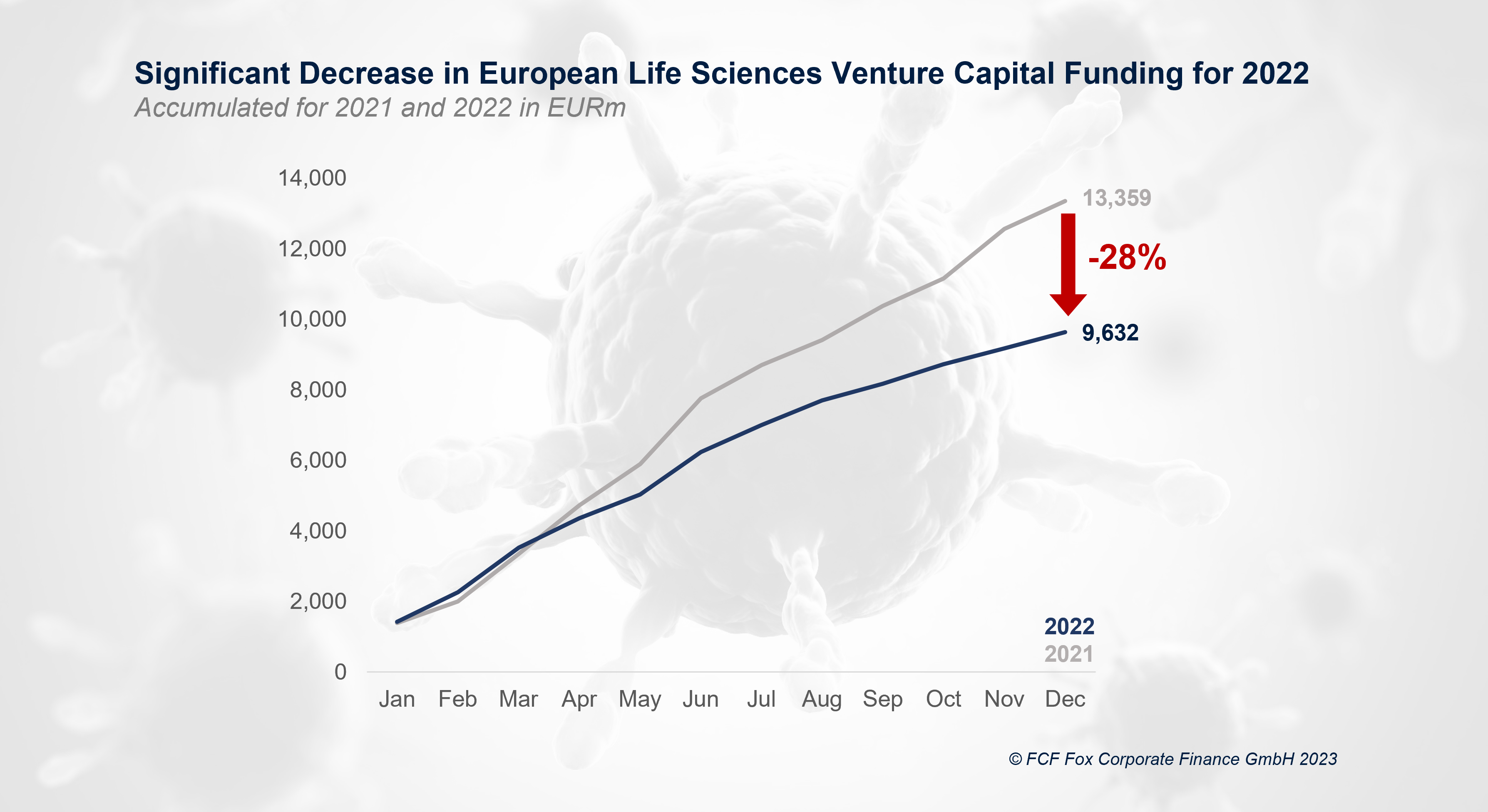

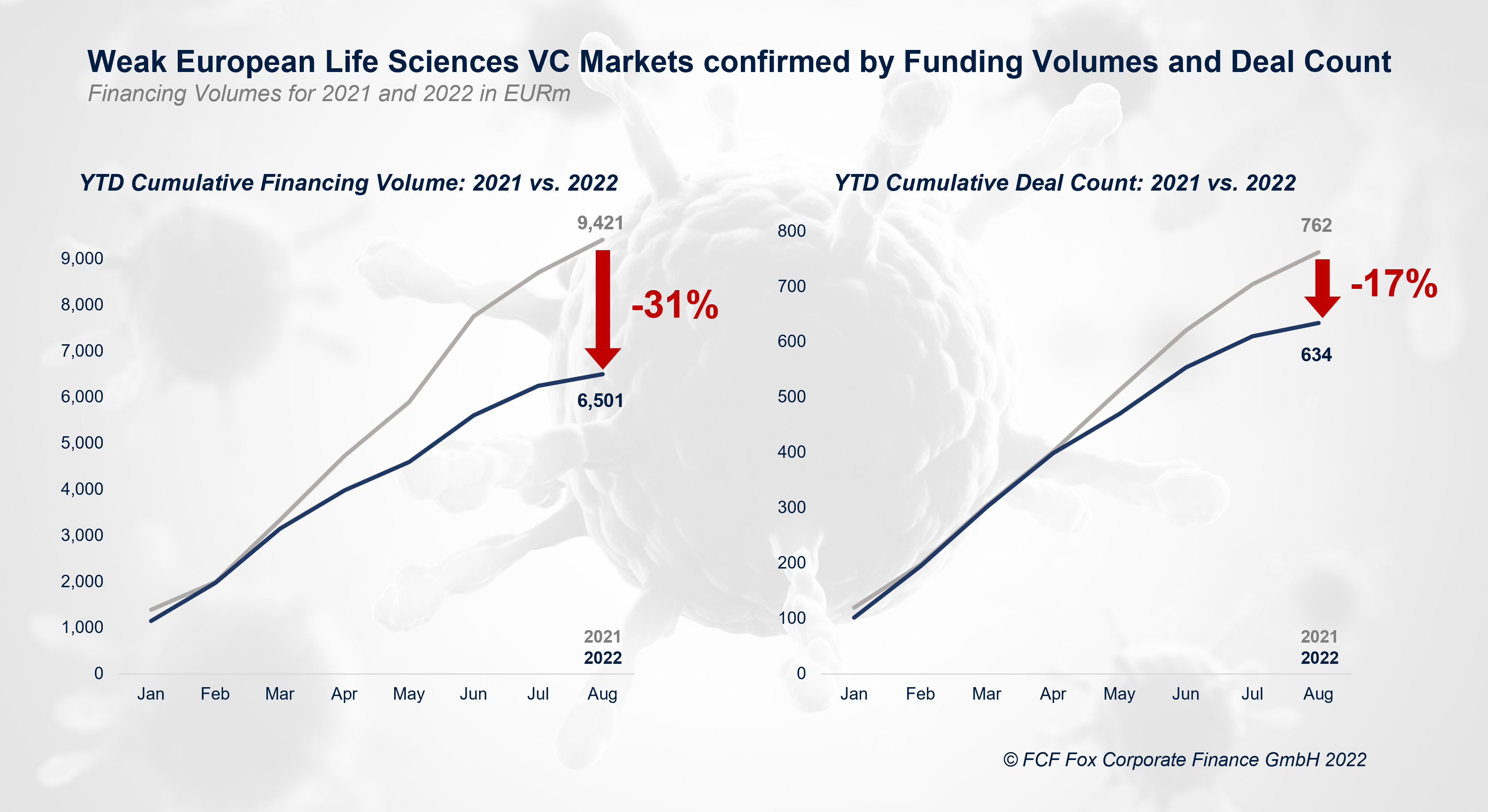

