FCF Fox Corporate Finance GmbH is pleased to publish the new “Industrial IoT Venture Capital Report – 2022”.

The report is part of the “FCF DeepTech Series”, which is a quarterly series of reports tracking European venture capital funding trends within four main DeepTech verticals.

Key findings are:

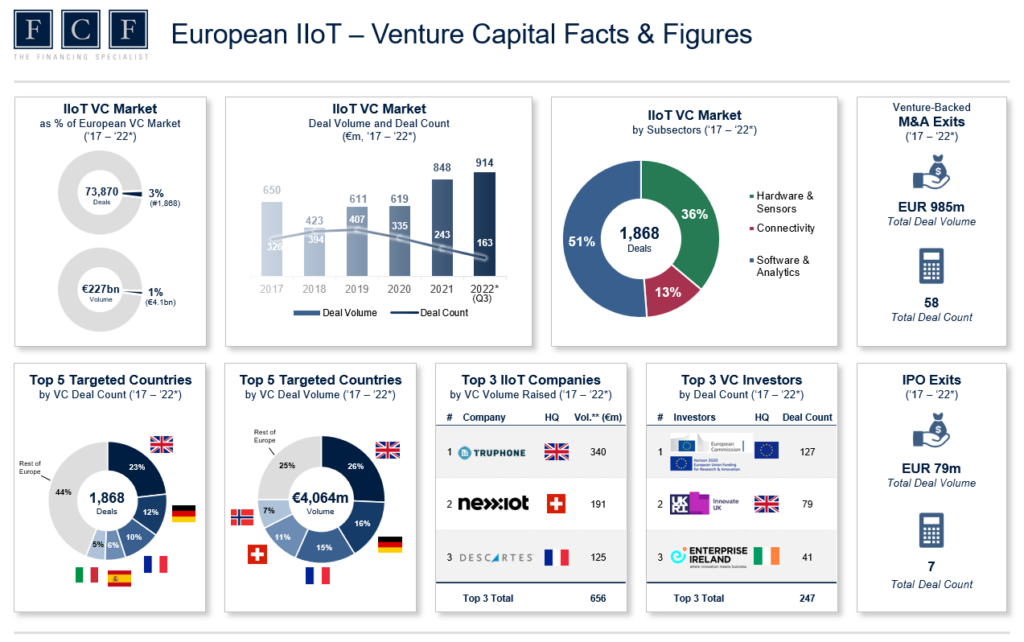

- The development of venture capital investments in IIoT start-ups is twofold: On the one hand, funding volumes have increased from €650m in 2017 to €914m in YTD Q3 2022, while on the other hand the number of deals is steadily decreasing since 2019 (407 in 2019 vs. 163 in YTD Q3 2022). The decline in the number of rounds started before the general cooling of the venture capital market since about early 2022 and the nevertheless increasing volumes indicate that the sector successfully holds its ground against slumps in other verticals.

- The maturity of the sector is increasing: The high volume in 2022 is mainly due to 3 mega deals (KINEXON with €119m, Descartes with €107m, Nexxiot with €102m). This is also a sign of the higher maturity of the sector, as reflected by higher average and median deal volumes as well as a decreasing share of seed & early-stage deals over time.

- UK IoT startups were able to attract the largest volume of funding: With a volume of €1.0bn in 2017 – Q3/2022, IoT startups from the UK are ahead of Germany with €632m and France with €627m. The UK also dominates in terms of the number of deals (GB 433, DE 217, FR 192 deals) and also has the largest deal to show (Truphone, €286m). This reflects the tendency towards a stronger start-up culture in the UK, where innovation more often comes from start-ups. Particularly in the case of “Industrial IoT”, the large industrial companies dominate the innovation topic in Germany and France.

- M&A as exit option clearly ahead of IPO: In the period 2017 – Q3/2022, 58 startups exited via M&A, while only 7 went public. The largest IPO was Astrocast with a volume of €44m (€306m IPO market cap). The exit in the form of a company sale is of course particularly pronounced in a sector such as “Industrial IoT”, as many business models and technologies of start-ups offer high synergy potentials for strategic buyers.

To access the full report, please click here.

By Florian Theyermann and Mathias Übler

Share