Debt Case Study: AMW GmbH

EUR 25m European Investment Bank Growth Finance Facility

Company Description

- The Company is a full-service, one-stop-shop pharma company, developing complex and innovative drug delivery systems:

- Transdermal delivery systems, e.g. patches

- Parenteral delivery systems, e.g. implants

- The Company successfully develops attractive and innovative branded generics for oncology and neurology / psychiatry therapies, pain management and hormonal treatments

- AMW focuses predominantly on prescription products (RX), with only a few non-prescription products (OTC) in its portfolio

- The Company´s strategy is to develop and license own products to global pharma companies, while still working on selected contract research and manufacturing projects

- Additionally, AMW develops new advanced drug delivery systems, e.g. microchip controlled patches or subcutaneous biodegradable implants

Transaction Highlights

- To promote future growth, the Company intends to:

- Administer new clinical studies for the development and registration

of new drug delivery systems for various indications, e.g. breast

cancer, Parkinson’s disease, diabetes and ongoing strong pain - Develop innovative production technologies together with the

installation of state-of-the-art R&D / production facilities

- Administer new clinical studies for the development and registration

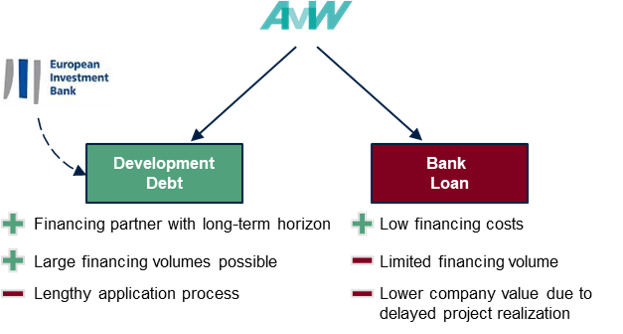

- FCF suggested to apply for an EIB development debt facility

- The most relevant advantages of the EIB debt for the company are:

- The possibility of large financing volumes combined with lower costs compared to equity

- The EIB as a financing partner with long-term horizon and the non-dilution of the shareholder structure

- Low proportion of cash-based and high proportion of performance based interest rate

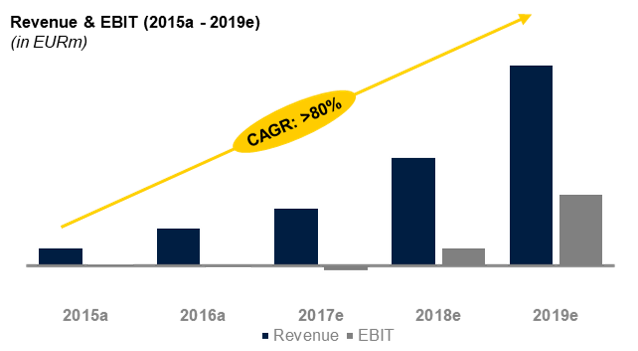

Key Financials

Financing Options