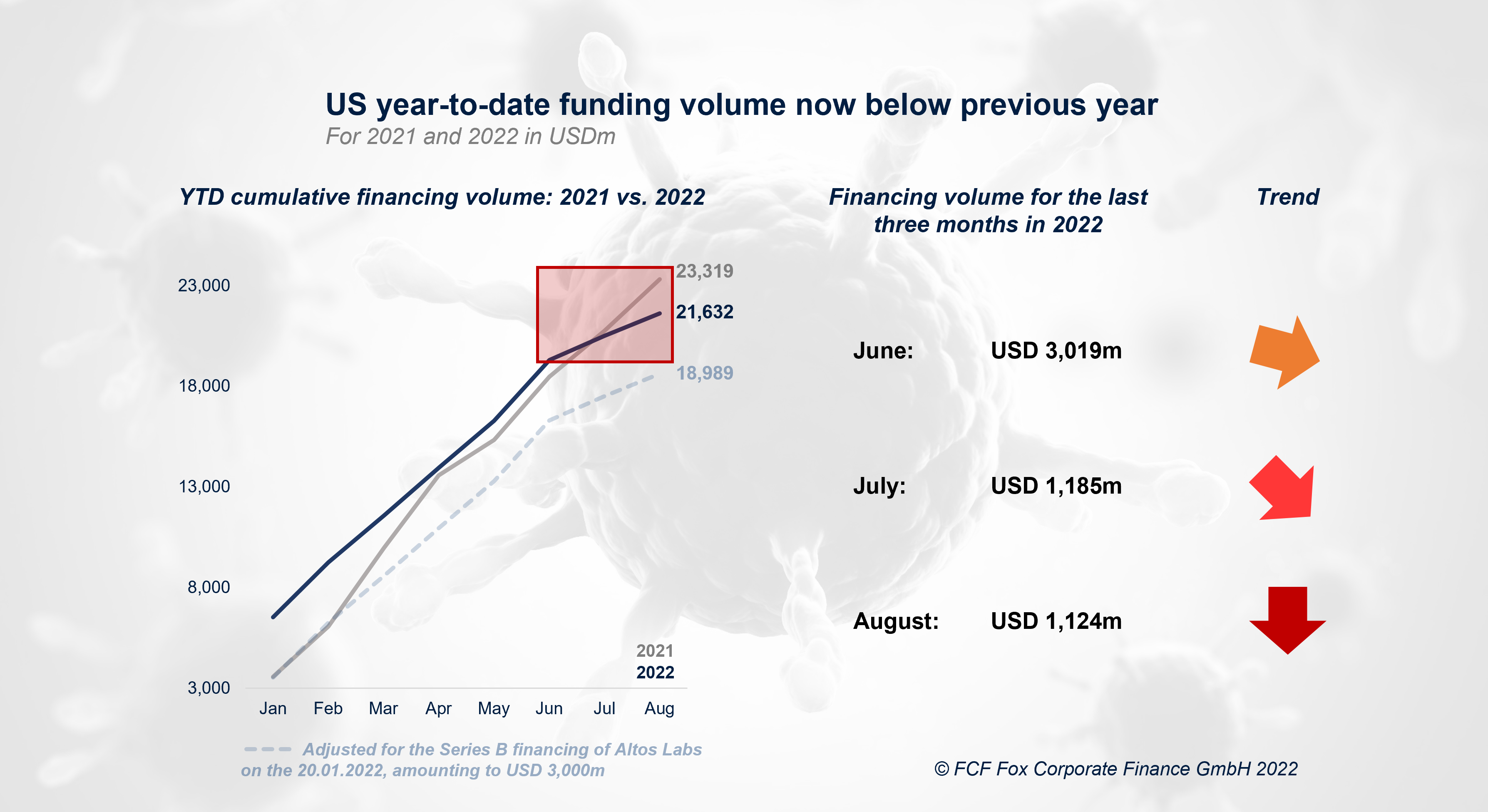

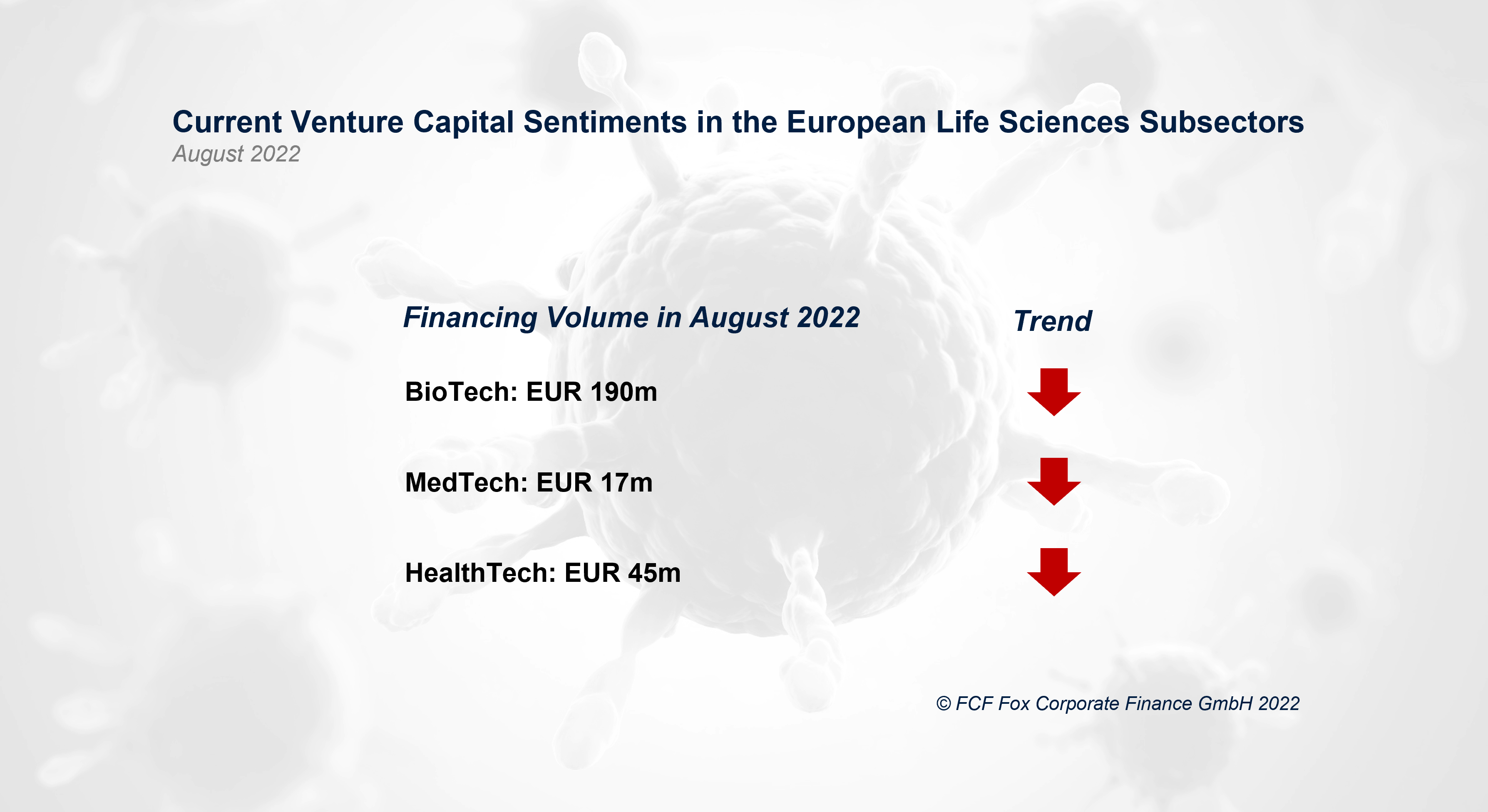

