Debt Case Study: Immunic AG

EUR 25m European Investment Bank Infectious Diseases Finance Facility

Company Description

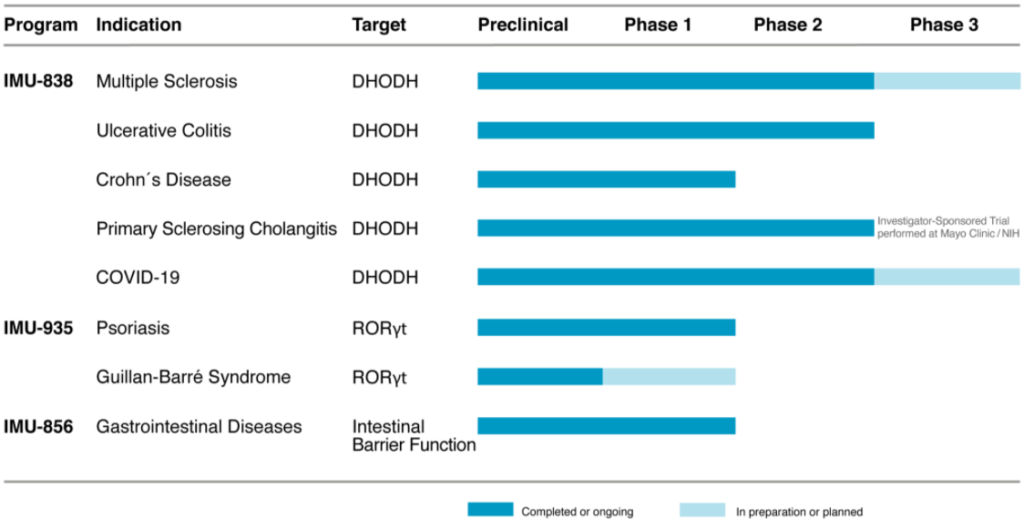

- Immunic AG (Immunic) is a clinical-stage biopharmaceutical company with a pipeline of selective oral immunology therapies aimed at treating chronic inflammatory and autoimmune diseases

- The company develops three small molecule products including relapsing-remitting multiple sclerosis, ulcerative colitis, Crohn’s disease, and psoriasis

- Its lead development program is IMU-838, a selective immune modulator that inhibits the intracellular metabolism of activated immune cells by blocking the enzyme dihydroorotate dehydrogenase, which is in phase 2 clinical development for treatment of ulcerative colitis,

relapsing-remitting multiple sclerosis and Crohn’s disease - Immunic is also evaluating IMU-838 as treatment for COVID-19

- Founded in 2016 and headquartered in Munich, Immunic currently has approximately 26 employees and has been listed on NASDAQ since 2019

Transaction Highlights

- In order to finance the R&D expenses of its COVID-19 program in the

amount of EUR 50m, Immunic was required to raise additional funds

either from public capital markets or through growth debt - FCF introduced Immunic to the Infectious Diseases Finance Facility

(IDFF) prioritizing COVID-19 programs at that time - The EIB granted Immunic a debt facility of ~EUR 25m to finance its

phase 2 study in COVID-19, to further support a phase 3 study as well

as the commercial production of IMU-838 - For Immunic, the most compelling advantages of the debt facility were:

- The EIB as a financing partner with long-term horizon

- The non-dilutive nature of the loan

- Tranches tailored to the business liquidity needs

- Standard market rates are included, i.e. cash, deferred and

performance-based interest rates

Drug Pipeline*

*as of 12/01/2021

FCF’s Role in the Transaction

- Direct access to relevant sector team at the EIB

- Management of accelerated financing process through proactive preparation of required tax, finance, business and regulatory documents

- Planning of an EIB-specific R&D budget

- Development of a purpose-built business case and EIB-specific, integrated financial model

- Support in the commercial, financial and tax due diligence process

- Negotiation of the term sheet and support in the finalization of financing contract