FCF Fox Corporate Finance GmbH is delighted to publish the new “FCF MedTech & Diagnostics Public Equity Monitor – May 2021”.

The MedTech & Diagnostics Public Equity Monitor, part of FCF Life Sciences Research Series, is the most detailed and comprehensive valuation analysis for med-tech and diagnostics companies in the micro, small and midcap market segment in Europe.

It provides relevant valuation metrics (e.g. ratios, multiples), general information, performance data, analyst consensus and shareholder analysis as well as statistics by sector.

The following trends were noted over the past year:

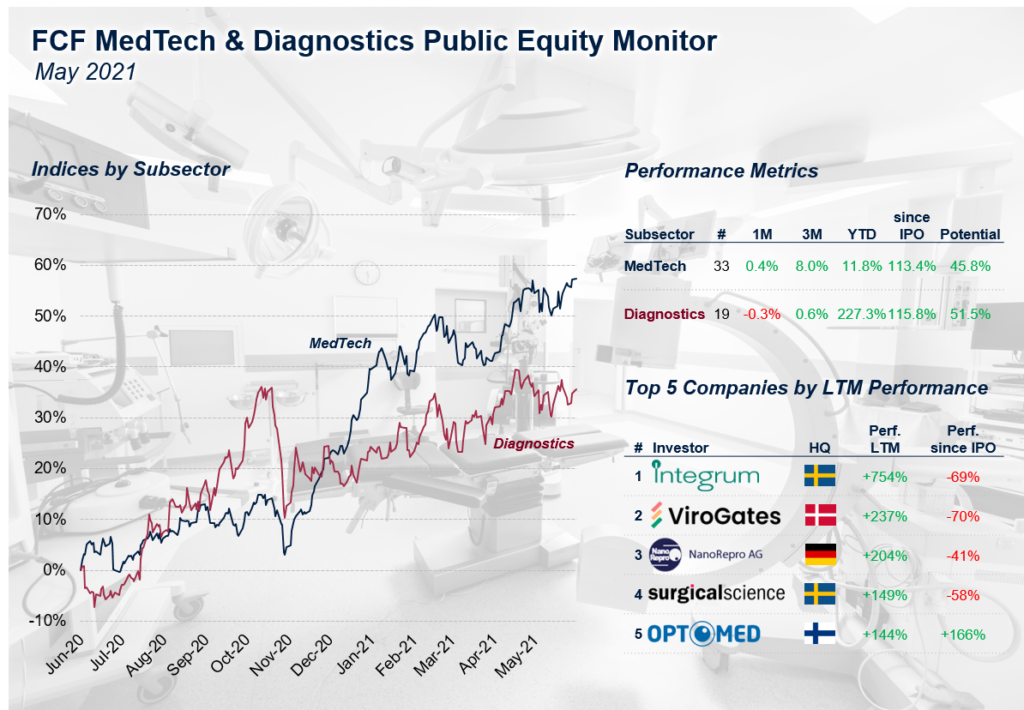

- Over the last year, the share price development of the European med-tech and diagnostics sector rose by +57% and +36%, respectively

- The diagnostics sector recorded an average share price performance of +227% since beginning of this year (Virogates A/S, ANGLE plc, Immunodiagnostics Systems Holding PLC being the main drivers)

- Companies from the med-tech and diagnostics sectors have almost doubled their share prices since the IPO with an average share price increase of approx. +115%

- Analysts see an average upside potential of +49% in the share prices of the European med-tech and diagnostics sector

- Integrum AB has recorded the highest share price performance with +754% within the last year, followed by ViroGates A/S with +237%, and NanoRepro AG with +204%

The selection of companies is based on the following criteria:

- Companies operating in the med-tech or diagnostics sector

- Headquarters located in Europe

- Current market capitalization is between EUR 50 million and EUR 1 billion as to focus on the micro – mid cap market segment instead of the large / blue chip companies

- Companies with a market capitalization below EUR 50m and above EUR 1 billion were excluded

- FCF may add additional companies on its own discretion (regardless of market capitalization)

To access the full report, please click here.

Share