Debt Financing

Using leverage to avoid dilution

OUR APPROACH

Venture debt financing offers several advantages for the companies and their shareholders due to its non-dilutive nature and is detached from valuation events while large ticket sizes are possible. Despite being well-funded, venture debt can be considered as an additional secured financing facility to strengthen the capital structure, which has not to be immediately drawn.

European Investment Bank

FCF Life Sciences is the leading advisor for growth debt financing from the European Investment Bank, e.g. European Growth Finance Facility (EGFF) and InnovFin – Infectious Diseases (IDFF). Over the past years, we have raised over EUR 200m for innovative European life sciences and deep tech companies.

Growth/Venture Debt

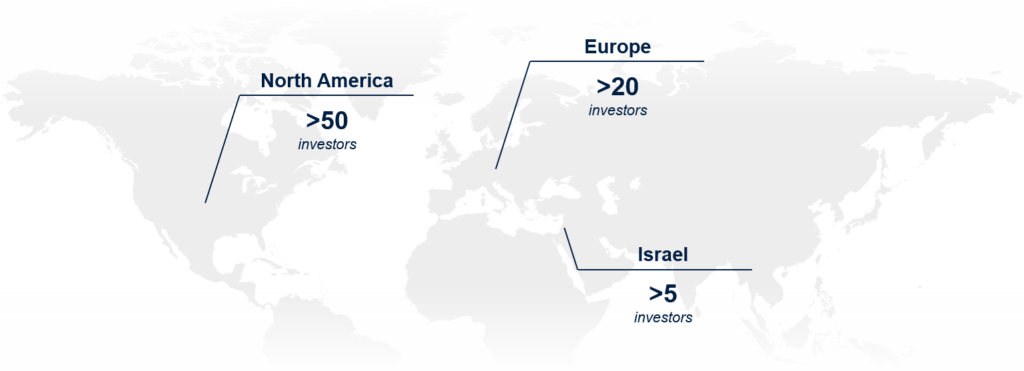

We maintain a network to over 70 growth/venture debt providers in Europe, U.S, and Israel, being able also to implement alternative financing structures, such as royalty financing, asset-based financing, acquisition financing, mezzanine, credit lines, etc.