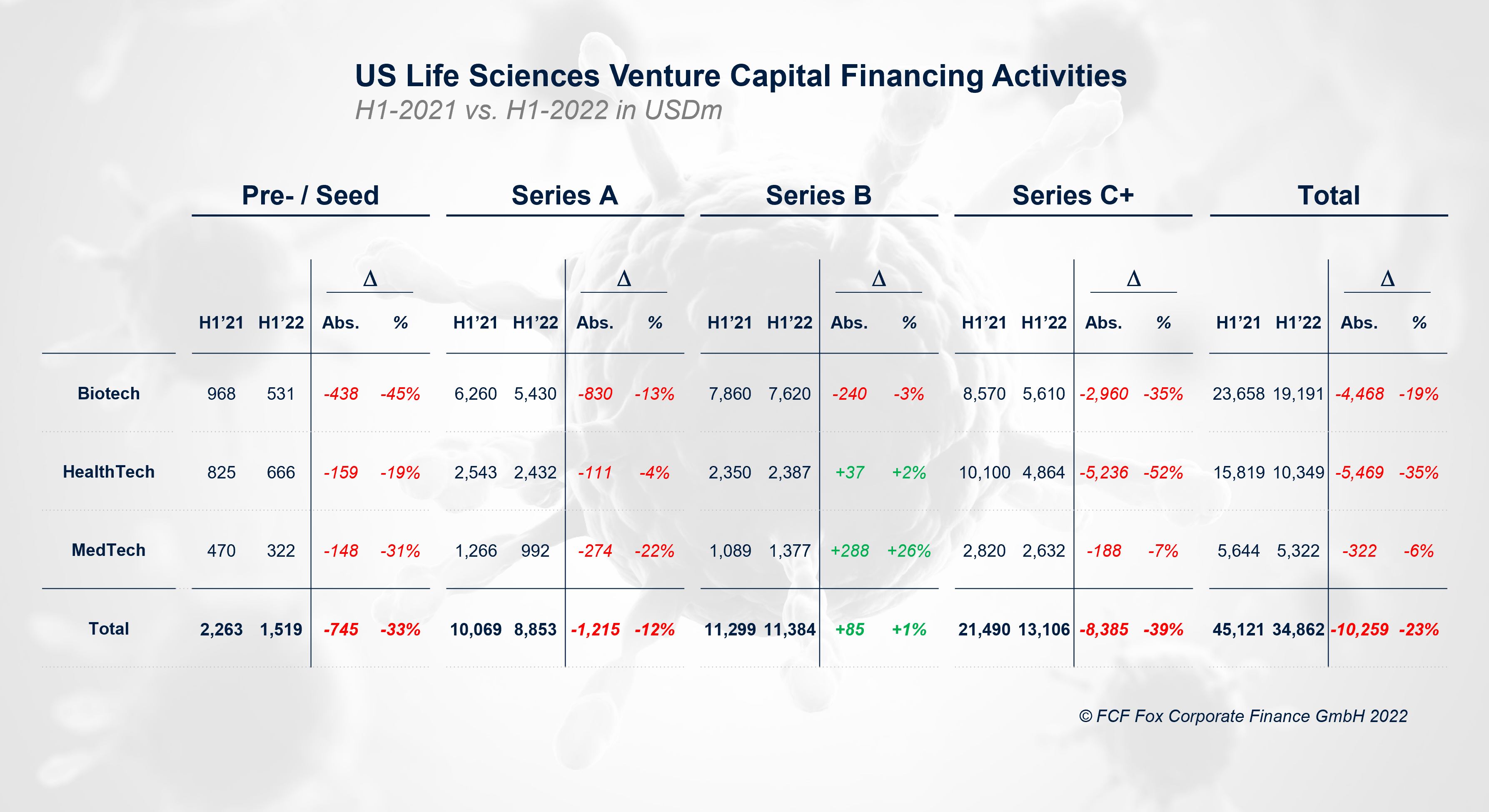

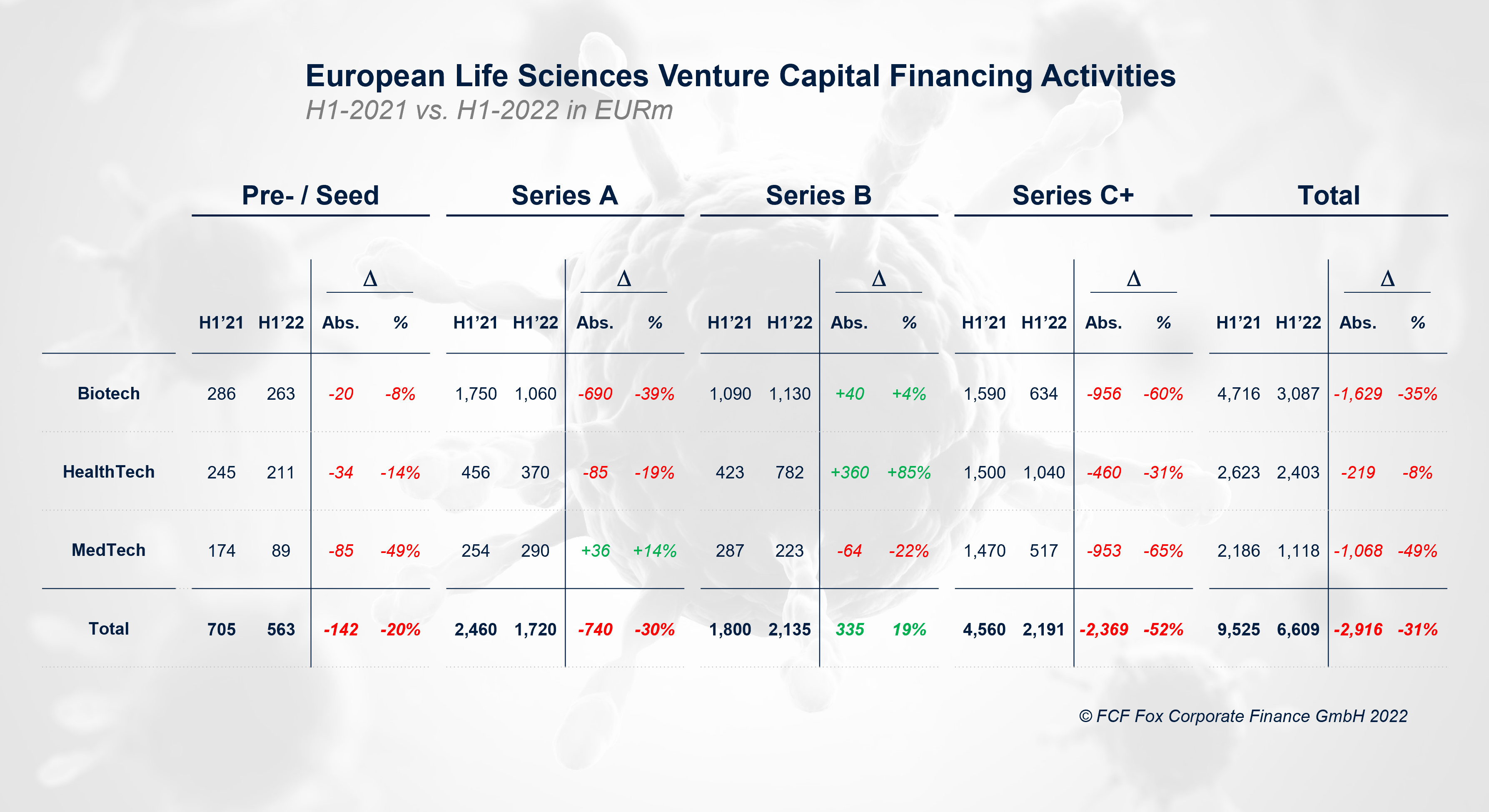

