Debt Case Study: MagForce AG

EUR 35m European Investment Bank Growth Finance Facility

Company Description

- MagForce AG is a leading medical device company in the field of nanomedicine focused on oncology, operating in the EU and US

- MagForce’s proprietary NanoTherm® therapy enables the targeted treatment of solid tumors. MagForce is the first company to receive European approval for a medical product using nanoparticles

- The core product range includes NanoTherm®, a ferrofluid liquid that reacts to the presence of a magnetic field; NanoPlan®, a therapy planning software; and NanoActivator®, a magnetic field applicator used for tumors in all areas of the body

- Founded in 1997, and headquartered in Berlin, MagForce currently employs approximately 25 people and has been listed on the German stock exchange since 2007

Transaction Highlights

- To finance the FDA approval and product roll-out in the US, the company was required to raise additional funds

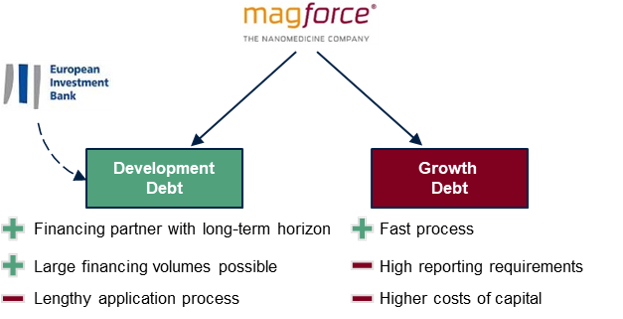

- FCF suggested to apply for the development debt programme by the EIB

- Advantages of the EIB development debt for the company are:

- The possible, large financing volumes combined with lower costs compared to equity

- The EIB as a financing partner with long-term horizon

- The non-dilution of current shareholders

- The EIB granted MagForce a loan facility of >EUR 35m to obtain regulatory approval in the US, to perform clinical trials in Europe and to finance the product roll-out

- Standard market rates are included, i.e. cash, deferred and performance-based interest rates

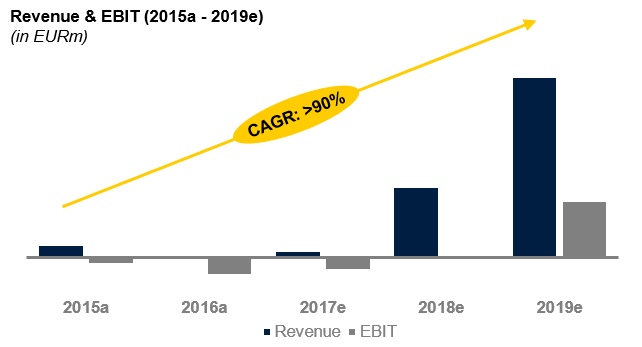

Key Financials

Financing Options