FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF Valuation Monitor – Q4 2019”.

The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and is published by FCF on a quarterly basis.

Key insights of Q4 2019 are:

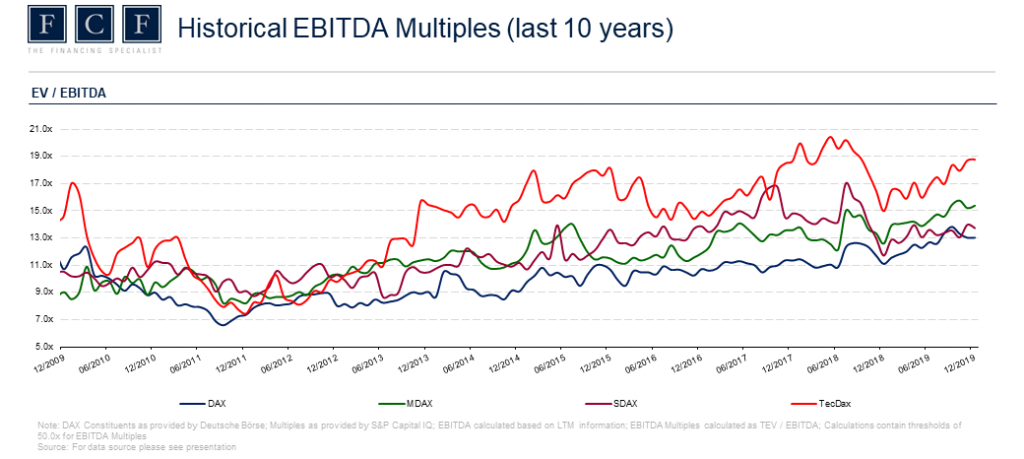

- All four major German market indices (DAX, SDAX, MDAX and TecDAX) have shown a positive performance over the last three months, whereas the SDAX showed the strongest performance with +16.3%

- The current valuation levels of all major German indices are on an upward trajectory lately, trending towards the record highs reached in late 2017 and mid-2018. Above all, the TecDAX significantly outperformed the other market indices with an EBITDA-multiple of 18.8x in Q4 2019 and 18.3x in Q3 2019 (+2.3%)

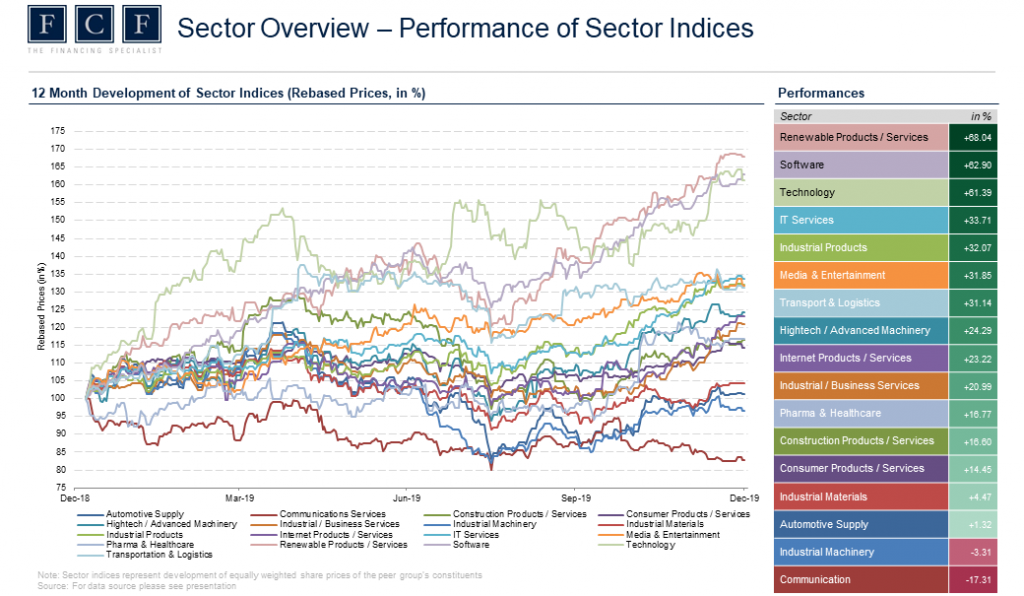

- The Renewable Products / Services, Software and Technology sectors showed the strongest share price performances with +68.0%, +62.9% and +61.4%, respectively. Thereby creating a discrepancy of nearly 30% to the next highest sector

- Across all sectors, the analysis indicates mean EBITDA-multiples for 2018 and 2019 of 12.8x and 10.4x, respectively

- Software and Internet Products / Services peer groups show the highest valuations at 21.4x and 19.1x in 2018 and 17.2x and 17.2x in 2019. Meanwhile, the Automotive Supply and Communication Services peer groups show the lowest valuations at 6.7x and 7.6x in 2018 and 9.6x and 6.0x in 2019, respectively

To access the full report, please click here.