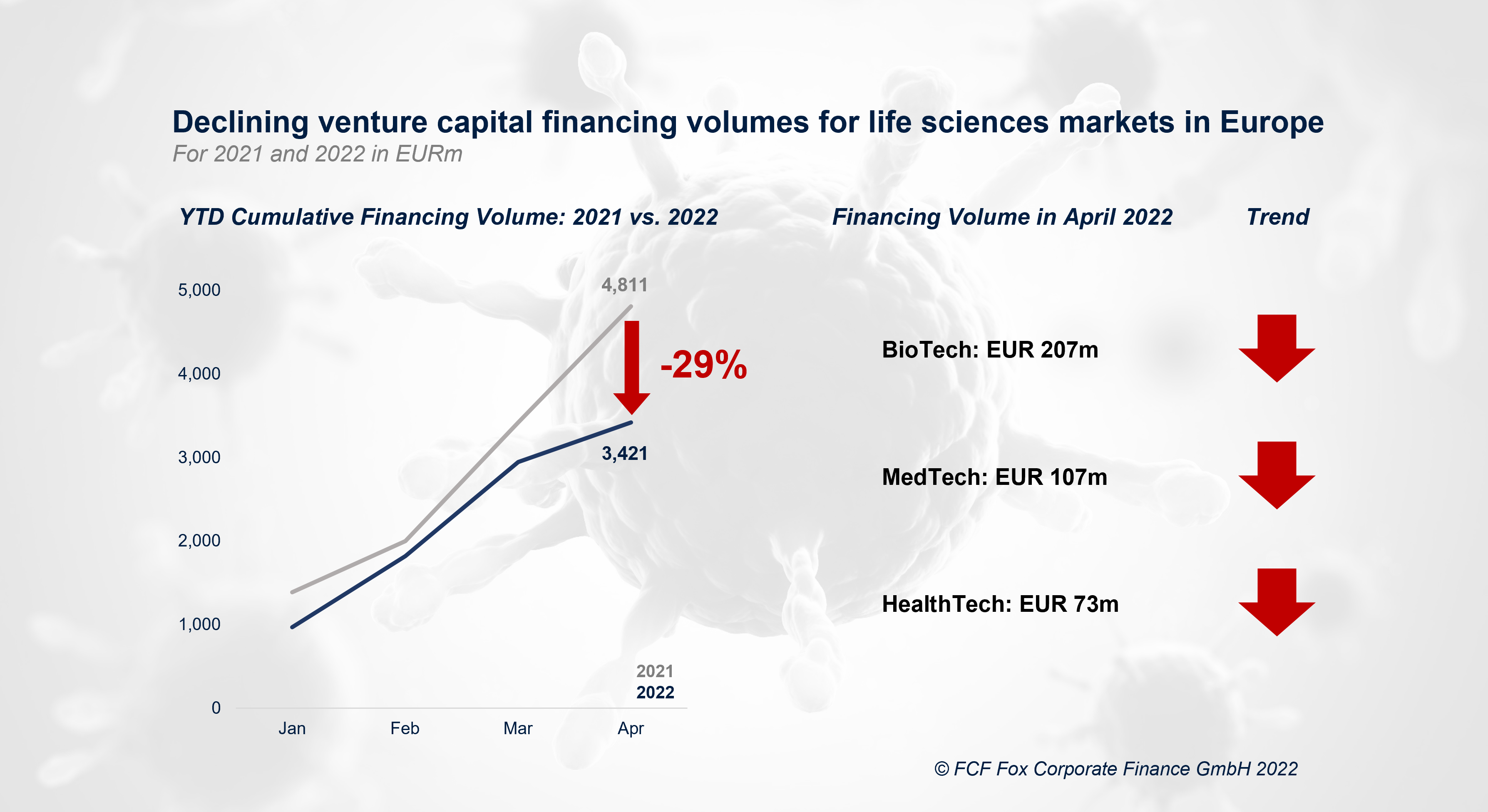

Venture capital funding in 2022 significantly decreased compared to 2021

The ever-increasing venture capital funding for European life sciences companies halted in 2022. With a roughly EUR 9.6bn volume, the overall financing for European life sciences companies in 2022 decreased significantly compared to 2021 (EUR … Read more