Debt Case Study: numares AG

EUR 20m European Investment Bank Debt Facility under the EGF

Company Description

- numares AG (numares) is an innovative diagnostics company that focuses on the discovery, development and commercialization of diagnostic tests, using metabolite constellations to solve unmet medical needs that cannot be addressed by single biomarker-based medicine

- It applies machine learning to metabolomics data to develop advanced analytical tests for high-throughput use in clinical diagnostics

- The AXINON® System employs advanced nuclear magnetic resonance (NMR) spectroscopy to evaluate metabolic constellations

- Magnetic Group Signaling (MGS®) is a proprietary technology that enables NMR for highly standardized and rapid throughput testing

- numares is developing metabolic tests enabling precision medicine to address unmet needs in cardiovascular, kidney, liver, and neurology

- The Company was founded in 2004 and is headquartered in Regensburg with a subsidiary in the US

Transaction Highlights

- In order to finance the R&D expenses of its product pipeline in the amount of approx. EUR 40m, numares was required to raise additional funds either from private capital markets or through growth debt

- FCF introduced numares to EIB’s Pan-European Guarantee Fund (EGF) responding to the economic impact of the COVID-19 pandemic

- The EIB granted numares a debt facility of EUR 20m to finance further clinical trials to validate the Axinon® technology in different indications and the necessary regulatory activities to obtain approval

- For numares, the most compelling advantages of the debt facility were:

- The EIB as a financing partner with long-term horizon

- The non-dilutive nature of the loan

- Tranches tailored to the business liquidity needs

- Standard market rates are included, i.e. cash, deferred and performance-based interest rates

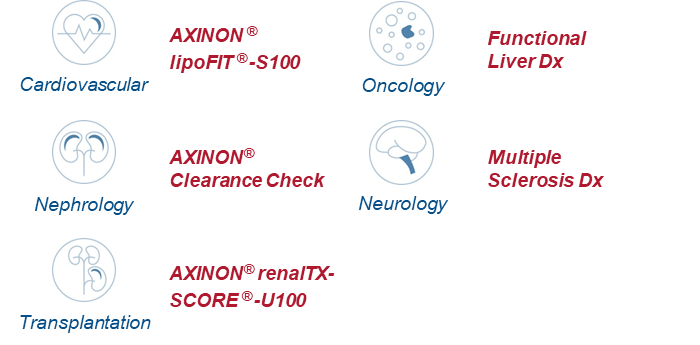

Product Portfolio*

*as of 28/04/2022

FCF’s Role in the Transaction

- Privileged access to relevant sector team at the EIB

- Management of accelerated financing process through proactive preparation of required tax, finance, business and regulatory documents

- Planning of an EIB-specific R&D budget

- Development of a purpose-built business case and EIB-specific, integrated financial model

- Support in the commercial, financial and tax due diligence process

- Negotiation of the term sheet and support in the finalization of financing contract