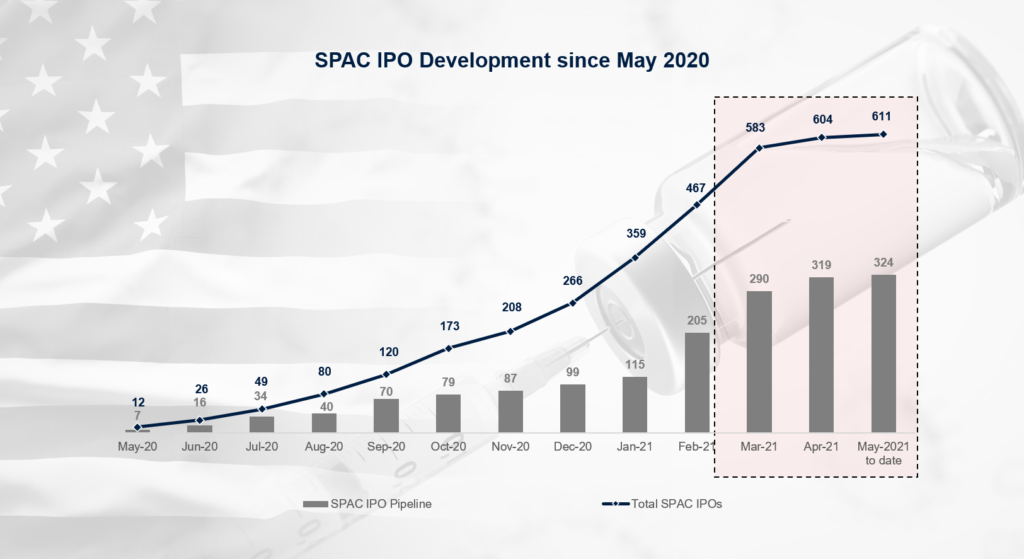

Is the boom around Special Purpose Acquisition Companies (SPAC) currently suffering a cool off?

The number of SPAC IPOs as well as the number of new SPACs in the IPO pipeline have significantly declined since last month. A potential reason could be an official SEC statement published in mid-April 2021. The SEC expresses its concerns about the current treatment of SPAC warrants as equity.

Since May 2020, 611 SPACs have been successfully listed on a public stock exchange. More than half of the IPOs took place within the 1st Quarter of 2021 (317 IPOs). The current SPAC IPO pipeline consists of 324 SPACs.

More facts and insights on the current SPAC market, particularly in the healthcare sector, are presented in the new FCF Life Sciences SPAC Monitor – May 2021.

About FCF Life Sciences

FCF Life Sciences advises leading healthcare companies in Europe on financing transactions (equity, debt, and licensing) with regional and international investors. Our team consists of science-driven industry and finance experts with a strong track record in managing financing processes. We thrive to maximize the efficiency in the fundraising process and increase its closing probability.

Learn more about FCF Life Sciences, click here.

We closely track the activity in the financial markets and are passionate about capital markets research. Not every idea or research question make it into the final selection for our publications. However, we generate interesting information on financing trends in Life Sciences sector, which we would like to share in our blog.

To hear from us on the latest insights, please sign up here: