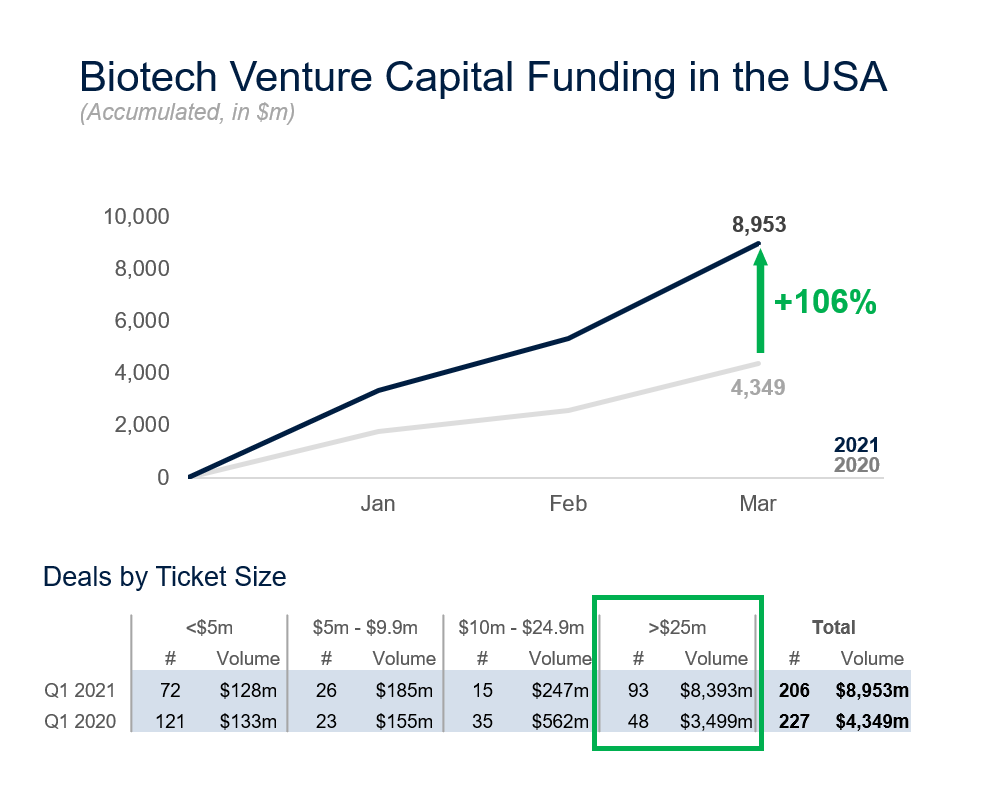

- Financing volume in the USA doubled in the first quarter of 2021

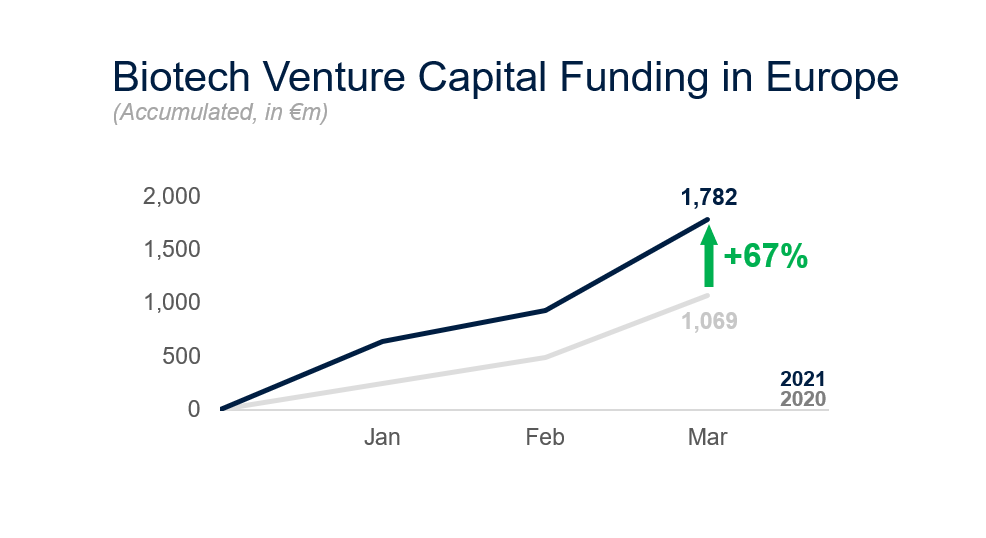

- High growth also in Europe

Munich, May 05, 2021 – The boom in biotech venture capital financing continues: In the US, the venture capital financing volume in the biotechnology industry doubled in the first quarter of 2021 compared to the same period last year. This is the result of an analysis by Munich-based financing specialist FCF Fox Corporate Finance GmbH. “The exceptional growth in the U.S. shows that the market for venture capital financing in the biotech sector continues to gain momentum,” said Dr. Mathias Schott, head of FCF Life Sciences. The cumulative volume of biotech venture capital financings increased by 106 percent to $8.95 billion compared to the first quarter of 2020. The main driver of the development in the first three months of this year was the doubling of the number of transactions with a volume of more than $25 million.

The increase in venture capital financings in the biotech sector also continued in Europe. The cumulative volume of venture capital financings in the European biotech sector increased by 67 percent to €1.78 billion in the first quarter of 2021 compared to the same period last year. “This leaves the industry unaffected by the negative impact of the Corona pandemic,” said Alexander Kuhn, analyst at FCF.

“With this highly positive development to date, the basis has been formed for significant growth in venture capital financing within the biotech sector in 2021,” Kuhn added.

ABOUT FCF FOX CORPORATE FINANCE

FCF is a specialized Investment Bank and Financing Specialist, advising public and private small/mid-market companies in the German speaking regions.

FCF focuses on four primary client segments:- MidCap: Medium-sized companies with sustainable business models in typical “Mittelstand” industries, such as industrial products and machinery, automotive, communications, logistics, and consumer products

- SmallCap / Growth: Companies with revenues between €20 and €100 million and high / above average growth rates

- DeepTech: R&D-driven companies in technology sectors, entering the commercialization stage with initial fast-growing revenues

- Life Sciences: Highly innovative companies focusing on the development of cutting-edge biotechnology, med-tech, health-tech and pharmaceuticals solutions

FCF structures, arranges and places equity and debt capital transactions and supports its clients’ growth, IPO/Pre-IPO, acquisition and standard balance sheet (re-)financing strategies.

Founded in 2005 and headquartered in Munich, FCF has direct relationships and works with all leading German, European and international financiers, lenders and investment houses addressing German small/mid-cap companies.

Media Contact newskontor – Agentur für Kommunikation Marco Cabras, Tel: +49 (0)172 2142968 Mail: marco.cabras@newskontor.de

Contact FCF Fox Corporate Finance GmbH Maximilianstrasse 12-14 80539 München Tel: +49-89-20 60 409-0 Fax: +49-89-20 60 409-299 www.fcf.de